Looking for the best SGD to THB exchange rate in Singapore?

Fun fact: exchanging currency at the right place and time can save you up to 5% of your trip budget! This comprehensive guide will walk you through everything you need to know about getting the best SGD to THB rate and managing your money in Thailand. 🇹🇭

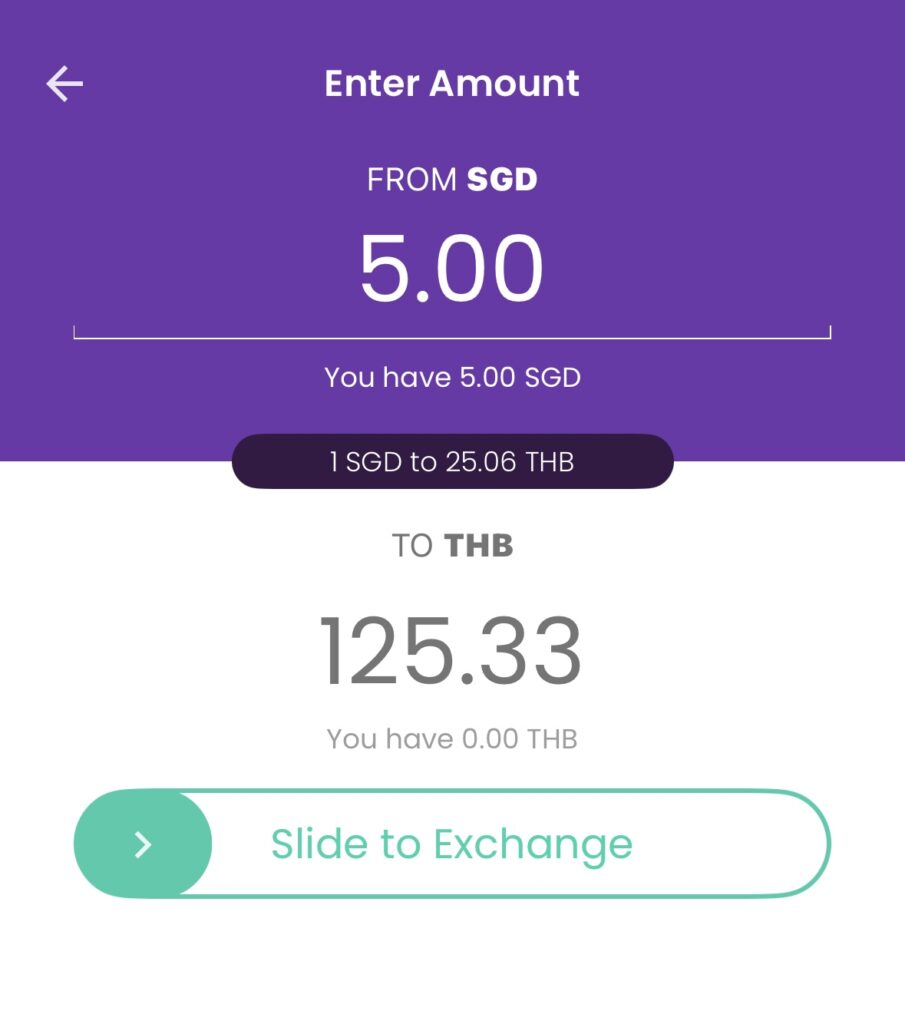

[NEW] YouTrip’s Thai Baht Wallet is here! You can now exchange and lock in the best Thai Baht (THB) rates in-app 🔄 – perfect for your next trip to Thailand ✈️

