MariBank, Singapore’s digital bank under Sea Group, has launched its overseas transfer service! Find out how to send money overseas with Maribank 👇🏻

Looking for information about MariBank‘s new overseas transfer service? In this guide, we’ve summarized everything you need to know about sending money overseas with MariBank – including transfer fees, exchange rates, features, and speed. Read on to see how it stacks up and whether it fits your remittance needs. ✨

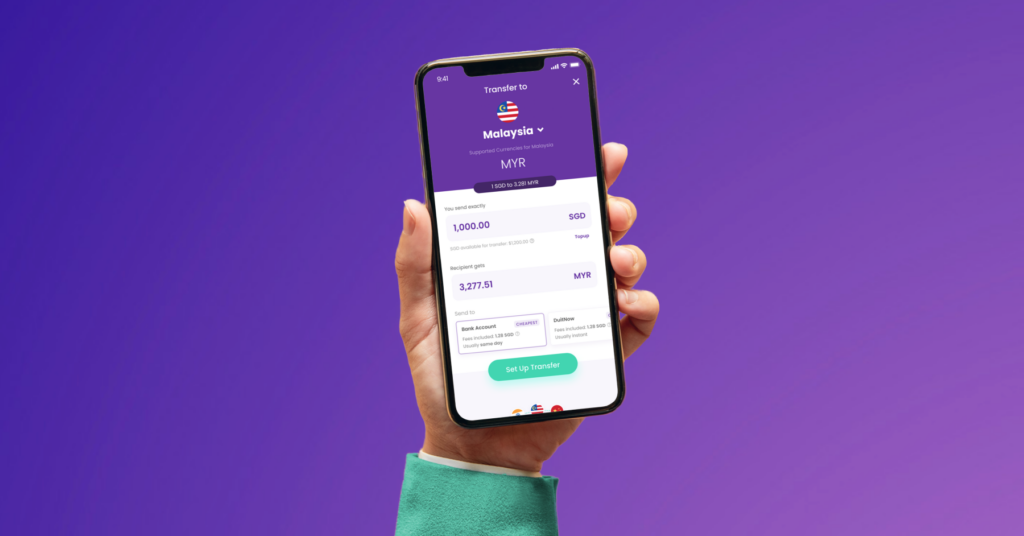

🧐 Exploring your options? YouTrip’s remittance service offers some of the best exchange rates with no hidden fees and low transfer costs. Find out how to send money overseas with YouTrip here!

All you need to know about sending money overseas with MariBank

What is MariBank?

MariBank is a digital bank in Singapore that offers simple, low-cost banking services for individuals and small businesses. Backed by Sea Group (the parent company of Shopee and Garena), it was created to make everyday banking more accessible and affordable.

Most recently, MariBank launched its international transfer service, allowing users to send money overseas seamlessly with competitive exchange rates.

Key Features of Maribank

MariBank’s overseas transfer service is still relatively new, but here’s what we know about it so far!

Key features of MariBank overseas transfer:

- Send Money to 13 Destinations: The new remittance service currently allows users to send money in 10 currencies to 13 destinations. At the moment, you can send money from Singapore to Malaysia, Indonesia, Japan, India, China, the Philippines, South Korea, Vietnam, USA, Thailand, Hong Kong, and Taiwan.

- $0 Transfer Fees Promotion: Enjoy zero transfer fees as part of their promotional offer, valid till 30 June 2025. Without the promotional offer, MariBank’s overseas transfer fees range from S$3 – S$28, depending on the destination of your transfer.

- Fast Processing: MariBank’s overseas transfer speed ranges from immediate to 1 – 3 business days for most destinations.

- Competitive Exchange Rates: MariBank claims to offer competitive FX rates for their international transfers. We’ve done a comparison of MariBank vs YouTrip’s exchange rates below 👀

Comparing Fees and Exchange Rates (YouTrip vs MariBank) ⚖️

How much local currency your recipient receives depends on the platform’s foreign exchange rate and transfer fees.

We’ve put together a quick comparison of how much your recipient will receive when you send S$1000 to them via YouTrip vs. MariBank:

| Transfer destination | YouTrip | MariBank |

| Malaysia (MYR) 🇲🇾 | S$1,000 = 3,288 MYR 👑 | S$1,000 = 3,266 MYR |

| The Philippines (PHP) 🇵🇭 | S$1,000 = 42,438 PHP 👑 | S$1,000 = 42,418 PHP |

*Rates taken as of 30 April 2025

💡 Based on this comparison, your recipient will receive more local currency when you send money with YouTrip vs. MariBank thanks to more competitive exchange rates. That said, MariBank’s temporary $0 transfer fee promotion is still a great perk to take advantage of! Of course, the rates and fees depend on the currency and destination you’re sending to. ✨

How to use MariBank to send money overseas?

