Travelling to Malaysia this long weekend? If so, bookmark this Touch ‘n Go eWallet guide! We promise it’ll come in handy. Let’s go cashless with TNG!

We’re all familiar with the Touch ‘n Go card as a must-have for road trips across the causeway — perfect for paying road charges at immigration counters and tolls. But what about the Touch ‘n Go eWallet? What can you actually do with it? Don’t worry — here’s the full breakdown on how to make the most of your TNG experience in Malaysia.

💜 Stay Up To Date:

– 21 Things To Do In Mount Austin JB | Food.& Activities (2025)

– 25 Best Things To Do In Ho Chi Minh City (2025)

– Top 15 Capsule Hotels In Tokyo Under S$100/Night (2025)

Touch ‘n Go eWallet features

Image Credits: SoyaCincau

We’re all about going digital in 2025. Whether it’s shopping online, paying for parking, or booking travel tickets, the TNG eWallet lets you breeze through transactions with just your phone. Here’s what you can do with it:

1. Toll Payments With Touch ‘n Go

You can use TNG RFID and PayDirect to pay for tolls. However, note that the TNG eWallet doesn’t yet support auto-debit at all tolls, so it’s a good idea to keep your TNG card topped up at all times.

👉 Tip: Use the TNG eWallet like PayNow in Singapore — scan and pay with ease.

2. QR Code Payments with Touch ‘n Go

Accepted at over 700,000 merchants across 1.2 million TNG touchpoints, including:

- 🛒 Supermarkets: Cold Storage, Giant

- ☕ F&B chains: McDonald’s, Starbucks, Baskin-Robbins

- 🛍️ Retail: Watsons

- ⛽ Petrol stations: Shell, Petron

- 🎬 Cinemas: TGV Cinemas

- 🚄 Online train, bus & airline ticket bookings

3. App & Online Payments

You can also use your Touch ‘n Go eWallet for shopping on:

- Lazada

- FoodPanda

- Taobao

- TMall

- iTunes, Apple Music & App Store

4. Street Parking With TNG eWalletApp & Online Payments

No more racing back to the meter! The TNG app:

- Sends you a reminder 15 minutes before expiry

- Lets you extend your parking session via app

Supported areas include:

Kuala Lumpur, Petaling Jaya, Shah Alam, Subang, Putrajaya, Seremban, Kuala Terengganu, Kelantan & more.

5. Peer-To-Peer (P2P) Transfers

Send or receive money instantly with other TNG eWallet users.

6. Reload Prepaid & Pay Postpaid Bills

Use your Touch ‘n Go Wallet to top up mobile plans and pay utilities.

7. Pay Taxi Fares With #JOMTEKSI

Look out for these TNG-enabled taxi hotspots:

- D’Pulze

- Lim Kok Wing University

- Putrajaya Sentral

- Shaftsbury Square

- Tamarind Square

8. Donate Digitally With TNG

Scan QR codes to contribute to NGOs, temples, mosques, and churches.

Touch ‘n Go eWallet Guide In Malaysia: Everything You Need To Know (2025): Here’s a guide to ATM withdrawals with YouTrip in Malaysia

TNG eWallet Tiers and Limits

Feeling limited by your 200 MYR wallet cap? You’re likely on the Lite tier. Here’s a quick comparison of the TNG eWallet tiers:

| Touch ‘n Go eWallet Tiers | Lite | Premium |

| eWallet Size | 200 MYR (~S$59.61) | 20,000 MYR (~S$5,960.77) |

| Monthly Transaction Limit (excluding transportation, RFID, and PayDirect) | 2,000 MYR (~S$596.08) | 120,000 MYR (~S$35,764.62) |

| Annual Transaction Limit (including transportation, RFID, and PayDirect) | 24,000 MYR (~S$7,152.92) | 360,000 MYR (~S$109,293.87) |

| Features | ✅ Make payments ✅ Reload ✅ RFID ✅ Receive money | ✅ Make payments ✅ Reload ✅ RFID ✅ Receive money ✅ Transfer money ✅ Money-back guarantee protection ✅ Earn daily returns via GO+ ✅ Balance Cash Out |

| How To Access Different Tiers | By registering in the Touch ‘n Go app | To upgrade from Lite to Premium, you will need to complete your eWallet Account Verification (eKYC). |

