Wondering which multi-currency card will grant you the biggest savings? Let us do the work for you as we compare the best multi-currency cards in Singapore and determine which suits your needs best.

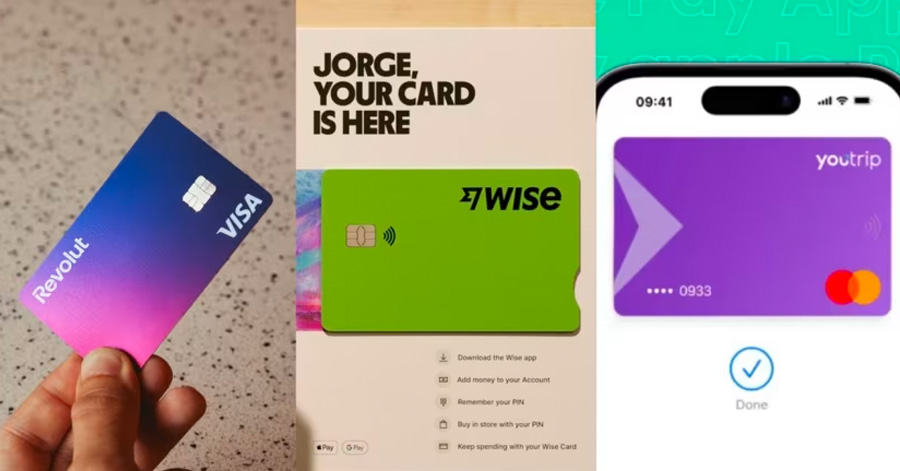

The holidays are coming up and you’re all but ready to splurge away — after all, you’re on vacation! But what if we told you that picking the right multi-currency card can make a huge difference when scoring greater savings? That’s where we come in. Read on as we compare the best multi-currency cards in Singapore — YouTrip, Revolut, Wise, Instarem Amaze, and Trust — and settle the debate of which multi-currency card suits your travel needs the best.

💜 Stay Up To Date:

– The Wildest Dream Music Experience For Two In Town

– How To Capitalise On The Malaysian Ringgit Right Now

– South Korea Cherry Blossom Forecast 2024: When And Where To Spot Them

What’s A Multi-Currency Card?

Image Credits: CNA

Multi-currency cards are no doubt the handiest tools to have on your travels. It allows you to skip the queues at money changers and simplifies the way we deal with foreign currencies — all while making things all the more convenient with contactless payments.

Wanna lock in the depreciating JPY/EUR/USD in advance? All it takes is a few taps on your phone. Simply top up your multi-currency wallet in SGD and exchange it for the in-wallet currency you need. Or let the card automatically convert the currency for you. With the right multicurrency card, you basically have a currency exchange service in the palm of your hand!

With various supported currencies in one place and the ability to switch between them easily, multi-currency cards are your best bet when it comes to overseas transactions. But with so many options to choose from, where do you start? What is the best multi-currency card? More below 👇

Best Multi-Currency Cards In Singapore 2024: Check out the best travel credit cards in Singapore for overseas spending here

Factors To Consider When Choosing A Multi-Currency Card:

1. Which has the best exchange rate?

If you’re looking for a card that’ll give you the biggest savings overseas, the one with the best foreign currency exchange rate will be your most crucial consideration.

Looking for real-time currency exchange rates that are close to the published rates you see on Google, XE.com, and other financial sites? You might want to explore a multi-currency card that utilises Wholesale Exchange Rates. These rates are foreign exchange rates used by banks, large corporations, and public and private institutions for large-volume currencies.

Refer to this Mastercard Calculator for Wholesale Exchange Rates.

Best Multi-Currency Cards In Singapore 2024: Find out more about Wholesale Exchange Rates here

2. Fees

Another factor to consider when choosing a multi-currency card is its fee structure. Some multi-currency cards offer higher fees compared to others. Here are some fees to look out for:

- Annual Fees: Some multi-currency cards come with an annual fee when you opt for premium plans that give you extra benefits. Consider if this extra cost is worth it for you.

- Foreign Transaction Fees: Some multi-currency wallets charge a foreign transaction or currency conversion fee of up to 3% when you’re paying in foreign currency.

