If you’re considering sending money overseas with DBS Remit, here’s a comprehensive guide that’ll cover everything you need to know — from features to fees, and exchange rates.

When it comes to sending money overseas, DBS Remit is one of the go-to platforms in Singapore. Known for its fast transfers, low fees, and user-friendly interface, DBS Remit caters to those looking for an efficient way to send funds internationally. Whether you’re sending money overseas to family, friends, or solely for your own savings, here’s a DBS Remit guide for your international money transfers.

Exploring alternatives? YouTrip is another great option for overseas transfers, offering the best rates, no hidden fees, and some of the lowest transfer costs on the market. Read on to uncover which platform suits your needs best, and start saving on your international money transfers today!

💜 Stay Up To Date:

– Bangkok to Chiang Mai: Bus, Train, Plane, Taxi or Car? (2024)

– Best Singapore Credit Card For Overseas Spending (2024)

– Korea Weather Guide: Best Time To Visit Korea By Month 2024

DBS Remit: Introduction

There are two ways you can send money overseas with DBS — DBS Remit and the standard outward telegraphic transfer.

What is DBS Remit?

DBS Remit is a service offered by DBS Bank which allows you to send money overseas directly from your DBS/POSB account via Internet banking or the DBS Digibank app. DBS Remit provides same-day* international money transfers to 50+ countries in 12 currencies at no fees.

What is Outward Telegraphic Transfer?

Outward Telegraphic Transfer (Regular Overseas Funds Transfer Online) provides international money transfers to 200+ countries in 19 currencies. The overseas transfer may require additional fees and could take 2 to 4 business days to reach your recipient.

You’ll mostly need to use a telegraphic transfer if you’re sending in a different currency than what’s used in the destination country (like sending SGD to Malaysia while you’re in Singapore), or if DBS Remit doesn’t support the destination you’re sending to.

DBS Remit International Money Transfer Guide: What is remittance? Here’s a guide to understanding the meaning of remittance

DBS Remit Vs Outward Telegraphic Transfer: Features Breakdown

What’s the difference between DBS Remit and outward telegraphic transfers? Here’s a breakdown of DBS’ remittance charges and how long it’ll take for your money to reach its designated destination.

| DBS Remit | Outward Telegraphic Transfer | |

|---|---|---|

| Number of Countries & Currencies | 50+ countries in 12 currencies | 200+ countries in 19 currencies |

| Speed of Transfer | Same-day transfer to select markets within the cut-off times* | 2-4 working days typically For regular overseas funds transfer to Taiwan in TWD: 1-2 weeks |

| Cable/Telex Charges | $0 | $20 |

| Handling Commission | $0 | 👉 S$5 for debiting amount equal to or below S$5,000 👉 S$10 for debiting amount equal to or below S$25,000 👉 S$35 for all other amounts |

| Agent Bank Charges | $0 | Varies based on destination |

Source: DBS

*Same-day transfers depend on the currency you’re sending and the cut-off time. Your recipient may not receive the funds immediately if the receiving bank is closed on certain days.

Cut-off times for DBS can range from 10 AM to 5 PM depending on the currency you’re sending. So if you’re sending money after these timings, note that your recipient will not receive the funds on the same day.

Here are the cut-off timings and availability for a few popular currencies:

- Malaysia: 2 PM (❌ Weekends)

- India: 4:30 PM (❌ Sundays)

- China: 3 PM (❌ Weekends)

- Indonesia: 2 PM (❌ Sundays)

- United States: 5 PM (❌ Sundays)

DBS Remit International Money Transfer Guide: Wondering what is the best Singapore credit card for overseas spending? Find out here

DBS Exchange Rates

You can easily refer to DBS’ Digibank app for DBS exchange rates. Here’s a comparison of the foreign exchange rates between YouTrip and DBS.

| YouTrip | DBS Remit | |

|---|---|---|

| MYR | S$1,000 = 3,317.74 | S$1,000 = 3,289.47 MYR |

| IDR | S$1,000 = 11,826,244 IDR | S$1,000 = 11,627,907 IDR |

| INR | S$1,000 = 62,624.08 INR | S$1,000 = 62,267 INR |

| PHP | S$1,000 = 43,602.46 PHP | S$1,000 = 43,407 PHP |

| USD | S$1,000 = 741.84 USD | S$1,000 = 738.93 USD |

| EUR | S$1,000 = 703.66 EUR | S$1,000 = 699.74 EUR |

*Rates taken as of 21 Nov 2024

DBS Remit International Money Transfer Guide: Find out how to send money from Singapore to Malaysia here

DBS Remit: Are there any transfer limits?

Generally, the daily transfer limit for sending money overseas is S$20,000. However, this varies based on the country you’re transferring to. Likewise, transaction limits can vary based on the currency as well.

This is how much you can send per transaction for the following popular currencies:

- Malaysia: 500,000 MYR per transaction

- China: 10,000 USD per transaction

- Philippines: 490,000 PHP per transaction

- Vietnam: 500,000,000 VND per transaction

DBS Remit International Money Transfer Guide: Find out how to send money overseas with YouTrip here

How to send money overseas with DBS Remit:

There are two ways you can send money overseas: 1. the DBS Digibank app or online banking, 2. Visit a DBS branch.