Touch ‘n Go eWallet Guide In Malaysia: Everything You Need To Know (2025): Here’s How To Capitalise On The Malaysian Ringgit Right Now

Touch ‘n Go eWallet Convenience Fees

| Fees & Charges | Amount |

| Credit card reloads (Malaysian bank) | 1% convenience fee of the reload amount |

| Credit card reloads (Non-Malaysian bank) | Up to 2.6% convenience fee of the reload amount |

| Debit card reloads (Malaysian bank) | No fee |

| Debit card reloads (non-Malaysian bank) | Up to 2.6% of the reload amount |

| Reload PIN | 1% of the reload amount or the converted amount from non-transferrable balance |

| Overseas Transactions | 1% overseas transaction conversion fee (included in the daily exchange rate of your travel destination) |

Touch ‘n Go eWallet Guide In Malaysia: Everything You Need To Know (2025): Check out 21 Things To Do In Mount Austin JB | Food & Activities (2025)

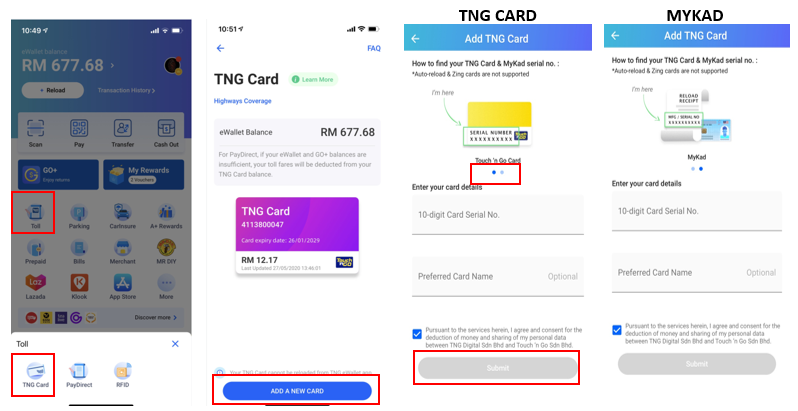

How to link my Touch ‘n Go card to my Touch ‘n Go eWallet?

Image Credits: Touch ‘n Go

Link your Touch ‘n Go card to the eWallet app to top up on the go!

1️⃣ Download the Touch ‘n Go eWallet on the App Store or Google Play

2️⃣ Tap on ‘TNG Card’ on the home page > ‘Add card’

3️⃣ Verify your account

4️⃣ Enter the 10-digit serial number on your Touch ‘n Go Card > ‘Submit’

5️⃣ Enter your 6-digit PIN to verify your identity

6️⃣ Your TNG card has now been added to your eWallet!

Touch ‘n Go eWallet Guide In Malaysia: Everything You Need To Know (2025): Here are the Best JB Massage Spots For Your Weekend Getaway 2025 (With Prices)

How to top up my Touch ‘n Go eWallet with YouTrip?

Link your YouTrip card to your Touch ‘n Go eWallet for easy top-ups. Here’s how:

1️⃣ Sign up for YouTrip

👉Don’t have an account yet? Sign up now and use the promo code <YTBLOG5> for free S$5!

2️⃣ Top up your YouTrip wallet with PayNow or a Linked Bank Account (eGIRO) > Tap ‘Exchange’ to lock in the best MYR rates!

3️⃣ On the home page of your Touch ‘n Go app, tap ‘+ Add money’ > ‘Debit Card’

4️⃣ Enter the amount you’d like to reload (minimum 20 MYR) > ‘Continue’

5️⃣ Enter your YouTrip card details > ‘Reload Now’

You’re all set to top up your Touch ‘n Go eWallet with the best MYR rates!