- Overseas ATM Withdrawal Fees: Most multi-currency cards charge a fee for overseas ATM withdrawals — but some offer free monthly withdrawals. Choose a card that lets you withdraw your money hassle-free.

- P2P Transfer Fees (Sending Money): If you’re studying abroad, contemplating an overseas student exchange program, or have relatives residing abroad, it’s worth considering a multi-currency card that doesn’t impose transfer fees. Some multi-currency wallets charge a fee of up to 3% when transferring funds to other accounts.

- Top-Up Fees: Top-up fees may reach as high as 2.08% and can vary depending on the type of card you use for top-ups — e.g. Mastercard vs Visa or debit vs credit card. These top-up fees can also vary depending on the currency.

Best Multi-Currency Cards In Singapore 2024: Find out how you can capitalise on the Malaysian ringgit now!

3. Wallet Limits

Wallet limits include top-up and annual spending limits. Some wallets have lower limits compared to others. Consider your overseas spending habits and if you tend to lock in the best rates before your trip.

Best Multi-Currency Cards In Singapore 2024: Check out our comparison guide on Wise Vs Revolut here

4. Other Added Benefits

Much like your traditional credit cards, some multi-currency cards also offer exclusive rewards and benefits for their users, whether it’s in the form of cashback for online shopping, air miles, or exclusive deals and discounts for their cardholders.

Different cards also come with their own unique added features that you can look out for, such as expense tracking tools, the ability to do money transfers, access to a virtual card, as well as integration with Apple Pay and Google Pay. These are all additional things you can look out for when deciding on the best multi-currency card for travel 👀

Best Multi-Currency Cards In Singapore 2024: Check out our comparison guide on YouTrip Vs Wise here

Comparing Best Multi-Currency Cards In Singapore 2024

Here’s a comparison between the most popular options when it comes to overseas spending — YouTrip, Revolut, Wise, Amaze, and Trust Bank. Read on as we list out each of their features.

| YouTrip | Revolut | Wise | Amaze | Trust Bank | |

|---|---|---|---|---|---|

| Currencies available to exchange in-app | 10 Currencies | 30 currencies | 40 currencies | 11 currencies | Unable to lock in currencies in-app |

| Annual Fees | No fees | Standard Plan: Free Premium Plan: S$9.99/month Metal Plan: S$19.99/month | No fees | No fees | No fees |

| Foreign Transaction Fees | No fees | On weekdays: No fees apply if you’re within your plan’s fair usage limit On weekends: 1% fee applies regardless of your plan | ✅ From 0.26% *fee varies by currency | No fees for FX transactions ✅ 1% fee (min. fee of S$0.50) for SGD transactions involving GrabPay, prepaid cards, & other e-wallet top-ups | No fees |

| Fair Usage Limit & Fees *A fair usage limit refers to the cap on the total amount of in-app exchanges that can be made per month. | No fair usage limits and fees | Standard Plan: S$5,000 limit and a fee of 0.5% when exceeded Premium Plan: S$15,000 limit and a fee of 0.5% when exceeded Metal Plan: No fair usage limits | No fair usage limits and fees | No fair usage limits and fees | No fair usage limits and fees |

| Overseas ATM Withdrawal Fees | ✅ Free monthly S$400 in ATM withdrawals with a 2% fee thereafter | ✅ Free monthly withdrawals of up to S$350/5 withdrawals with a 2% fee thereafter | ✅ Free monthly withdrawals of up to S$350/2 or less withdrawals with a 1.75% fee thereafter | ✅ 2% fee on the value of all amounts withdrawn | None |

| Sending Money Overseas | Variable fee based on currency and value of transfer | Variable fee from 1.99% | Variable fee from 0.31% | Variable fee from 0.4% | Unable to send money overseas |

| Bank Withdrawals | No fees, limited to 10 bank withdrawals per calendar month. *If you wish to make more than 10 bank withdrawals, you’ll have to request for a refund (processing fee of S$10) | Fair usage limit of 5 free transfers with a fee of S$2.99 for each transfer thereafter | Same currency balance withdrawal/transfer: Fixed fee (varies by currency) Different currency balance transfer: Fixed fee + Variable fee from 0.41% (varies based by currency) | N/A – does not have bank withdrawals | No fees For PayNow or FAST transfer to added payees: Maximum transfer limit of S$100,000 per transaction & S$100,000 for overall daily limit For PayNow to non-added payees: Default daily transfer limit of S$5,000 |