All you need to know about SGD to THB rates in Singapore

1. What is the SGD to THB exchange rate today?

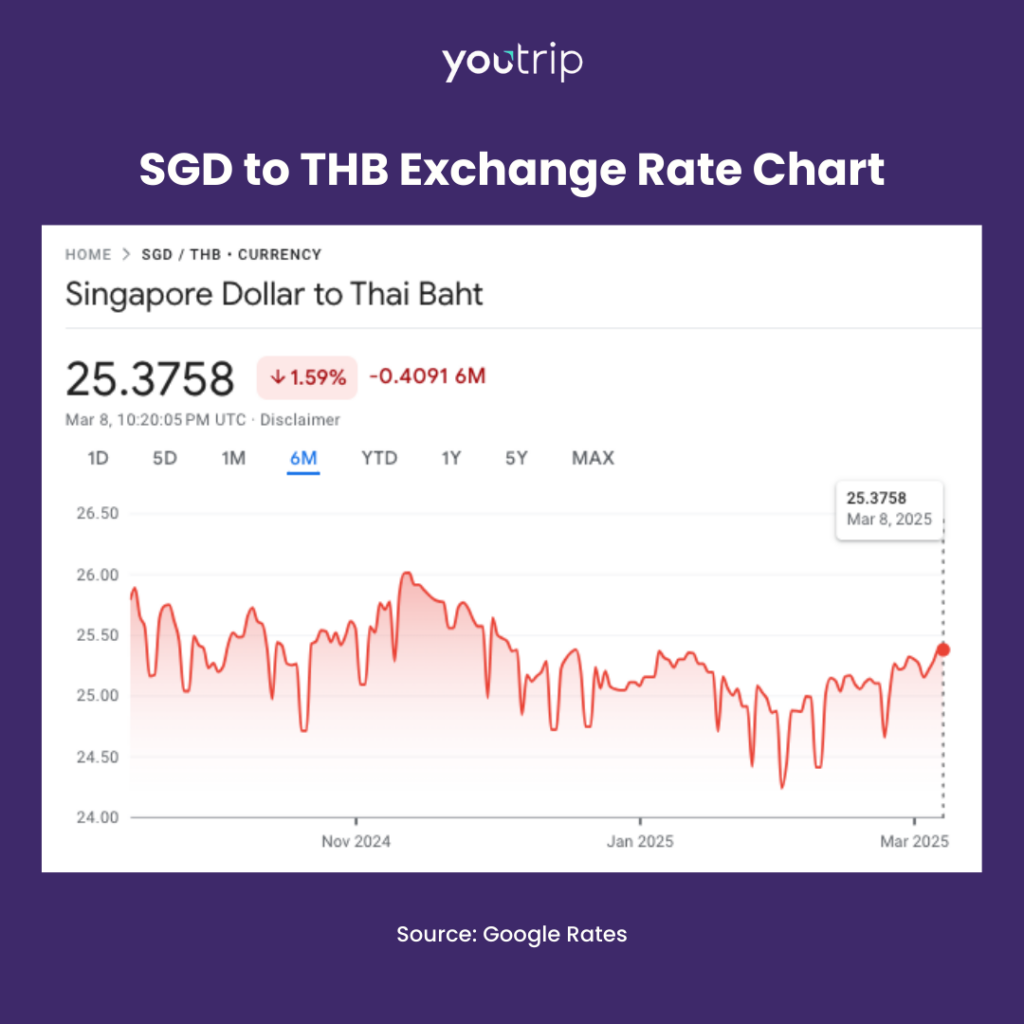

As of March 2025, the SGD to THB exchange rate stands at approximately 1 SGD = 25.38 THB. The SGD to THB exchange rate has dipped by -1.59% over the past six months, which means you’ll get fewer Thai Baht for your SGD compared to before.

💡 Pro tip: To maximize your travel budget, consider monitoring real-time exchange rates and using a multi-currency card like YouTrip to secure the best rates with no hidden fees!

2. Where to check live SGD to THB exchange rates?

There are many sites for you to check live SGD to THB rates quickly and easily. Here are some sites where you can monitor real-time exchange rates:

- Google & XE.com: These sites are good for general reference, but do not reflect the exact rates banks or money changers offer.

- Bank websites (DBS, UOB, OCBC): Bank websites show daily rates clearly, but often include markups.

- Multi-currency apps (YouTrip, Wise, Revolut): These platforms typically showcase real-time rates and display fees transparently.

- Money changer aggregators (CashChanger, Get4x): These sites are good for comparing money changer rates in Singapore before heading down.

