Planning a trip to the U.S. soon and wondering if now is a good time to convert SGD to USD? 🇺🇸

Exchange rates can be unpredictable, and even small fluctuations affect how much you actually spend on your trip—whether it’s shopping, hotels, or everyday transactions.

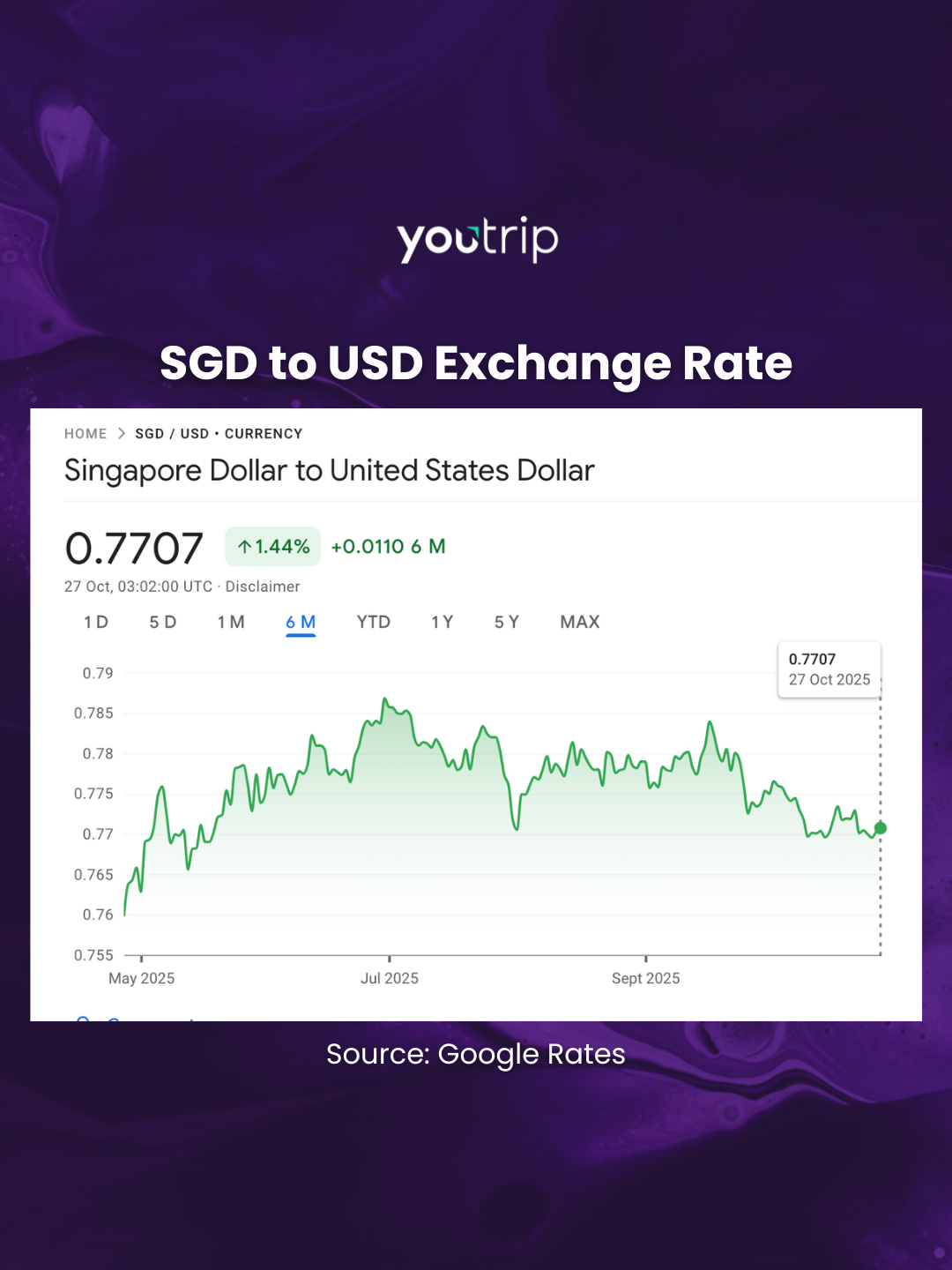

As of 27 October 2025, the SGD to USD rate is 1 SGD = 0.77 USD. The Singapore Dollar has held relatively strong, while the U.S. Dollar has softened slightly in recent months. This means you may get better value when converting SGD to USD now compared to earlier this year.