1. DBS Digibank app or online banking

1️⃣ Open a POSB/DBS account

2️⃣ Sign up with Digibank > log in to your POSB/DBS account

3️⃣ Select ‘Pay & Transfer’ > ‘Overseas Transfer Funds’

4️⃣ Select ‘existing recipient’ or ‘add new recipient’

5️⃣ Enter transaction details > verify details and submit

2. Visit a DBS branch

If you’re transferring over S$200,000, you can choose to make your DBS overseas transfer at a branch. Here’s how you do it:

1️⃣ Complete a telegraphic transfer form

2️⃣ Submit the form to a bank teller for processing

3️⃣ Verify your identity with the teller and confirm your transfer details

DBS Remit International Money Transfer Guide: Find out more about YouTrip’s Wholesale Exchange Rates here

Alternative options: Send money overseas with the best rates via YouTrip

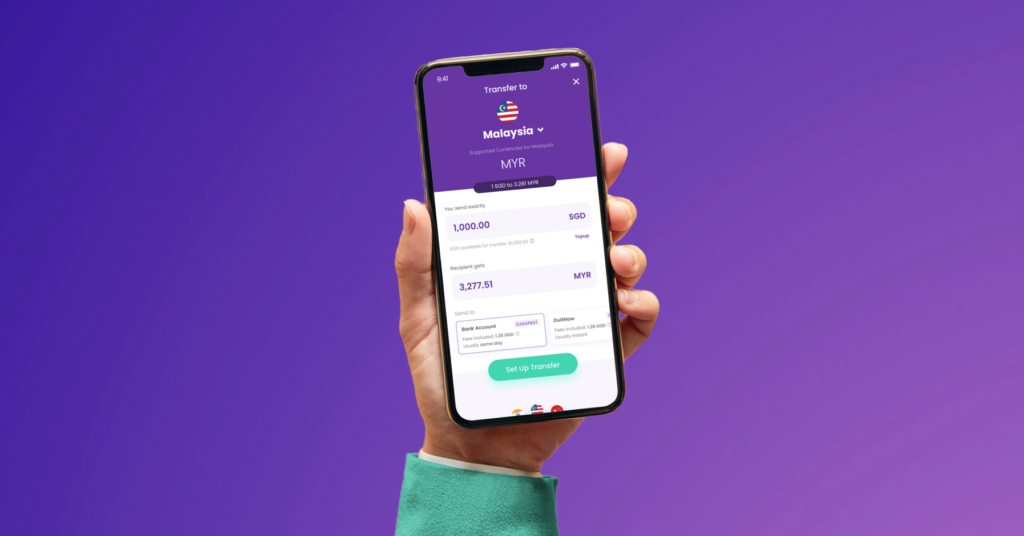

Send money overseas to 40+ countries with the best rates all day and no hidden fees with YouTrip. Experience same-day or even instant transfers for popular currencies with Duitnow, Gcash and UPI — with no cut-off timings anytime, any day.

Here’s a six-step guide on how to send money overseas with YouTrip:

1️⃣ Sign up for YouTrip

Don’t have an account yet? Sign up now and use the promo code <YTBLOG5> for free S$5!

2️⃣ Top up your YouTrip wallet with a Linked Bank Account (eGIRO) or PayNow to ensure your SGD wallet has sufficient funds

3️⃣ Click ‘Transfer’ > ‘Transfer Overseas’ > Select the desired currency you wish to transfer

4️⃣ Enter the amount you want to transfer in SGD > Choose your preferred transfer method based on the destination you’re transferring to:

- Bank Account

- DuitNow

- Gcash

- UPI

5️⃣ Tap ‘Set Up Transfer’ > ‘+ Add Recipient’ and enter the required details

6️⃣ Slide to transfer and voilà! Your recipient will receive the money in their local currency, hassle-free!

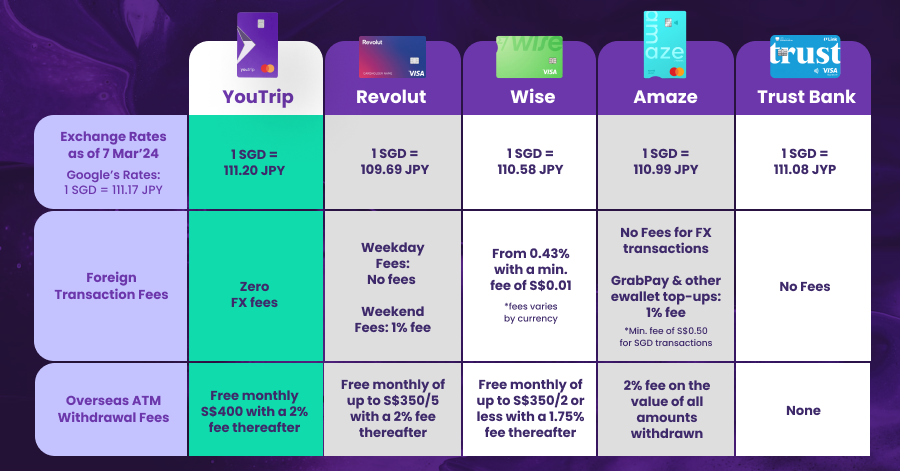

DBS Remit International Money Transfer Guide: Check out our guide to the best multi-currency cards for the biggest savings here

Save more on your overseas transfers with YouTrip

Sending money overseas has never been easier, faster, or more affordable. With YouTrip, you’re in control of every aspect of your transfer — from getting the best exchange rates to low transfer fees.

Ready to get started? Sign up today with <YTBLOG5> to get FREE S$5 in your account and experience a smarter way to transfer money internationally!

For more great tips and articles like this, join our Telegram (@YouTripSG) and subscribe to our free weekly newsletter here or down below. And while you’re at it, why not join the conversation with thousands of #YouTroopers in our very own Community Telegram Group @YouTripSquad? Get tips and tricks to everything YouTrip including exclusive invites to exciting events and experiences, & be part of the #YouTripSquad! 💜

Bon voyage!

Related Articles

Overseas Transfers: Send Money Overseas With The Best Rates

How To Send Money From Singapore To Malaysia

How To Send Money To Indonesia From Singapore