💡 Pro tip: YouTrip’s live exchange rate for SGD to THB can be checked via the Mastercard currency converter calculator! Input “0” in the ‘Bank Fee’ field, as YouTrip charges no extra fees.

3. Where to exchange SGD to THB in Singapore?

Like most global currencies, there are three main ways to exchange Singapore Dollar (SGD) to Thai Baht (THB) in Singapore. Here are your options:

- 💵 Money Changers: Read our guide to the best money changers in Singapore 👀

- 🏦 Banks: While convenient, they typically don’t offer competitive rates.

- 📱 Online Currency Exchange Platforms: Platforms like YouTrip often provide favourable rates and convenience.

While traditional methods like money changers and banks are popular options for exchanging currency, they often don’t offer the best rates. Which brings us to the next question: where’s the best place to exchange SGD to THB in Singapore? 🔽

4. Where can I get the best SGD to THB exchange rate in Singapore?

Surprise! The best rates aren’t at money changers or banks. To get the best SGD to THB rate, consider using a multi-currency card like YouTrip!

Here’s why you should use a YouTrip card:

- Competitive rates: Enjoy competitive wholesale exchange rates with no inflated markups when you pay with your YouTrip card! 💳 Fun fact: Banks typically mark up mid-market rates and sneak in extra fees, leaving you with less to spend. With YouTrip, you get direct wholesale rates with zero extra charges – this basically means more Thai Baht for every Singapore Dollar! 🚀

- No hidden fees: Unlike typical credit cards, YouTrip doesn’t charge users additional conversion or transaction fees. While these fees may seem insignificant (fun fact: credit cards charge an average of 2 – 3% fees per overseas transaction), they can really add up with every payment you make 📈

- Ultimate convenience: Skip the queues at money changers! Exchange your currency anytime, anywhere through the YouTrip app.

- Safety & security: YouTrip is fully licensed and regulated by the Monetary Authority of Singapore (MAS). ☑️ Carry less cash and enjoy enhanced security features with your YouTrip card.

5. Cash, card, or YouTrip?

Curious how YouTrip’s THB exchange rates stack up against other cards in Singapore? Here’s a breakdown of how much you’ll be charged when spending 10,000 THB in Thailand 🇹🇭:

| Card | SGD to THB rate (as of 10 Feb 2025) | Fees | SGD charged for 10,000 THB |

| YouTrip | 1 SGD = 24.94 THB | $0 | S$400.96 👑 |

| Credit Card | 1 SGD = 24.67 THB | up to 3.25% | S$418.44 |

| Trust | 1 SGD = 24.66 THB | $0 | S$405.69 |

| Revolut | 1 SGD = 24.85 THB | 1% on weekends | S$402.42 |

| Wise | 1 SGD = 24.85 THB | from 0.26% | S$402.42 |

Based on the rate comparisons, YouTrip offers the best THB rate in Singapore, meaning you’ll pay less SGD for the same amount spent ✨ These savings may seem small in a glance, but can add up significantly with big purchases and long trips.

6. How to pay in Thailand?

In Thailand, tourists can pay with cash, cards, or e-wallets. Cash is widely accepted, especially at smaller towns, night markets, street stalls, local eateries, and small vendors. However, most larger establishments like shopping malls, hotels, and restaurants accept cards.

For digital payments, QR code payments via PromptPay (Thailand’s national e-payment system) are popular. International e-wallets like Alipay and Apple Pay are also accepted at some retailers.

7. Should I use cash or card in Thailand?

Wondering if you should pay with cash or card in Thailand? It depends on your preference and places you intend to visit! For the most convenience, we’d recommend having a combination of both cash and card.

We’d recommend:

- 💳 Having a travel card like YouTrip for the best rates and seamless card payments

- 💵 A small amount of Thai Baht in cash for small transactions and payments at small towns, local restaurants, and night markets

💡 Pro tip: Use a multi-currency card like YouTrip for larger purchases to avoid hidden fees and take advantage of the best exchange rates!