This guide covers everything from current exchange rates, historical trends, forecasts, and practical tips to get the best value with your YouTrip card.

TL;DR: Quick Conversion + Must-Knows

| Topic | Info |

|---|---|

| 1 SGD to USD today | 1 SGD = 0.77 USD (27 Oct 2025) |

| 100 USD in SGD | ~S$129.87 |

| Historical High | 1 SGD = 0.83 USD (Aug 2011) |

| Historical Low | 1 SGD = 0.65 USD (Mar 2009) |

| Forecast | SGD likely to remain strong; USD may fluctuate based on US economic data |

| Why? | Softer U.S. inflation + interest rate expectations + SGD’s strong policy stance |

| Best way to exchange | YouTrip card – zero fees, competitive rates |

| Tips | Monitor rates, lock in via multi-currency cards, avoid cash surcharges |

📚 Table of Contents:

- 1 SGD to USD Today (Latest Exchange Rate)

- Historical SGD to USD Rates

- Is USD Going Up or Down Against SGD?

- SGD to USD Forecast

- Best Way to Exchange SGD to USD

- How to Use YouTrip to Lock in Rates

- Paying in the United States

- Do I Really Need Cash in the United States?

- Withdrawing Money in the United States

- FAQ: SGD to USD

1 SGD to USD Today (Latest Exchange Rate)

As of 27 October 2025:

- 1 SGD = 0.77 USD

- S$100 ≈ 77 USD

- 100 USD ≈ S$129.87

The Singapore Dollar remains relatively stable, while the U.S. Dollar has softened. This makes the current rate fair to favourable for travellers.

💡 Tip: Rates fluctuate daily. Use tools like the YouTrip app to check real-time SGD to USD rates and convert instantly without hidden fees.

Historical SGD to USD Rates

| Date | 1 SGD to USD |

|---|---|

| Mar 2009 | 0.65 USD (historical low) |

| Aug 2011 | 0.83 USD (historical high) |

| Oct 2025 | 0.77 USD (current rate) |

Understanding historical trends can help you decide when to exchange currency for travel or online purchases.

Is USD Going Up or Down Against SGD?

- As of 27 Oct 2025: USD has slightly weakened against SGD

- Why USD is weakening: Lower interest rates, economic slowdowns, trade deficits, geopolitical uncertainty

- Why SGD is strong: Stable economy, sound fiscal policies, positive trade balance, foreign investment inflows

Monitoring trends helps you choose the right time to convert SGD to USD.

SGD to USD Forecast

Whether you’re planning a short trip to the US or managing longer-term travel expenses, keeping an eye on the SGD to USD rate is essential. Here’s what the forecasts suggest for late 2025 and beyond.

🟢 Short-Term Outlook (Oct–Dec 2025)

- Projected range: 0.76 – 0.772 USD per SGD

- Supported by Singapore’s GDP growth of 2.9% YoY in Q3 2025 (Reuters)

🟡 Medium-Term Outlook (2026)

- USD may strengthen if U.S. interest rates rise, attracting capital (Moomoo)

- Expect short-term volatility; SGD could lose some purchasing power if USD spikes

🟠 Long-Term Outlook (2025–2030)

- USD/SGD could gradually reach 1.34 by Dec 2025 (Traders Union)

- Influenced by U.S. fiscal policy, global conditions, and capital flows

💡 Tip: Lock in rates early using multi-currency cards like YouTrip to avoid fluctuations.

Tips:

- Use platforms like YouTrip for real-time updates and wholesale exchange rates.

- You can convert SGD to USD at competitive rates without hidden fees, ensuring you get maximum value for every Singapore Dollar.

- Monitoring daily trends can help you decide when to exchange or top up your travel wallet for upcoming trips.

Best Way to Exchange SGD to USD

The best rates aren’t always at banks or money changers.

