Wondering when’s a good time to make a currency exchange for AUD on the YouTrip app? Here’s our guide to securing the best SGD to AUD rate! 🇦🇺

In this guide, we’ll explore where to find the best SGD to AUD rates in Singapore, the best way to make payments in Australia, and answer various other essential payment-related questions. Read on to save smart on your adventures and enjoy a hassle-free trip to Aussie!

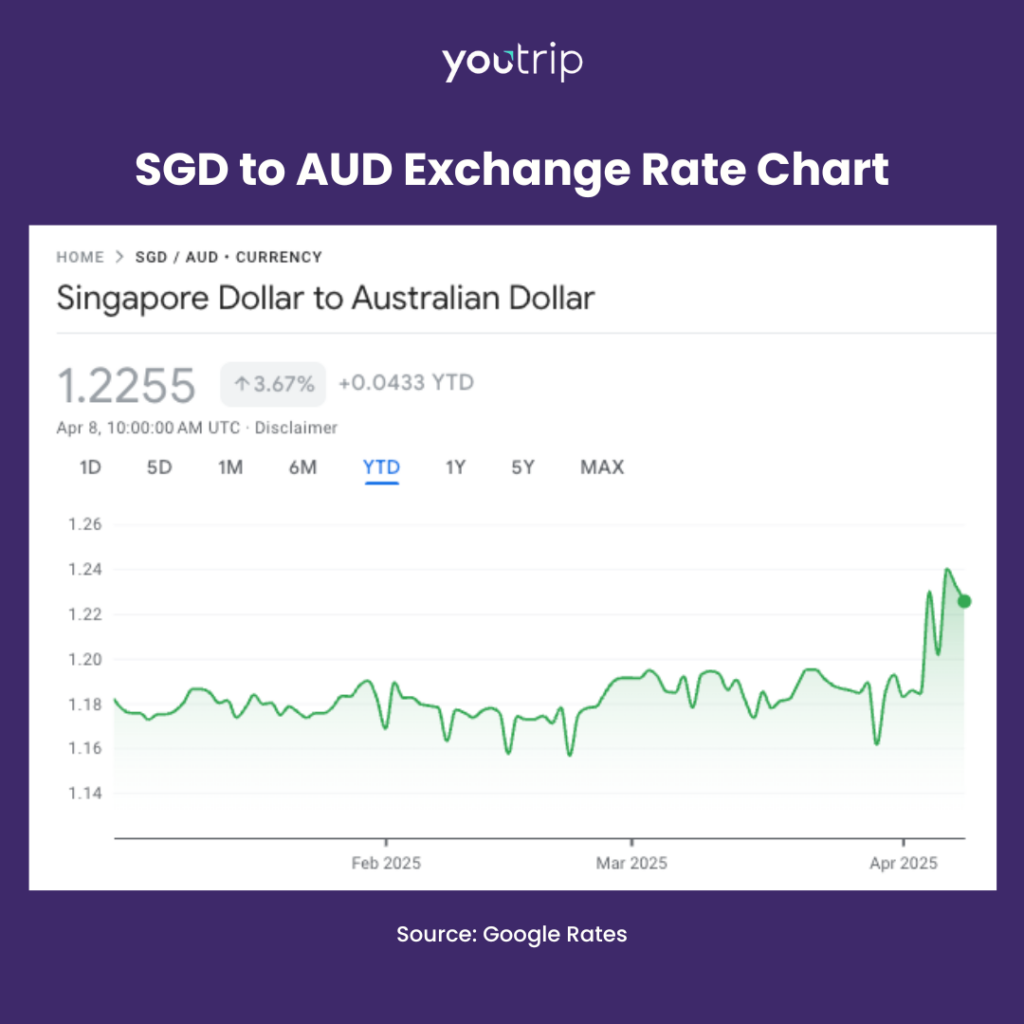

📣 Breaking News: The Australian dollar has hit an all-time low

On 7 April 2025, the Australian Dollar (AUD) fell to a notable all-time low against the Singapore Dollar (SGD). 📉 This significant depreciation is largely attributed to global market responses to recent U.S. tariff announcements. The exchange rate today (8 April 2025) stands at S$1 = 1.225 AUD.