8. Can I use my Singaporean debit or credit card in Thailand?

Yes, you can use your Singaporean debit or credit cards in Thailand. However, be aware of potential foreign transaction fees and less favorable exchange rates, which can affect your spending overseas.

💡 To get the best rates with 0% mark-ups and no fees, apply for a free YouTrip card!

9. Where can I use YouTrip in Thailand?

The YouTrip card is a prepaid Mastercard that’s widely accepted anywhere that takes Mastercard payments in Thailand.

Here are some ways and places you can use your YouTrip card in Thailand:

- 🛍️ Stores & restaurants: Use your YouTrip card to pay for your shopping, meals, or attraction tickets wherever cards are accepted! As long as a shop accepts debit or credit cards, you should be able to use your YouTrip card with no issues.

- 🚝 Public transport rides: Some public transport systems in Thailand (e.g. the BTS Skytrain and MRT Subway in Bangkok) allow you to ride the train simply by tapping your card at the turnstiles. You can also use it to purchase tickets at ticket machines and counters.

- 🚗 Grab & Bolt (e-hailing apps): Link your YouTrip card to your Grab or Bolt app for transport payments with the best exchange rates!

10. How to use YouTrip in Thailand?

YouTrip is a prepaid payment card. All you have to do is top-up your YouTrip card via your YouTrip app and pay like a regular card when you’re travelling! We also have an in-app currency exchange function 🔄 which allows you to convert your SGD to THB with a few taps – this means you can lock in favourable THB rates anytime, anywhere before your trip.

11. Should I exchange money before going to Thailand?

It’s a good idea to bring some Thai Baht cash for small purchases during your trip. Here are some tips for getting the best rates before your trip:

1. 💰 Best money changers in Singapore for THB:

- The Arcade (Raffles Place)

- People’s Park Complex (Chinatown)

- Mustafa Centre (Little India)

- Lucky Plaza (Orchard Road)

2. ❌ Avoid exchanging money at the airport: Airport money changers (whether in Singapore or Thailand) typically offer poor rates with high markups.

12. Can I withdraw cash in Thailand?

No time to exchange money before your trip? Yes, you can withdraw THB cash from ATMs in Thailand using your Singaporean card – most ATMs in Thailand accept international Mastercard and Visa cards.

📌 Important: Some ATMs may charge fees depending on the ATM or your card provider. Check before withdrawing!

💡 Pro tip: Enjoy free* ATM withdrawals of up to S$400 in foreign currency per calendar month with your YouTrip card! 🆓 A 2% fee will be imposed thereafter.

13. How much cash should I bring to Thailand?

The amount of cash you should bring depends on your travel style, itinerary, and destination. As a general guide, here’s how much Singaporeans typically spend in Thailand:

- Budget travelers: 1000-1500 THB (40-60 SGD) per day

- Mid-range travelers: 2000-3000 THB (80-120 SGD) per day

- Luxury travelers: 4000+ THB (160+ SGD) per day

Ready for your trip to Thailand?

Getting the best SGD to THB exchange rate in Singapore doesn’t have to be a hassle! By comparing rates across various options available and using fee-free multi-currency cards like YouTrip, you can maximize your savings for your trip to Thailand. Ready to stretch your Singapore Dollar further? Get a YouTrip card today for the best rates all day in 150+ countries across the globe. 🌍

📱 Download the YouTrip app and sign up with code <YTBLOG5> to get FREE S$5 in your account upon registration! 💜

More articles you may enjoy:

- 10 tips to save money in Thailand

- 15 things to do in Phuket, Thailand

- 4D3N Bangkok itinerary: 34 best things to do in Bangkok

More currency exchange guides! 🤑

- How to get the best SGD to MYR rates 🇲🇾

- How to get the best SGD to KRW rates 🇰🇷

- How to get the best SGD to CNY rates 🇨🇳

- How to get the best SGD to USD rates 🇺🇸

- How to get the best SGD to JPY rates 🇯🇵

- How to get the best SGD to AUD rates 🇦🇺

- How to get the best SGD to NZD rates 🇳🇿