YouTrip Card Advantages:

- Competitive rates: Wholesale exchange rates, zero markups

- No FX fees: Avoid 2–3% credit card foreign transaction fees

- Convenience: Skip money changer queues; pay anywhere Mastercard is accepted

- Safety: Licensed by MAS, secure, and globally accepted

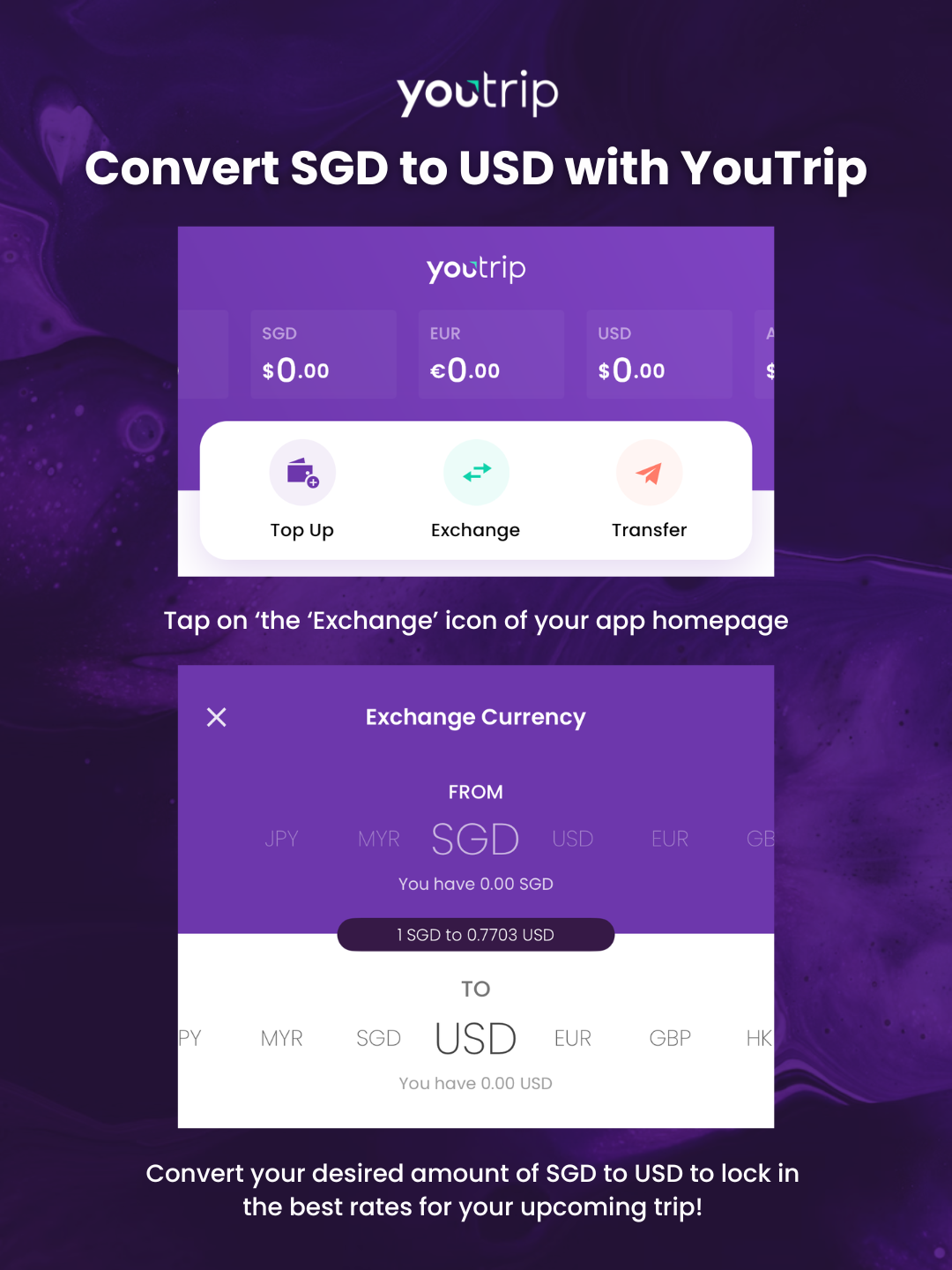

How to Use YouTrip to Lock in Rates

In a nutshell, YouTrip works to “unpinch” your wallet – so you don’t need to worry about losing money from exchange rate margins. Here’s how you can lock in the best USD rates with zero fees:

