Searching for the card that gives you the best exchange rates overseas? YouTrip might just be your new best friend!

When it comes to paying overseas, what you actually get charged boils down to two key things: exchange rates and fees. In this guide, we explain everything you need to know about YouTrip’s exchange rates – simply, clearly, and with zero fluff. ✨ We promise you’ll be one step closer to travelling smarter (and saving more) by the end!

What exchange rates does YouTrip use?

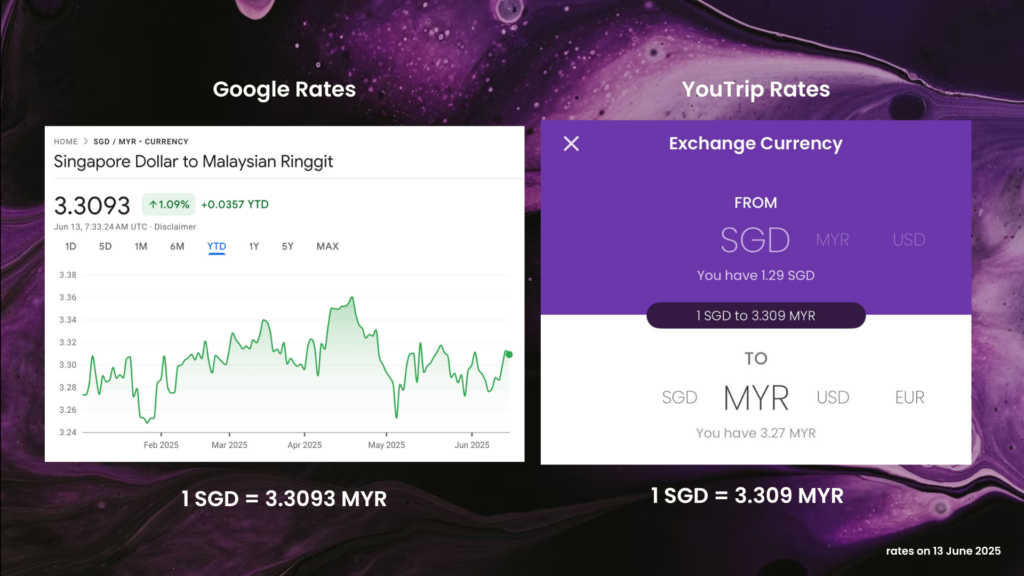

YouTrip uses real-time, mid-market exchange rates – also known as Wholesale Exchange Rates. These are rates that are very similar to the ones you see on platforms like Google and XE.com, and they reflect the most accurate, up-to-date value between two currencies. Best of all? No hidden fees or markups are added to these fair rates.

In contrast, traditional banks and credit cards typically add a markup to the market rate (typically between 2 – 3%). That means you end up paying more for the same transaction – often without realising it.

With YouTrip, what you see is what you pay.

How are YouTrip’s exchange rates better than others?

Most banks, credit cards, and other payment cards add a markup to their exchange rates or charge foreign transaction fees – meaning you pay more for every dollar you spend overseas.

YouTrip, on the other hand, is built to help you save with every swipe. Here’s our commitment:

- 💹 Real-time, mid-market rates – no hidden markups

- 🆓 No admin or service fees – including free sign-ups, card issuance, and no annual charges

- 👀 Transparent pricing – rates displayed clearly in the app before you pay

Basically no sneaky charges, no inflated rates!

Want a quick, straightforward comparison? Here’s how YouTrip’s exchange rates compare to other popular payment cards in Singapore:

| Card | Additional Fees | USD Rate 🇺🇸 | JPY rate 🇯🇵 | THB rate 🇹🇭 |

| YouTrip | no fees 🫱🏻🫲🏼 | 1 SGD = 0.7797 USD 👑 | 1 SGD = 111.90 JPY 👑 | 1 SGD = 25.27 THB 👑 |

| Credit Card | up to 3.25% | 1 SGD = 0.7736 USD | 1 SGD = 110.63 JPY | 1 SGD = 24.91 THB |

| Revolut | 1% on weekends | 1 SGD = 0.7779 USD | 1 SGD = 111.60 JPY | 1 SGD = 25.18 THB |

| Wise | from 0.26% | 1 SGD = 0.7791 USD | 1 SGD = 111.85 JPY | 1 SGD = 25.27 THB |

Rates were taken on 13 June 2025.

📚 YouTrip Exchange Rates (2025 Guide): a comparison of the best multi-currency cards in Singapore

How can I check YouTrip’s exchange rates?