| Top-up Fees | ✅ Mastercard credit/debit card, Visa debit card, PayNow: No fees ✅ Linked Bank Account (eGIRO): No fees ✅ Visa credit cards: 1.5% service fee | ✅ Mastercard debit card: 0.51% ✅ Mastercard credit card: 0.62% ✅ Visa debit card: 0.30% ✅ Visa credit card 1.97% ✅ International cards: 2.08% ✅ Commercial cards: 1.12% ✅ From bank accounts in Singapore: Free | ✅ Debit card: From 0.43% fee ✅ Credit card: From 0.43% fee ✅ PayNow: No fees ✅ Manual bank transfer: No fees ✅ Linked bank account (eGIRO): 0.3% fee | ✅ Mastercard credit/debit card & PayNow: No fees ✅ Visa debit & credit cards: 1.5% fee | Fees vary by destination & currency |

| Wallet Limits | ✅ Maximum top-up limit at any time: S$20,000 ✅ Annual spending limit: S$100,000 | Maximum top-up limit at any time: S$20,000 Annual spending limit: S$100,000 | Maximum top-up limit at any time: S$20,000 Annual spending limit: S$100,000 | ✅ Maximum top-up limit at any time: S$5,000 ✅ Annual spending limit: S$30,000 | N/A |

Best Multi-Currency Cards In Singapore 2024: Check out our comparison guide on Trust Bank Vs GXS Bank here

Comparing Exchange Rates Using YSL Bags:

Image Credits: YSL

👜 The Bag In Question: Le 5 À 7 In Smooth Leather

Let’s start off with looking at one of the most popular YSL handbags — the classic 5 to 7 bag. Currently, this iconic bag is going at €1,890 (~S$2,680.79) at the time of writing in France — way cheaper compared to Singapore’s price of S$3,390. But how much would it cost when purchasing it with different multi-currency cards?

Best Multi-Currency Cards In Singapore 2024: Check out YSL’s 5 to 7 in Smooth Leather here

Best Multi-Currency Cards In Singapore 2024: Check out this comparison article on YouTrip Vs Amaze here

Best Multi-Currency Cards In Singapore: Comparing Exchange Rates

| YouTrip | Revolut | Wise | Amaze | Trust Bank | |

| Current Exchange Rates as of 18 Dec’24 Google’s Rate: 👉 1 SGD = 0.71 EUR | 1 SGD = 0.7050 EUR | 1 SGD = 0.7040 EUR | 1 SGD = 0.7017 EUR | 1 SGD = 0.7047 EUR | 1 SGD = 0.6999 EUR |

| Total Cost Of YSL Le 5 À 7 In Smooth Leather Bag (€1,890 =~S$2,680.79) | ~S$2,680.85 | ~S$2,684.65 | ~S$2,693.45 | ~S$2,681.99 | ~S$2,700.38 |

Best Multi-Currency Cards In Singapore 2024: Check out this comparison article on YouTrip Vs iChange here

Best Multi-Currency Cards In Singapore: Sending Money Overseas

In case you missed it, YouTrip just launched a brand new remittance feature! You can now send money overseas to 40+ countries with the best rates and no hidden fees. Supported options include Bank Account, DuitNow, GCash, and UPI. Read more here!

As such, we’ll be comparing YouTrip’s remittance feature to Revolut, Wise, and Amaze. This is to determine how much your recipient would roughly receive when sending money to the following countries from Singapore.

*Trust Bank currently does not offer remittance services and will not be included in this comparison table

| | YouTrip | Revolut | Wise Card | Amaze |

|---|---|---|---|---|

| MYR | S$1,000 = 3,300.76 MYR Fees included: S$1.28 | S$1,000 = 3,290.45 MYR Fees included: S$4 | S$1,000 = 3,280.29 MYR Fee included: S$3.95 | S$1,000 = 3,281.10 MYR Fees included: S$7.5 |

| IDR | S$1,000 = 11,860,453 IDR Fees included: S$2.36 | S$1,000 = 11,849.780 IDR Fees included: S$4 | S$1,000 = 11,796,093 IDR Fee included: S$5.12 | S$1,000 = 11,832,804 IDR Fees included: S$6 |