- Top up SGD via PayLah, linked bank account, or debit/credit card

- Tap the exchange icon in the YouTrip app

- Select USD to convert at real-time wholesale rates

- Done! You’re ready to spend USD with zero fees

Paying in the United States

- Credit/debit cards: Mastercard & Visa are widely accepted

- Multi-currency cards: YouTrip avoids foreign transaction fees

- Mobile wallets: Apple Pay, Google Pay

- Cash: Useful for tipping, street vendors, small businesses

Do I Really Need Cash in The United States?

While the US is largely cashless-friendly, carrying a small amount of cash can still be handy in certain situations:

- Tipping: Most restaurants allow card tips, but some prefer cash

- Small vendors: Food trucks, farmers’ markets, and small shops may require cash

- Public transport & taxis: Cards work in major cities, but rural areas may require local transit cards

💡 Tip: Using a multi-currency card like YouTrip reduces the need to carry cash and lets you pay conveniently with USD without worrying about fees.

Withdrawing Money in The United States

- Use Major Bank ATMs: Bank of America, Chase, Wells Fargo, Citibank for better rates and lower fees

- Avoid private ATMs: 3–7 USD per withdrawal, plus poor rates

- Use YouTrip: Withdraw USD at wholesale rates with minimal fees

- Pro Tip: Free ATM withdrawals up to S$400/month; 2% fee imposed thereafter

💡 Extra Tip: Check ATM networks (Visa/Mastercard) and always opt to pay in local currency to avoid DCC charges for better conversion.

Secure the best USD rates with YouTrip!

Get the best SGD to USD rates and enjoy a smooth trip to the U.S. with YouTrip. Skip hidden fees and long queues—convert SGD to USD at wholesale rates with zero markups straight from the app.

💜 Looking for a go-to travel card? Sign up for your free YouTrip card today with <YTBLOG5> and get S$5 in your account!

Join our Telegram @YouTripSG for tips, and connect with #YouTroopers in @YouTripSquad for exclusive advice and travel perks.

Travel smart, stay safe, and enjoy every moment!

FAQ: SGD to USD

Q1: What is 1 SGD to USD today?

1 SGD = 0.77 USD (27 Oct 2025)

Q2: How much is $100 USD in Singapore?

Approximately S$129.87

Q3: What was the lowest SGD to USD rate ever?

~0.65 USD in March 2009

Q4: Is USD going up or down against SGD?

USD has slightly weakened recently due to lower US interest rates and economic factors

Q5: Why is USD weakening?

Economic slowdown, low interest rates, trade deficits, geopolitical uncertainty

Q6: Why is SGD getting stronger?

Stable economy, sound fiscal policies, trade surpluses, foreign investment inflows

Q7: What is a good SGD to USD exchange rate?

Rates around 1 SGD = 0.77–0.78 USD are considered favourable

Q8: Where can I get the best SGD to USD exchange rate in Singapore?

Multi-currency cards like YouTrip offer wholesale rates with zero markups

Related Currency Exchange Guides:

- 🇲🇾 SGD To MYR Rate Today

- 🇯🇵 SGD To Yen Guide

- 🇰🇷 SGD To Korean Won

- 🇨🇳 Best SGD to CNY Rate in Singapore

- 🇹🇭 Best SGD to Thai Baht Rate in Singapore

- 🇦🇺 Best SGD To AUD Exchange Rate

- 🇳🇿 SGD to NZD Exchange Rate

- 🇻🇳 SGD To VND: How To Get The Best Vietnamese Dong Rate

- 🇹🇼 SGD To TWD: How To Get The Best Taiwan Dollar Rate

- 🇭🇰 Best SGD to HKD Rate in Singapore

- 🇨🇭 Best SGD To CHF Exchange Rate

- 🇪🇺 Best SGD to EUR Rate in Singapore

- 🇬🇧 Best SGD to GBP Rate in Singapore

*All currency conversion rates are accurate to the nearest 10 cents on 12 July 2022 SGT 3.10 PM. Bank card prices are calculated based on 3.25% foreign currency transaction fee.