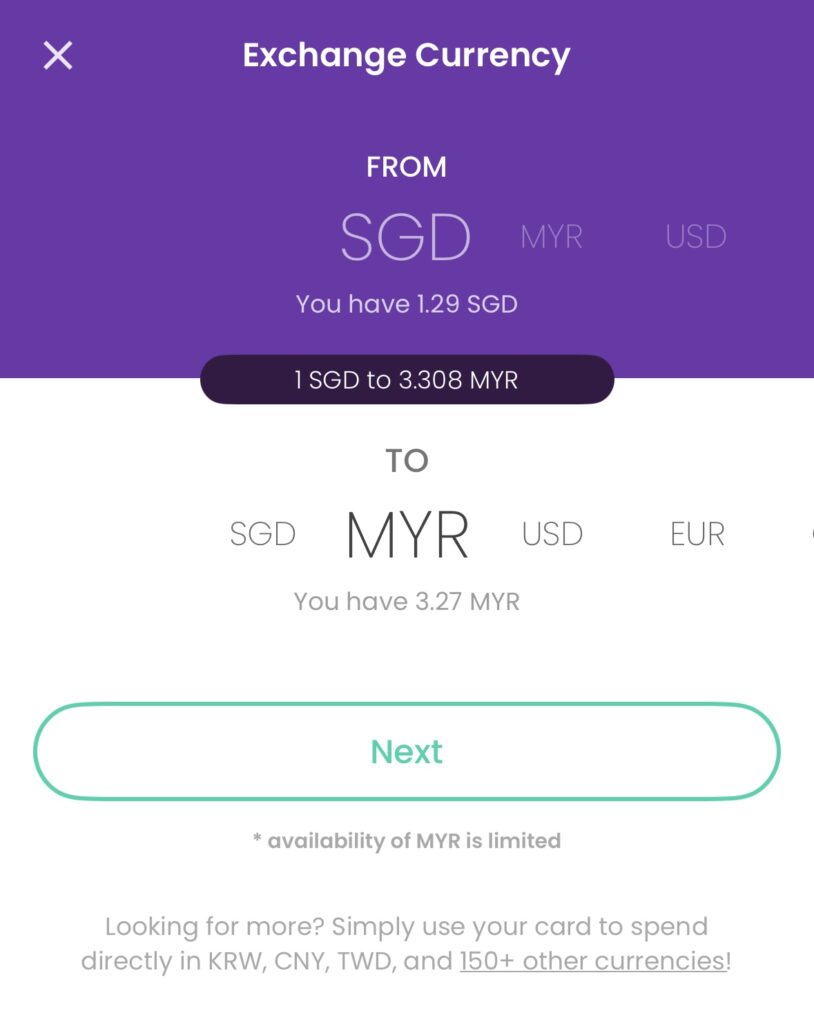

Checking YouTrip’s exchange rates is easy – all you need is access to the YouTrip app! You can sign up for a free account in 3 minutes, and once you’re in, here’s how to view our live rates:

- Launch the YouTrip app

- Tap on the “Exchange” icon on the homepage

- Select the currency pair you want to check (e.g. SGD to MYR)

- Instantly view the live exchange rate for your selected currency

P/s: You can view live exchange rates for 12 wallet currencies on YouTrip. For other currencies, YouTrip uses Mastercard’s wholesale exchange rates, which you can find on the Mastercard Currency Converter Calculator. Just input “0” in the ‘Bank Fee’ field, as YouTrip does not charge any fees for currency conversion!

[NEW FEATURE] Never miss out on the best rates, ever! Activate ‘Rate Updates’ on your YouTrip app for real-time alerts when exchange rates hit their best in the past week or month. 💹📱

Which currencies are supported by YouTrip?

YouTrip supports:

- 12 Wallet Currencies: Singapore Dollar (SGD), Malaysian Ringgit (MYR), Japanese Yen (JPY), Thai Baht (THB), US Dollar (USD), Euro (EUR), British Pound (GBP), Hong Kong Dollar (HKD), Australian Dollar (AUD), New Zealand Dollar (NZD), Swiss Franc (CHF), Swedish Krona (SEK)

- 150+ Dynamic Currencies Worldwide: Including currencies like Chinese Yuan (CNY), Indonesian Rupiah (IDR), Philippine Peso (PHP), Korean Won (KRW), Vietnamese Dong (VND), Indian Rupee (INR), Canadian Dollar (CAD), and more. (🚨 Note: When travelling to countries with these currencies, you just need to top-up your YouTrip wallet with SGD and we’ll automatically convert your SGD to the foreign currency at Mastercard’s wholesale exchange rate with no fees and no markups! ✨)

💡 Pro Tip: You can lock-in favourable rates for 12 wallet currencies, and spend effortlessly with our dynamic currencies in 150+ countries worldwide. For non-wallet currencies, we’ll complete the automatic conversion for you with Mastercard’s Wholesale Exchange Rates!

📚 YouTrip Exchange Rates (2025 Guide): read our guide on the best money changers in Singapore

Does YouTrip charge any fees?

No – YouTrip doesn’t charge any fees for foreign currency transactions. Unlike traditional credit cards or payment cards that tack on charges for currency conversion, foreign transactions, or admin fees, we keep it simple and fee-free:

- ✅ Zero FX fees

- ✅ No service charges

- ✅ No annual or sign-up fees

- ✅ Free card issuance & delivery to your doorstep

- ✅ Free* ATM withdrawals for up to S$400 in foreign currency per calendar month. 2% fee applies thereafter.

P/s: The only time you may see a fee is if you’re using third-party payment platforms like Alipay or WeChat Pay. These platforms may impose processing fees – but these fees come from them, not from YouTrip. It’s the same for ATM cash withdrawals, whereby certain overseas ATM operators may impose additional fees, which are typically displayed on the ATM before withdrawal.

📚 YouTrip Exchange Rates (2025 Guide): find out how to link your YouTrip card to Alipay and WeChat Pay!

Ready to check out YouTrip’s exchange rates for yourself?

We hope this guide clears up all you’ve wondered about YouTrip’s exchange rates. If you want to get the best value when spending overseas – YouTrip might just be the upgrade you need. ✨ Enjoy the best exchange rates in 150+ countries, zero fees, and peace of mind while you pay abroad or shop online.

👀 Sign up for YouTrip today with code <YTBLOG5> to get free S$5!

More guides you may enjoy:

- Everything You Need To Know About YouTrip

- Can YouTrip Be Used In China?

- Send Money Overseas With YouTrip

- Best Singapore Credit Cards For Overseas Spending

- Can YouTrip Be Used In Japan?