Sending money with MariBank is pretty easy. Here’s a step-by-step guide:

- Sign up: Download the MariBank app and create an account.

- Verify your identity: Complete the verification process by providing necessary documents.

- Navigate to Transfer page: Click on “Overseas Transfer” on the home screen.

- Set up your transfer: Choose your recipient’s country and enter recipient details.

- Make payment: Select fund source and amount you want to send.

- Review & confirm transfer: Double-check all details and complete your transfer!

Alternatives to MariBank in Singapore

While MariBank is a good new option for international transfers, you have many other remittance options in Singapore such as DBS Remit, Wise, Ria Money Transfer, Western Union, and YouTrip! 👀 Consider picking a money transfer service that best suits your needs.

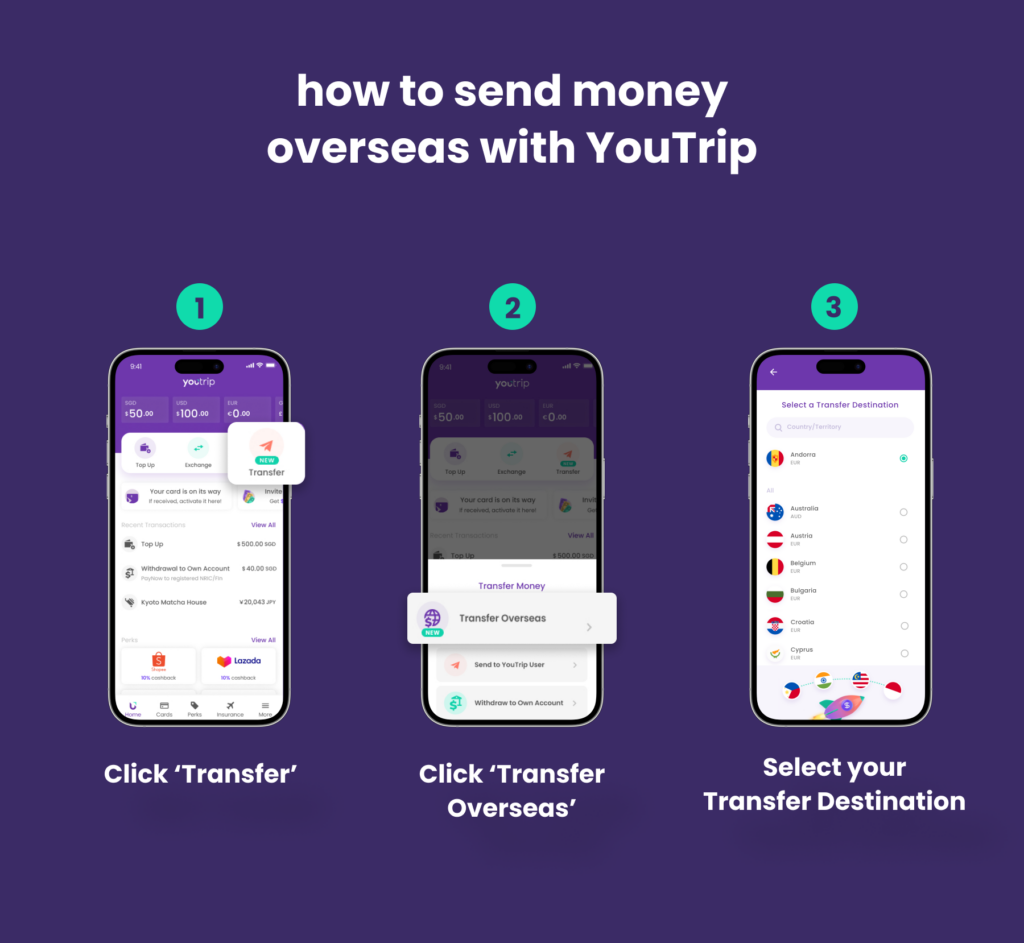

You can now send money to 40+ countries with the best rates and no hidden fees with YouTrip! Enjoy fast, secure, and hassle-free overseas transfers in six simple steps 🌍💵

