Wise Vs Revolut — which is the better card? In this comparison guide, we’ll be listing out the pros and cons of each and their features, as well as giving you the lowdown on their fees, wallet limits, and exchange rates at the time of writing.

If you’re a fan of multi-currency cards, you’re surely no stranger to these two — Wise and Revolut. They’re handy on your travels and help you to manage your money overseas. In fact, you might already hold one of these cards yourself. But in 2024, which is better? Wise Vs Revolut 🤔

We’re doing the heavy lifting for you so sit back and relax as we delve into the nitty gritty and compare which is the better multi-currency card to use on your travels abroad 👇

💜 Stay Up To Date:

– Destinations: Anywhere With $1

– YouTrip’s Budget Guide: Free Things To Do In New Zealand 2023

– YouTrip’s Guide To The Best Scuba Diving Sites In Asia

Wise Vs Revolut: Comparing Features

While this is a Wise Vs Revolut comparison, we’ll be adding our fave purple YouTrip card to the mix for those on the hunt for a brand-new multi-currency card to take along on their adventures.

| YouTrip | Wise | Revolut | |

| Currencies Available In Wallet | 10 currencies | 40 currencies | 30 currencies |

| Annual Fees | No fees | No fees | Standard Plan: Free Premium Plan: S$9.99/month Metal Plan: S$19.99/month |

| Foreign Transaction Fees | No fees | ✅ From 0.43% with a min. fee of S$0.01 (fee varies by currency) | ✅ Fees during Foreign Exchange Market Hours for Standard Plan Customers: No fee for all currencies ✅ Fees outside Foreign Exchange Market Hours for Standard Plan Customers: 1% fee for all currencies |

| P2P Transfer Fees (Sending Money) | No fees | From 0.43% (fee varies by currency) | ✅ Free instant transfers to other Revolut users within Singapore ✅ 1.99% fee for instant transfers to other Revolut users globally ✅ 1% fee for bank transfers, subjected to a min. fee of US$1 ✅ 3% fee for card transfers, subjected to a min. fee of US$1 |

| Top-Up Fees | ✅ Mastercard credit/debit cards, Visa debit cards, PayNow: No fees ✅ Visa credit cards: 1.5% service fee ✅ Linked Bank Account (eGIRO): No fees | ✅ PayNow: No fees ✅ Manual bank transfer: No fees ✅ Debit card: 4.2% fee ✅ Credit card: 4.2% fee ✅ Linked bank account: 0.3% fee | ✅ Mastercard debit card: 0.51% ✅ Mastercard credit card: 0.62% ✅ Visa debit card: 0.30% ✅ Visa credit card 1.97% ✅ International cards: 2.08% ✅ Commercial cards: 1.12% ✅ From bank accounts in Singapore: Free |

| Bank Withdrawals | No fees, limited to 10 bank withdrawals per calendar month. *If you wish to make more than 10 bank withdrawals, you’ll have to request for a refund (processing fee of S$10) | Same currency balance withdrawal/transfer: Fixed fee (varies by currency) Different currency balance transfer: Fixed fee + Variable fee from 0.41% (varies based by currency) | Fair usage limit of 5 free transfers with a fee of S$2.99 for each transfer thereafter |

| Wallet Limits | Maximum top-up limit at any time: S$20,000 Annual spending limit: S$100,000 | Maximum top-up limit at any time: S$20,000 Annual spending limit: S$100,000 | Maximum top-up limit at any time: S$20,000 Annual spending limit: S$100,000 |

| Overseas ATM Withdrawal Fees | Free monthly withdrawals of up to S$400 with a 2% fee thereafter | Free monthly withdrawals of up to S$350/2 or less withdrawals with a 1.75% fee thereafter | Free monthly withdrawals of up to S$350/5 withdrawals with a 2% fee thereafter |

Wise Vs Revolut Comparison 2024: Check out our YouTrip VS Amaze Comparison in Malaysia 2024 here

Which Card Holds The Best JPY Rates?

