Should you exchange money in Singapore or overseas? Both offer different exchange rates, but which option gives you the best deal?

Before we embark on our adventures, there’s always a nagging concern about whether we should exchange money in Singapore and how much we should exchange while we’re overseas.

Most of us split our travel cash equally – exchanging half of it in Singapore first, then the other half overseas as needed.

For frequent travellers, we know that the money changers at The Arcade offer the best currency exchange rates in Singapore. But for some of us who don’t live or work nearby, we settle for the money changers nearest to us.

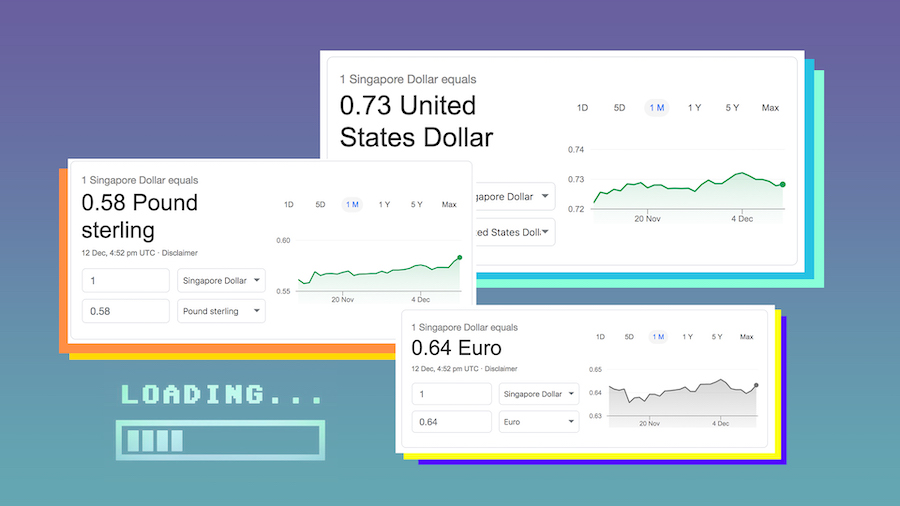

No matter how good the exchange rates are at a certain money changer in Singapore or overseas, you’ll realise that the exchange rates won’t match up to what you see on Google (also known as interbank rates).

That’s because money changers in Singapore and overseas always add a margin to their rates to cover their operational costs and profit margins. That’s why the exchange rates listed on Google are mostly better.

Should I Exchange Money in Singapore or Overseas? — Check out the best places to exchange money in Singapore here

So Where Do I Exchange Money?

In short, it doesn’t really matter, because money changers worldwide have to maintain a margin in their rates to make a profit.

Whether you exchange your money in Singapore or overseas, you’ll still lose a cut. Also, not to mention the risk of dealing with fake money while exchanging money (yes, even in Singapore!).

A Modern Solution: YouTrip

In contrast, YouTrip works to “unpinch” your wallet – you don’t need to worry about losing money from exchange rate margins like you do at money changers!

With YouTrip, you’ll have Wholesale Exchange Rates at your fingertips, and also the freedom to pay in 150+ countries globally. Just top up sufficient SGD in your mobile wallet and YouTrip will do all the work with Smart Exchange™. No fuss, right? It’s really that easy.

Should I Exchange Money in Singapore or Overseas? — Check out YouTrip’s enhanced wallet limits here