For Singaporean travellers, the weakened AUD means that expenses in Australia is now relatively more affordable when converted from SGD! If you’re planning a trip to Australia this year, now could be a good time to exchange your SGD to AUD. 👀

1. What is the SGD to AUD exchange rate today?

As of 8 April 2025, the SGD to AUD exchange rate stands at approximately 1 SGD = 1.2255 AUD. Starting the year around the 1.18 mark, the SGD to AUD rate showed moderate volatility before the Singapore Dollar experienced a notable surge in value against the Australian Dollar over the past few days.

This strengthening culminated in a peak of 1 SGD = 1.24 AUD on Monday (6 April). This upward trend means that your SGD now converts to slightly more AUD! If you’re planning a trip to Australia soon, it might be a good time to exchange your SGD to AUD while the rate remains favourable.

💡 Tip: Use YouTrip’s in-app money changer to convert your SGD to AUD in advance and avoid unfavourable fluctuations during your trip! Lock in the best rates with 0% markups today.

2. Where to check live SGD to AUD exchange rates?

There are many sites for you to check live SGD to AUD rates quickly and easily. Here are some sites where you can monitor real-time exchange rates:

- Google & XE.com: These currency converter sites are good for general reference, but do not reflect the exact rates banks or money changers offer.

- Bank websites (DBS, UOB, OCBC): Bank websites show daily rates clearly, but often include markups.

- Multi-currency apps (YouTrip, Wise, Revolut): These platforms typically showcase real-time rates and display fees transparently.

- Money changer aggregators (CashChanger, Get4x): Sites like these are good for comparing money changer rates in Singapore before heading down.

3. Where can I get the best SGD to AUD exchange rate in Singapore?

Surprise! The best rates aren’t at money changers or banks. To get the best SGD to AUD rate, consider using a multi-currency card like YouTrip!

Here’s why you should use a YouTrip card:

- Competitive rates: Enjoy competitive wholesale exchange rates with no inflated markups when you pay with your YouTrip card! 💳 Fun fact: Banks typically mark up mid-market rates and sneak in extra fees, leaving you with less to spend. With YouTrip, you get direct wholesale rates with zero extra charges – that basically means more Australian Dollar for every Singapore Dollar! 🚀

- No hidden fees: Unlike typical credit cards, YouTrip doesn’t charge users additional conversion or transaction fees. While these fees may seem insignificant (fun fact: credit cards charge an average of 2 – 3% fees per overseas transaction), they can really add up with every payment you make 📈

- Ultimate convenience: Skip the queues at money changers! Just pay with your YouTrip card for the best rates – you can also use it to withdraw cash at ATMs worldwide 💵

- Safety & security: YouTrip is fully licensed and regulated by the Monetary Authority of Singapore (MAS). ☑️ Carry less cash and enjoy enhanced security features with your YouTrip card.

4. Cash, card, or YouTrip?

Curious how YouTrip’s AUD exchange rates stack up against cash or your regular credit card? Here’s a breakdown of how much you’ll be charged when spending 1,000 AUD in Australia 🇦🇺:

| Card | SGD to AUD rate (as of 8 Apr 2025) | Fees | SGD charged for 1,000 AUD |

| YouTrip | 1 SGD = 1.2240 AUD | $0 | S$816.99 👑 |

| Credit Card | 1 SGD = 1.2012 AUD | 3.5% | S$861.64 |

| Revolut | 1 SGD = 1.2218 AUD | $0 (1% on weekends) | S$818.47 |

| Wise | 1 SGD = 1.2240 AUD | 0.2% | S$818.62 |

💡 Based on the comparison of rates and fees, you’ll be charged the least amount with YouTrip, followed by Revolut and Wise. Paying with a regular credit card can cost you up to S$45 more for a 1,000 AUD spend due to less favourable rates and high foreign transaction fees! 🧐

5. How can I lock in the best AUD rates with YouTrip?

In a nutshell, YouTrip works to “unpinch” your wallet – you don’t need to worry about losing money from exchange rate margins.

- ✅ Simply top up the desired amount of SGD you wish to change to Australian Dollars in your mobile wallet

- ✅ Tap on the exchange icon in your YouTrip app and YouTrip will do all the work with Smart Exchange™

- ✅ You’ll see our major currencies available for real-time currency exchange and conversion – go ahead and pick out AUD

- ✅ And there you have it, you have the best AUD rates locked in!

6. How to pay in the Australia?

Paying in Australia is super easy! Here are the most common payment methods:

- Debit and credit cards: Cards by issuers like Mastercard and Visa are widely accepted.