With the Japanese yen rate depreciating, we know you’re all curious about which card holds the best JPY rates if you’re heading to the Land of the Rising Sun for a much-needed getaway. Let’s get to it 👇

| YouTrip | Wise | Revolut | |

| Current Exchange Rate as of 2 Apr 2024 for JPY (Google’s Rate: 1 SGD = 112.13 JPY) | 1 SGD = 112.10 JPY | 1 SGD = 111.57 JPY | 1 SGD = 111.74 JPY |

Wise Vs Revolut Comparison 2024: Check out our guide on how to add your YouTrip card to your Apple Wallet

Pros & Cons:

1. Wise

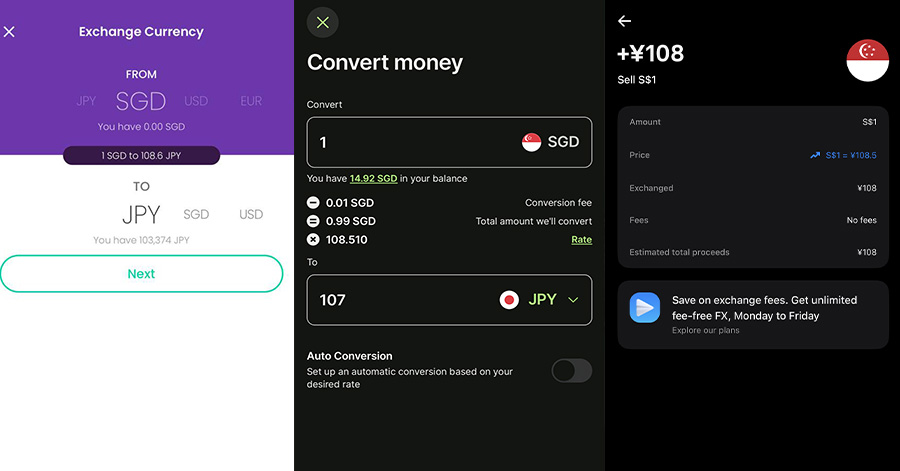

Image Credits: Wise

Formerly known as TransferWise, Wise was founded in 2010 and focuses on international money transfers and currency exchange using mid-market rates.

Pros: Compared to Revolut, with Wise, you’re able to hold more currencies and top up your wallet with a slightly higher limit of S$5,000 compared to Revolut (S$4,800). Wise also has a lower ATM withdrawal fee of 1.75% compared to Revolut’s 2% fee

Cons: However, Wise has a higher top-up fee of 2% compared to Revolut, as well as a lower daily withdrawal limit of S$2,700. When exchanging currencies on the Wise app, there’s also a conversion fee of S$0.01 as shown above, giving you a lower exchange rate (1 SGD = 111.57 JPY — 2 Apr 2024).

Wise Vs Revolut Comparison 2024: Find out more about YouTrip’s Wholesale Exchange Rates here

2. Revolut

Image Credits: TechCrunch

Revolut was founded in 2015 with various financial services available including international money transfers, cryptocurrency trading, and currency exchange using Dynamic Currency Conversion (DCC) rates.

Pros: Revolut has a higher daily withdrawal limit of £3,000 (~S$4,974.49) compared to Wise as well as a lower top-up fee which varies according to the type of card used for top-ups.

Cons: Revolut has a high transaction fee of 1.0% on weekends for all currencies. Unlike Wise, Revolut also holds a higher fee for money transfers (a 1% fee for bank transfers and a 3% fee for card transfers) and a higher ATM fee of 2%.

Wise Vs Revolut Comparison 2024: Check out our guide to the best multi-currency cards for the biggest savings here

The Verdict

Wise Vs Revolut — which is the better card? That’s up to you to decide. But hey, if you’re looking for a card with the best rates all day AND zero fees (be it on the weekdays or weekends), sign up for our trusty YouTrip card! Psst, we also come with monthly ATM withdrawals of up to S$400 with a 2% fee thereafter and have the lowest top-up fees and the best JPY exchange rates compared to the two above 😉

As Singapore’s favourite multi-currency wallet, we aim to get those pesky fees out of the way and help you save on your travels. With the best FX rates, you will no longer have to deal with those long queues at money changers or those extra charges with your credit cards! So if you’re looking for a go-to travel card, sign up for your complimentary YouTrip card today with promo code <YTBLOG5> and get FREE S$5 in your account!

And while you’re at it, why not join the conversation with thousands of #YouTroopers in our very own Community Telegram Group @YouTripSquad? Get tips and tricks to everything YouTrip including exclusive invites to exciting events and experiences, & be part of the #YouTripSquad! 💜

Happy travels!

Related Articles

How To Easily Top Up Your Virtual Suica Card In Japan Via Apple Pay With YouTrip

Did You Know You Could Add Your YouTrip Card To Alipay And WeChat?

Best Travel Credit Cards In Singapore For Overseas Spending 2024