- 1️⃣ Sign up for YouTrip account via the YouTrip app

- 2️⃣ Top up your YouTrip wallet with a Linked Bank Account (eGIRO) or PayNow

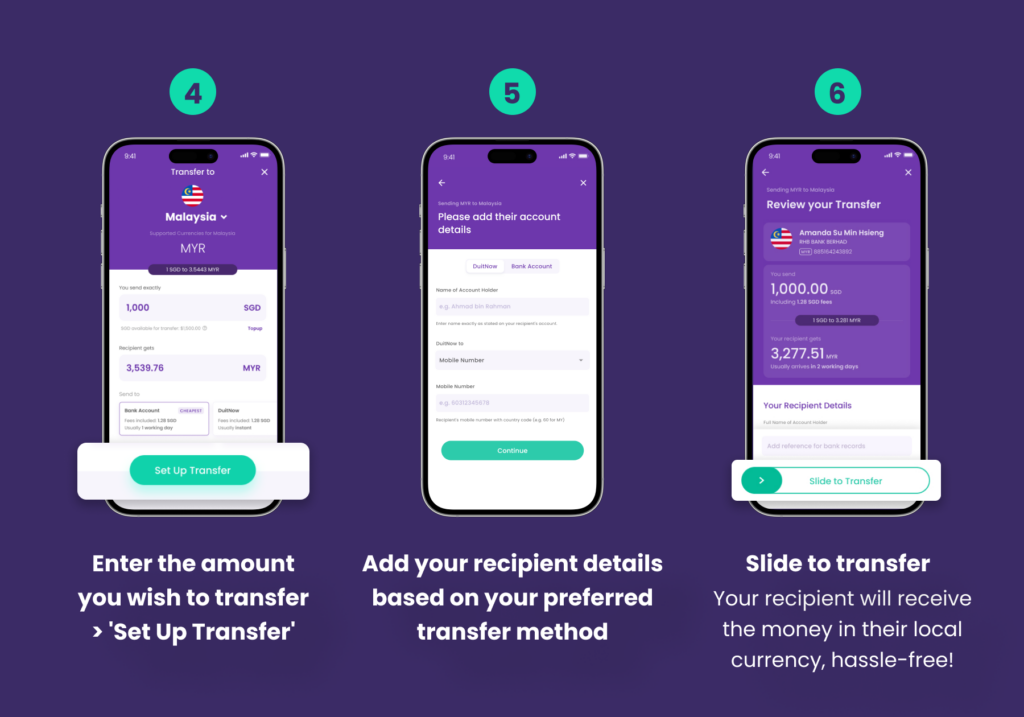

- 3️⃣ Click ‘Transfer’ > ‘Transfer Overseas’ > Select the desired currency you wish to transfer

- 4️⃣ Enter the amount you want to transfer in SGD > Choose your preferred transfer method (e.g. bank account, DuitNow, GCash, UPI)

- 5️⃣ Tap ‘Set Up Transfer’ > ‘+ Add Recipient’ and enter required details

- 6️⃣ Slide to transfer and voilà! Your recipient will receive the money in their local currency, hassle-free!

Ready to start sending money overseas?

We hope this guide gives you a clear understanding of all you need to know about sending money abroad with MariBank! In general, MariBank’s new overseas transfer service opens doors for quick and affordable international transfers that can be done in a few clicks.

However, as with any financial service, it’s crucial to compare options and consider your specific needs before deciding which platform to go for.

We’d recommend keeping a eye on the most current rates and fees, as well as considering factors like transfer speed and reliability when making your remittance service choice ✨

If you’re looking for a safe, secure, and affordable way to send money overseas – consider YouTrip! Send money to Malaysia, Indonesia, the Philippines, Europe, and more in a few easy taps 💜 We’re here to solve your international transfer headaches!

Ready to get started? Sign up for a YouTrip account in minutes – use code <YTBLOG5> to get FREE S$5!

More guides you may enjoy!

- How to send money to Malaysia from Singapore

- How to send money to Philippines from Singapore

- How to send money to the USA from Singapore

- How to send money to Europe from Singapore

- How to send money to India from Singapore

- How to send money to Indonesia from Singapore

Guides on money transfer services in Singapore:

- DBS Remit Money Transfer Guide

- Ria Money Transfer Guide

- Western Union Money Transfer Guide

- Easy and Cheap Overseas Transfers from Singapore (2025 Guide)