YouTrip is a multi-currency wallet that helps you save big on your travels with the best rates all day and zero FX fees — but there’s more! Here are all the key things you need to know about YouTrip.

If you’re a YouTrooper like us, you’re probably a master at avoiding those pesky FX fees and getting the most out of every dollar when travelling overseas. If you didn’t already know, our card has gone through a few upgrades since entering the Fintech arena in 2018 — with bigger and better features to make YouTrip your ultimate travel companion.

We now have a new virtual card, FREE monthly ATM withdrawals of up to S$400, bank withrawals, new top-up methods (Linked Bank Account (eGIRO) & Apple Pay), enhanced security measures, and more! Psst, you can also now add your card to Apple Pay and Google Pay.

Keep your app updated and bookmark this page for easy reference so you’re always getting the most bang for your buck!

Why YouTrip?

Before COVID-19, did you know Singaporeans were said to average 5 trips per year? And while travel was off the table for more than a year, most of us seamlessly transitioned over to our next favourite pastime — shopping. Online shopping, to be precise. Retail therapy is great for relieving stress, but are you aware of the additional fees and exchange rate mark-ups you pay when spending on foreign e-commerce sites? Enter: YouTrip.

Not only is this multi-currency card the perfect solution to your wanderlust, but YouTrip might just be the cheapest way to pay cashless wherever you are. With the best rates guaranteed and no FX fees, you have one less thing to worry about on your travels — since you can be sure you’re getting the best value out of every dollar. Here’s everything you need to know about Singapore’s first-ever multi-currency wallet built for travellers and shoppers alike!

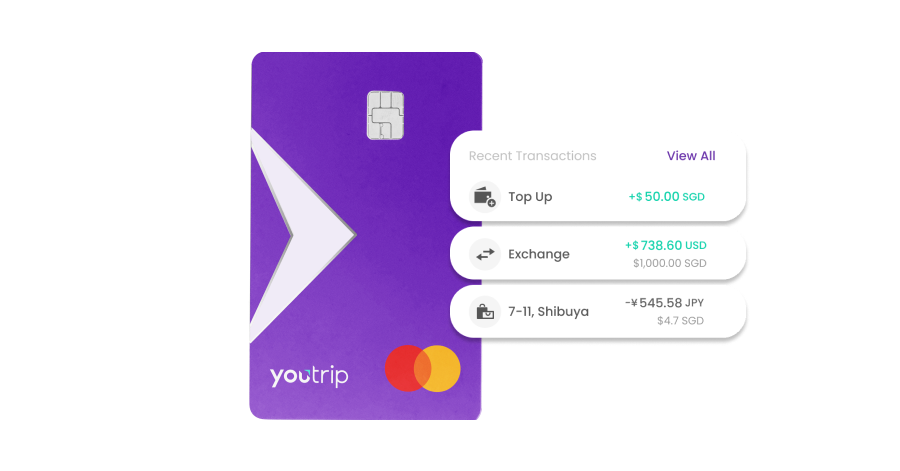

One App, One Card; Multiple Currencies

YouTrip is a multi-currency card and mobile wallet available on both iOS and Android operating systems. Every YouTrip app is linked directly to a contactless Mastercard®, which is free upon sign-up with no registration or annual card fees.

So while you’re off booking your next flight to your dream destination, keep in mind that YouTrip helps make payments a breeze in over 150+ currencies and 30 million merchants worldwide. We’re not just talking about physical stores, but also online purchases from your favourite overseas e-commerce stores with absolutely no hidden foreign transaction fees and competitive exchange rates. Now that’s a truly a global mobile wallet.

No More Overseas Bank Fees In 150+ Countries

Yes, you heard us right, there are absolutely no fees whatsoever!

A typical bank-issued credit card charges 2.8% – 3.5% in admin fees for foreign currency transactions, or even more if you choose to pay with Dynamic Currency Conversion (DCC).

This also comes on top of additional markups on exchange rates on the foreign currency you’ve used for purchases. What’s the typical price you’d have to pay when going cashelss abroad? That depends on the card you use and the way you choose to transact (i.e., with or without DCC), as these can add up to as much as 3 – 5% in total fees paid to banks.

Well, not anymore! With YouTrip you can now say bye-bye to all those hidden bank fees you’ve been paying unknowingly. We guarantee 0% in admin/processing fees for foreign currency fees and 0% markups on Wholesale Exchange Rates for all 150+ currencies.

For example, here’s an illustration of what you pay in SGD for a 500 Euro purchase overseas:

Top Up Methods:

1️⃣ PayNow (free)

2️⃣ Linked Bank Account (free)

3️⃣ Any Singapore debit or credit card*

- Mastercard debit/credit cards: Free

- Visa debit cards: Free

- Visa credit cards: 1.5% service fee

4️⃣ Apple Pay

*Do note that a 1.5% service fee will be applied on top-ups made with Visa credit cards.