| INR | S$1,000 = 62,614.11 INR Fees included: S$2.96 | S$1,000 = 62,444.80 INR Fees included: S$4 | S$1,000 = 62,260.84 INR Fee included: S$5.10 | S$1,000 = 62,455.24 INR Fees included: S$5.80 |

| PHP | S$1,000 = 43,044.98 PHP Fees included: S$4.51 | S$1,000 = 43,056.16 PHP Fees included: S$4 | S$1,000 = 42,847.06 PHP Fee included: S$6.56 | S$1,000 = 43,026.24 PHP Fees included: S$6.60 |

| USD | S$1,000 = 737.16 USD Fees included: S$4.10 | S$1,000 = 735.88 USD Fees included: S$4 | S$1,000 = 733.30 USD Fee included: S$4.34 | S$1,000 = 731.53 USD Fees included: S$3.90 |

| EUR | S$1,000 = 702.10 EUR Fess included: S$3.31 | S$1,000 = 701.18 EUR Fees included: S$4 | S$1,000 = 699.46 EUR Fee included: S$3.18 | S$1,000 = 699.06 Fees included: S$8 |

*Rates taken as of 18 Dec 2024 at the time of writing

Best Multi-Currency Cards In Singapore 2024: Find out how to send money overseas with YouTrip here

Pros & Cons:

1. YouTrip

Estimated price of Le 5 À 7 In Smooth Leather Bag: ~S$2,680.85

What is YouTrip?

YouTrip is a multi-currency digital wallet that enables you to lock in the best rates all day from 10 popular in-app currencies. Plus, score favourable exchange rates for 150+ currencies worldwide at zero fees. YouTrip is also the first e-wallet to enhance its wallet limits, enabling you to top up S$20,000 and spend with an upsized annual limit of S$100,000. YouTrip offers a range of services which include:

- Transferring money to other YouTrip users via YouTrip Send

- Transferring funds back to your bank account via Bank Withdrawals

- Free* S$400 in ATM withdrawals per month

- Discounts & cashback with merchant partners via YouTrip Perks

- In-app travel insurance with HLAS

Pros:

- One of the major advantages of YouTrip is its exchange rates. By leveraging wholesale exchange rates and charging zero fees, you’re able to score extra savings on items like YSL products.

- YouTrip also offers a higher amount in free monthly ATM withdrawals (S$400) as compared to other multi-currency cards.

- YouTrip was the first in the market to enhance its wallet limits — suitable for those looking to lock in more rates and spend larger amounts.

- YouTrip cardholders can get access to exclusive cashback deals and discounts via YouTrip Perks.

Cons:

- YouTrip is only able to store 10 major currencies in-wallet

- Does not have budgeting tools available

Best Multi-Currency Cards In Singapore 2024: Find out more about YouTrip’s enhanced wallet limits here

2. Revolut

Estimated price of Le 5 À 7 In Smooth Leather Bag: ~S$2,684.65

What is Revolut?

Image Credits: Capture the Atlas

Founded in 2015, Revolut has a multi-currency card and app that leverages interbank rates. Revolut enables you to lock in 30+ currencies and spend in 130+ countries at favourable exchange rates. Accounts range from free standard plans to the pricier Metal plan with more features at higher fees. Revolut offers a wide variety of banking services which include:

- Multi-currency accounts

- Money transfers

- Cryptocurrency trading

Pros:

- Has 30 wallet currencies

- Has various plans that meet different needs — from a free basic account to a premium paid plan

- Has budgeting tools available

- Offers competitive exchange rates

Cons:

- Revolut has annual fees of up to S$19.99 per month to unlock the highest tier for full access

- Has foreign transaction fees of 1% on weekends, P2P transfer fees, as well as fair usage fees when you exceed your plan limit

- Has higher top-up fees that apply across both Mastercard and Visa credit and debit cards

Best Multi-Currency Cards In Singapore 2024: Find out more about Revolut’s fees here

3. Wise

Estimated price of Le 5 À 7 In Smooth Leather Bag: ~S$2,693.45

What is Wise?