Touch ‘n Go eWallet Guide In Malaysia: Everything You Need To Know (2025): YouTrip Vs Amaze in Malaysia — which suits your travel needs best?

How to pay with the Touch ‘n Go (TNG) eWallet?

Using the TNG eWallet for payments in Malaysia is not only simple but also convenient. With over 360,000 participating merchants in Malaysia, it’s accepted just about everywhere.

✅ In-store

Simply open up the Touch ‘n Go app and scan the merchant’s QR code — or let them scan yours. Look for the TNG logo at checkout.

✅ Online:

Select ‘Touch ‘n Go’ as your payment method on sites like Lazada.

Pro Tip: Make sure your TNG Wallet is topped up. For overseas merchants, check for currency conversion fees (unless linked with YouTrip or another multi-currency card).

Touch ‘n Go eWallet Guide In Malaysia: Everything You Need To Know (2025): Here’s how you can send money from Singapore to Malaysia with YouTrip

Paying with the Touch ‘n Go eWallet overseas

If you’re shopping overseas, the TNG eWallet works with partners in over 40 countries. You can use it internationally at:

- Singapore: NETS terminals

- Thailand: PromptPay

- EU, UK, US, China: Alipay+ supported outlets

Touch ‘n Go eWallet Guide In Malaysia: Everything You Need To Know (2025): Find out more about petrol holding fees in Malaysia here

Using the Touch ‘n Go eWallet for transport

- Train Tickets: Buy online using TNG Wallet

- Tolls: Link your RFID tag for cashless toll payments

- Buses: Some still require the physical TNG card

Touch ‘n Go eWallet Guide In Malaysia: Everything You Need To Know (2025): Check out this guide for 15 Best JB Hotels From S$46/Night (2025)

Using the Touch ‘n Go eWallet for parking

Using PayDirect, link your TNG card to the eWallet for auto deductions during parking. No more topping up manually!

Touch ‘n Go eWallet Guide In Malaysia: Everything You Need To Know (2025): Here are 16 fun things to do in Malacca

Which multi-currency card should I link to my Touch ‘n Go eWallet?

YouTrip Vs Revolut Vs Wise Vs Trust Bank. Here’s a comparison between the most popular multi-currency wallets in Singapore so you can determine which works best for you when basking in the sun on your next Malaysia getaway!

Here’s a breakdown of some of the key features and benefits available:

| YouTrip | Revolut | Wise | Trust Bank | |

| Able to lock in currencies? | ✅ | ✅ | ✅ | ❌ |

| Exchange rates at the time of writing on 13 Apr 2025 | 1 SGD = 3.335 MYR | 1 SGD = 3.322 MYR | 1 SGD = 3.322 MYR | 1 SGD = 3.322 MYR |

| Transaction Fees | No fees | ✅ During weekdays: No fee for all currencies ✅ During weekends: 1% fee for all currencies | ✅ From 0.43% with a min. fee of S$0.01 (fee varies by currency) | No fees |

| Fees Incurred When Topping Up Your TNG eWallet | Up to 2.6% convenience fee | Up to 2.6% convenience fee | Up to 2.6% convenience fee | Up to 2.6% convenience fee |

Touch ‘n Go eWallet Guide In Malaysia: Everything You Need To Know (2025): Here are 27 things to do in JB!

New to YouTrip?

Now you’re all set to travel the causeway hassle-free! Link your YouTrip card with your Touch ‘n Go eWallet for the best MYR rates with zero FX fees and no hidden charges.

Skip the money changer and get a free YouTrip card + S$5 YouTrip credits with code <YTBLOG5>.

Then, head over to our YouTrip Perks page for exclusive offers and promotions — we promise you won’t regret it. Join our Telegram (@YouTripSG) and Community Group (@YouTripSquad) for travel tips, event invites, and more!

Happy travels!

Related Articles:

23 Trendy JB Cafes To Visit Right Now 2025

Best Things To Do In Desaru (1HR Away From JB) 2024

3-Day Penang Itinerary: Best Things To Do In Penang