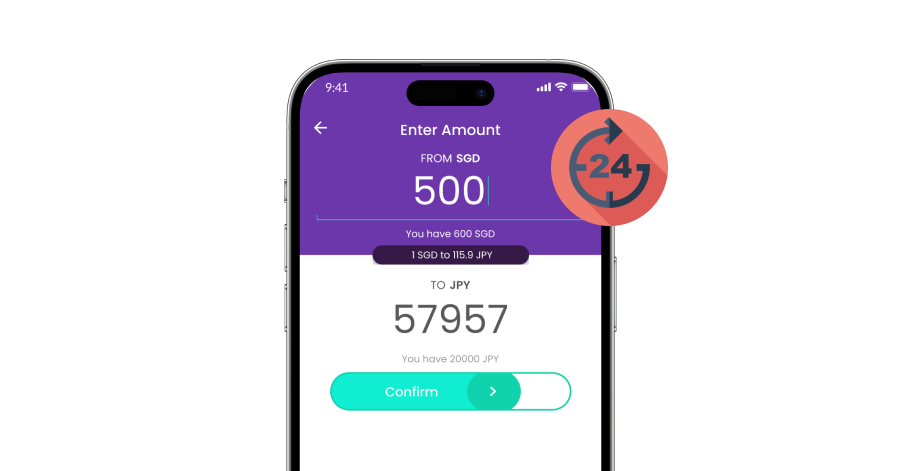

24/7 In-app Money Changer For 10 Currencies

With the YouTrip app, you can exchange and store up to 10 popular currencies, so you can be sure to lock down a good rate when you see one. It’s convenient and easy too, at just a swipe of a button on your app.

YouTrip exchange rates are also constantly updated every second so you can be sure to get only ‘real’ exchange rates wherever and whenever.

In case you’re unsure of what’s a good rate, simply check it out on Google as it usually displays interbank rates before any markups are made by retail banks and money changers.

Need to see it to believe it? Download YouTrip to compare exchange rates against what you can find on Google or even XE.com! Here’s how to exchange currencies on your YouTrip app.

Currencies available for in-app exchange includes; SGD, GBP, EUR, USD, HKD, JPY, AUD, NZD, CHF, SEK.

Virtually Yours

Say goodbye to the days of waiting for your physical YouTrip card to arrive and hello to our new VIRTUAL card! Simply add your virtual card to Apple Pay or Google Pay to enjoy the best rates with seamless in-app and online payments while waiting for your physical card to be delivered.

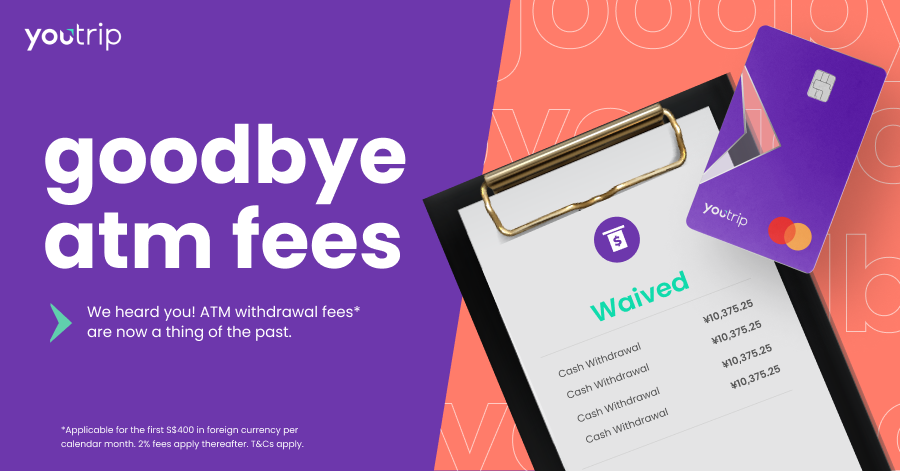

Say Goodbye To ATM Fees

Enjoy FREE withdrawals of up to S$400 in foreign currency per calendar month. A 2% fee will be imposed thereafter on the amount withdrawn once you surpass the S$400 threshold. But fret not, this S$400 calendar limit will reset on the 1st of each month!

Do note:

1️⃣ Some overseas banks that operate the ATM may charge a fee

2️⃣ ATM withdrawals will not be available in Singapore

Your Wallet Limit, Unlocked

✅ Your wallet limit is capped at S$20,000

✅ Your annual spend is capped at S$100,000

❌ There is no daily spend limit

Your wallet limit refers to how much you can hold in your YouTrip or withdraw per day in cash from an overseas ATM. If you’ve lost count, don’t worry. We’ve got an Online Payment & ATM Alert to ensure that you’re kept up-to-date on all of your online transactions and ATM withdrawals in the past 24 hours via an e-statement consolidated daily.