Wise, formerly known as TransferWise, is a global money transfer service that offers low-cost international transfers and a multi-currency account. Wise supports 40 wallet currencies and allows users to pay in 160+ countries with competitive exchange rates at low fees. Wise offers a range of services which include:

- International money transfers

- Multi-currency accounts

Image Credits: Wise

Pros:

- Wise utilises mid-market rates to offer users competitive exchange rates and is able to support a vast array of currencies compared to other multi-currency accounts.

- Wise also has a lower ATM withdrawal fee of 1.75%.

Cons:

- Wise offers a higher transaction fee starting from 0.43% onwards

- Has a higher top-up fee of 2% compared to the other multi-currency cards on this list

- Has a 2% fee for funding e-wallets and external accounts (fee varies by currency)

Best Multi-Currency Cards In Singapore 2024: Find out more about Wise’s fees here

4. Amaze

Estimated price of Le 5 À 7 In Smooth Leather Bag: ~S$2,681.99

What is Amaze?

Image Credits: Instarem

The Instarem Amaze card is a multi-currency debit card which offers competitive foreign exchange rates when making overseas purchases. The Instarem Amaze card allows you to:

- Link up to 5 Mastercard debit/credit cards

- Has a reward system that allows you to earn points and redeem them for cashback/miles/rewards in blocks

Pros:

- The Instarem Amaze Card allows you to link up to five Mastercard debit/credit cards,

- Has 0 FX fees

- Able to rack up rewards like InstaPoints

Cons:

- Amaze charges a 1% fee for SGD transactions involving GrabPay, prepaid cards, and other e-wallet top-ups.

- Doesn’t offer any free ATM withdrawals.

- Might not have the most competitive exchange rates in the market when it comes to overseas spending

Best Multi-Currency Cards In Singapore 2024: Find out more about Amaze’s fees here and read our comparison of Amaze vs YouTrip here

5. Trust Bank

Estimated price of Le 5 À 7 In Smooth Leather Bag: ~S$2,700.38

What is Trust Bank?

Image Credits: Trust Bank

Trust Bank is a Full Bank backed by Standard Chartered and FairPrice Group. Trust Bank offers two cards: The Trust Link Card and the NTUC Link Card (exclusively for NTUC Union members). Trust offers:

- A base interest rate of 1.25% p.a. for deposits up to S$500,000

- 0.05% p.a. for deposits above S$500,000

- A bonus interest rate of up to 3.5% p.a. when meeting the following requirements

- No minimum account balance is required, however, the maximum deposit-earning interest amount is S$125,000.

Pros:

- The Trust Bank card is a savings account

- Offers minimal fees – doesn’t charge for ATM withdrawals or foreign currency transactions

- Offers rewards such as coupons and stamp cards

Cons:

- Compared to other multi-currency cards, you’re not able to lock in depreciating rates with Trust.

- Although Trust Bank offers minimal fees, there’s a late payment charge of S$100 and interest accrued if the minimum amount due is not received by the due date

- Trust Bank’s FX rates had the worst exchange rates compared to its competitors

- Doesn’t offer remittance services

Best Multi-Currency Cards In Singapore 2024: Find out more about Trust Bank’s late fees here

Maximise Your Savings — Every Cent Counts!

And there you have it! You’re all set with your very own cheat sheet on the best multi-currency cards in Singapore. Find a card that suits your needs best — whether you’re looking for the best rates in town or one with zero fees.

As Singapore’s favourite multi-currency wallet, we’re all about giving you the best rates with none of those pesky fees for bigger and better savings. So if you’re looking for a go-to travel card, sign up for your complimentary YouTrip card today with <YTBLOG5> and get FREE S$5 in your account!

For more great tips and articles like this, join our Telegram (@YouTripSG) and subscribe to our free weekly newsletter here or down below. And while you’re at it, why not join the conversation with thousands of #YouTroopers in our very own Community Telegram Group @YouTripSquad? Get tips and tricks to everything YouTrip including exclusive invites to exciting events and experiences, & be part of the #YouTripSquad! 💜

Happy travels!

Related Articles:

YouTrip’s Ultimate Saving Guide: Unveiling Brands That Are Cheaper In Japan Than Back Home

Best Travel Cards in Singapore: Credit Card Edition

Don’t Miss Out Saving With The Best Deals

Budget-Friendly Family Holidays In Europe