Change Money Wherever, Whenever

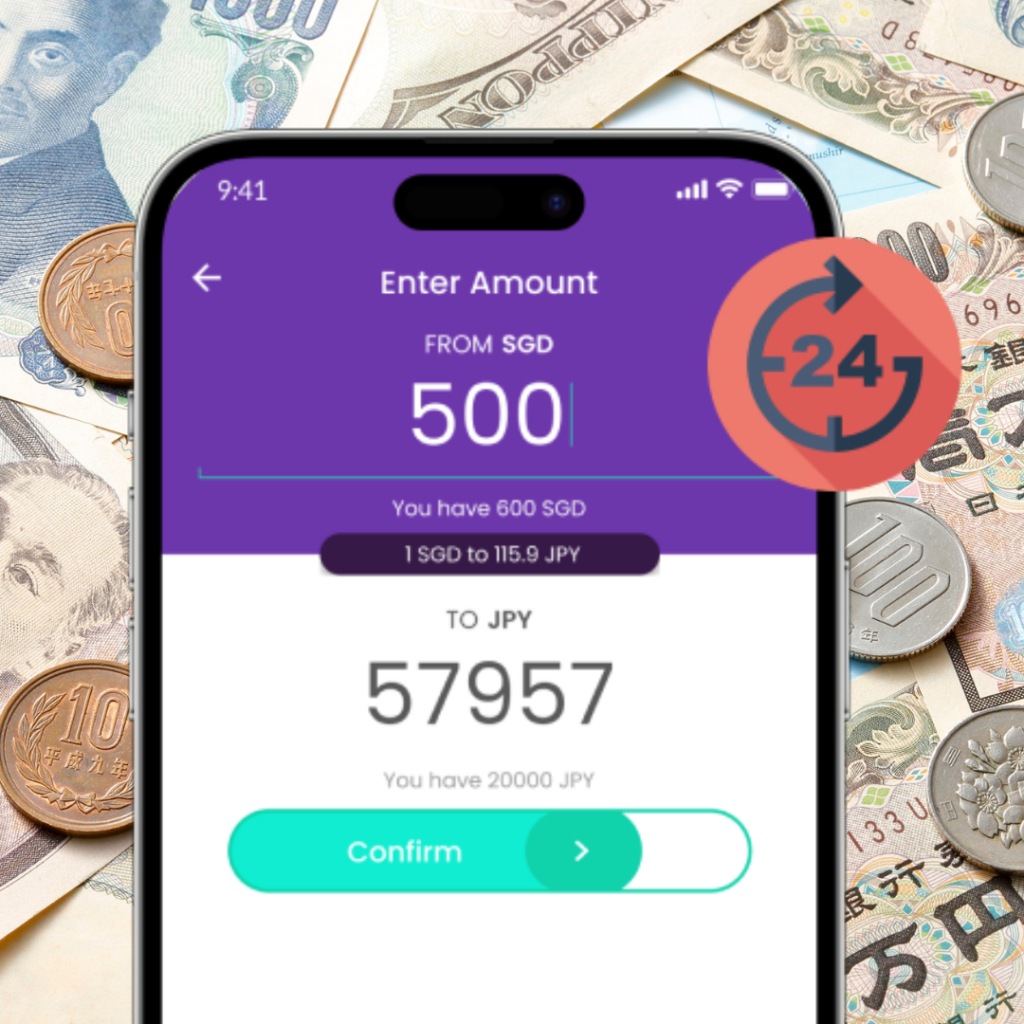

Enjoy monitoring exchange rates and exchanging money when rates are favourable? Guess what? The YouTrip app comes with an in-app ‘money changer’ that allows you to exchange and lock-in favourable rates whenever and wherever, with just a few clicks! 👀📱

Simply tap on the ‘Exchange’ icon on your YouTrip app and you’ll see 12 major currencies available for real-time currency exchange and conversion.

The 12 major currencies available for conversion on YouTrip are:

- Singapore Dollar (SGD)

- US Dollar (USD)

- Euro (EUR)

- British Pound (GBP)

- Japanese Yen (JPY)

- Hong Kong Dollar (HKD)

- Australian Dollar (AUD)

- New Zealand Dollar (NZD)

- Swiss Franc (CHF)

- Swedish Krona (SEK)

- Malaysia Ringgit (MYR)

- Thai Baht (THB)

When you exchange currency in-app, the same Wholesale Exchange Rates will be utilised. What’s more, exchanging currencies on YouTrip also comes with zero fees and markup!

When the exchange rates seem favourable to you, simply slide the bar to exchange currency in real time and lock in the rates instantly. No queues, no fees, no hidden charges – all done within seconds, in just a few taps. No need to visit a money changer anymore – our rates are better anyway! 💵

Comparing Rates: YouTrip vs Money Changer

Wondering how YouTrip’s exchange rates compare to the rates at money changers in Singapore? Here’s a quick comparison of our rates vs two popular money changers in Singapore:

| Currency | YouTrip | Money Changer A in Raffles Place | Money Changer B in Orchard Road |

| Malaysian Ringgit (MYR) 🇲🇾 | 1 SGD = 3.307 MYR 👑 | 1 SGD = 3.29 MYR | 1 SGD = 3.28 MYR |

| US Dollar (USD) 🇺🇸 | 1 SGD = 0.768 USD 👑 | 1 SGD = 0.76 USD | 1 SGD = 0.750 USD |

| Japanese Yen (JPY) 🇯🇵 | 1 SGD = 112.9 JPY 👑 | 1 SGD = 112.2 JPY | 1 SGD = 112.1 JPY |

| Thai Baht (THB) 🇹🇭 | 1 SGD = 25.54 THB 👑 | 1 SGD = 25.45 THB | 1 SGD = 25.1 THB |

| British Pound (GBP) 🇬🇧 | 1 SGD = 0.577 GBP 👑 | 1 SGD = 0.562 GBP | 1 SGD = 0.571 GBP |

💡 As you can see, YouTrip’s offers better exchange rates than money changers in Singapore – thanks to zero mark-ups and no hidden fees 💜 While the difference might seem small at first glance, they’re sure to add up significantly when you’re exchanging larger amounts. Besides, paying by card is more convenient than handling cash nowadays! Need some cash on the go? No worries – the YouTrip card also allows you to withdraw cash from ATMs worldwide. 💷

Should I Exchange Money in Singapore or Overseas? — Here’s a guide on how to add your YouTrip card to WeChat Pay

Lock In The Best Rates All Day With YouTrip!

So if you‘re planning a trip, sign up for YouTrip and start keeping an eye on the in-app exchange rates to save more!

If you’ve not yet gotten a YouTrip card, sign up today with <YTBLOG5> and get FREE S$5 in your account! Then, head over to our YouTrip Perks page for exclusive offers and promotions — we promise you won’t regret it.

Stay safe and happy travels!

Related Articles:

Best Travel Credit Cards In Singapore

Make The Most Of Your Touch ‘n Go eWallet In Malaysia

A Guide To ATM Withdrawals With YouTrip In Malaysia