Stay In Control Of Your Expenses

There’s never a transaction too small to note. That’s why we’ve made instant transaction notifications possible on your mobile device with the YouTrip app. Every transaction on your YouTrip Mastercard will appear immediately so you’ll never miss out on an expense. You’ll also be alerted of any wrong or fraudulent transactions instantly.

Managing your daily expense budget is now easier than ever. Simply log in to your YouTrip app to view your transaction history at a glance. No more waiting for your card statements and managing clunky PDF documents.

Transaction Search

Say goodbye to those tiresome scrolls — the next time you’re in search of a specific transaction, simply look for that new magnifying glass icon at the top-right corner of your screen, beside the YouTrip logo, to begin your search! You can search using any of the following fields: merchant name, location, currency code, amount, or date.

YouTrip Send

TLDR: You can now send money through 10 wallet currencies to other YouTrip users instantly, with no fees (we use real-time wholesale exchange rates) and no lag time or delays.

YouTrip Send is especially great for reimbursing your friends when making group purchases with others — from an overseas online store to save on shipping costs. And don’t forget to use it when sending money to loved ones or family overseas!

All you have to do is update your YouTrip app and you’ll find a new button at the top of your home page labelled ‘Send’. Tap on it and grant YouTrip access to your contacts. Just make sure that your recipient is a YouTrip user and you’re good to go!

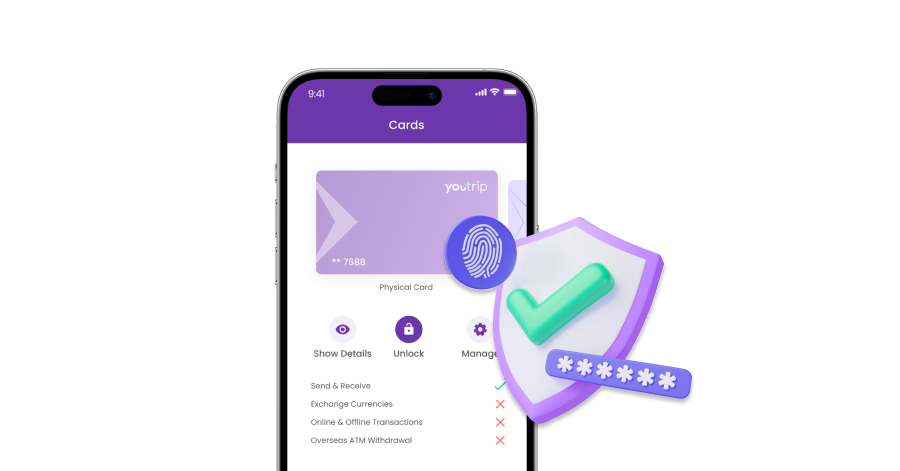

Card Security Is Right At Your Fingertips

Ever lost your credit card and had to call the bank to block your card to avoid fraudulent transactions? Well, in most cases like this, you’re likely to be protected by your card-issuing bank but why subject yourself to all that hassle? All it takes is a touch of a button to lock and unlock your card in the YouTrip app.

Find out how else we’ve enhanced our security measures here

3DS Authorisation For Payments

You’re probably already familiar with 3D Secure, a verification step that helps to ensure that you’re really the one behind the screen when making a purchase. Either way, you’ll be glad to know that it’s a here-to-stay function for every YouTrip card — especially since online fraud has become more prevalent in recent years.

All It Takes Is 3 Minutes

In case you didn’t know, YouTrip is completely free! There are no minimum income requirements, account fall-below fees, or annual card membership fees. All you’ll need to do is to download YouTrip to register, wait to get verified and you’ll receive your spanking new YouTrip card in the mail within 5-7 days!

If you still haven’t gotten your free YouTrip card yet, sign up now! Don’t forget to check out our YouTrip Perks page for exclusive offers and promotions too! For more great tips and articles like this, join our Telegram(@YouTripSG) and subscribe to our free weekly newsletter here or down below!

And while you’re at it, why not join the conversation with thousands of #YouTroopers in our very own Community Telegram Group @YouTripSquad? Get tips and tricks to everything YouTrip including exclusive invites to exciting events and experiences, & be part of the #YouTripSquad! 💜

Related Articles:

WeChat Pay For Foreigners In China Guide 2024

Alipay For Foreigners: How To Use Alipay In China

Japan Travel: How To Top Up Your Virtual Suica Card With YouTrip