- Prepaid cards: Prepaid travel cards like YouTrip are accepted wherever card payments are accepted, and can help you avoid high foreign transaction fees 🤓

- Mobile wallets: Mobile payment services like Apple Pay and Google Pay are accepted in many places.

- Cash: While not essential, some smaller vendors, markets, or rural areas in Australia may still prefer cash.

7. Do I need cash in Australia?

For the most part, cash is not necessary in Australia due to wide acceptance of card and contactless payments. However, it’s still a good idea to have a small amount of cash for:

- Cash-only small businesses, markets, or food stalls

- Rural areas or smaller towns

- Taxi rides (most taxis also accept card, but typically include a high surcharge of 5 – 10%)

8. Can I use my Singaporean debit or credit card in Australia?

Yes! Most Singapore-issued debit and credit cards work in Australia, especially if they’re issued by Mastercard, Visa, or AMEX.

Here are some helpful tips for using cards in Australia:

- Watch out for foreign transaction fees – some banks or even merchants themselves charge you surcharges when you pay with a credit or debit card. Credit cards typically have higher fees (~1% – 2.5%) while debit card fees are smaller (~0.5% – 1%).

- AMEX fees are the highest – AMEX cards typically get charged the highest fees, so avoid using your American Express card if possible!

- Watch out for DCC (Dynamic Currency Conversion) – Always choose to be charged in AUD instead of SGD to avoid bad exchange rates.

- Public transport is card-friendly too – You can ride trains, buses, and ferries directly with your card in most major cities like Sydney, Melbourne, Brisbane, and Perth! Note: You’ll still need a Myki (reloadable transport card) card to ride public transport in Melbourne, but we heard that contactless payment readers may be rolled out soon.

- Some places are card-only – Some shops and cafes no longer accept cash. So make sure you have a card with you!

💡 Card surcharges and fees tend to be common in Australia. Use a travel card like YouTrip to get the best rates with 0% mark-ups wherever you go! 🌍

9. What are the best travel cards to use in the Australia?

The best card depends on your spending habits, but in general for overseas spending, opt for a card with competitive exchange rates and low, transparent fees!

10. Can YouTrip be used in Australia?

YouTrip is a prepaid Mastercard, and can be used seamlessly in Australia with no foreign transaction fees. It’s perfect for contactless payments, online bookings, and ATM withdrawals.

11. Can I withdraw cash in Australia?

Yes, but watch out for fees! ATM fees vary, but charges average around AUD 2 – 5 (S$1.7 – S$4) per withdrawal.

Here are some tips for withdrawing cash in Australia:

- ✅ Use major bank ATMs (ANZ, NAB Commonwealth Bank, Westpac) for typically lower fees

- ✅ Avoid independent ATMs in small stores or bars – these have the highest fees!

- ✅ Withdraw cash with a multi-currency card like YouTrip for favourable rates

Ready for your trip to Australia?

We hope this guide helps you prepare for your trip to Australia! By understanding the SGD to AUD exchange rate, knowing where to get the best rates for exchanging your Australian Dollars, and choosing the right payment methods, you’re set for a smooth and hassle-free experience. Have an amazing time in Australia!

Join the YouTrip fam!

As Singapore’s favourite multi-currency wallet, we aim to get those pesky fees out of the way and help you save on your travels. With the best foreign exchange rates, no longer will you have to deal with those long queues at money changers! So if you’re looking for a go-to travel card, sign up for your complimentary YouTrip card today with <YTBLOG5> and get FREE S$5 in your account!

For more great tips and articles like this, join our Telegram (@YouTripSG) and subscribe to our free weekly newsletter here or down below.

And while you’re at it, why not join the conversation with thousands of #YouTroopers in our very own Community Telegram Group @YouTripSquad? Get tips and tricks to everything YouTrip including exclusive invites to exciting events and experiences, & be part of the #YouTripSquad! 💜

Stay safe, and happy travels!

More articles you may enjoy:

- Best things to do in Melbourne, Australia (hidden gems included!)

- 5 family-friendly road trips in Australia

- 11 ways to save money in Australia

More currency exchange guides! 🤑

- How to get the best SGD to MYR rates 🇲🇾

- How to get the best SGD to KRW rates 🇰🇷

- How to get the best SGD to CNY rates 🇨🇳

- How to get the best SGD to THB rates 🇹🇭

- How to get the best SGD to USD rates 🇺🇸

- How to get the best SGD to JPY rates 🇯🇵

- How to get the best SGD to NZD rates 🇳🇿