If you’re thinking about sending money with Western Union, here’s a comprehensive guide that’ll cover everything you need to know — from features to fees, and exchange rates. Here’s how to make your international transfers smooth and stress-free.

Western Union is a go-to for many when it comes to international money transfers. Whether you’re sending funds to family, helping out a friend abroad, or paying for overseas services, Western Union offers flexibility and convenience. Here’s everything you need to know about sending money overseas with Western Union in 2024.

Exploring alternatives? YouTrip is another great option for overseas transfers, offering the best rates, no hidden fees, and some of the lowest transfer costs on the market. Read on to uncover which platform suits your needs best, and start saving on your international money transfers today!

💜 Stay Up To Date:

– Bangkok to Chiang Mai: Bus, Train, Plane, Taxi or Car? (2024)

– Best Singapore Credit Card For Overseas Spending (2024)

– Korea Weather Guide: Best Time To Visit Korea By Month 2024

What is Western Union?

Image credits: PYMNTS.com

Western Union is a global leader in money transfer services, operating in 200+ countries and territories. With options for bank transfers, cash pickups, and mobile wallet transfers, it’s a versatile platform that works for a variety of needs.

You can send money in three ways:

1️⃣ Online: Sign up or log in to Western Union’s website to send money online. Use payment options like your debit card, digital wallet, or other online payment methods.

2️⃣ In-App: Send money with the Western Union app. Pay through the app, start a transfer online, and finish it in-store, or save your frequent recipients for quick transfers later.

3️⃣ In-Person: Send money in-person at a Western Union agent location.

4️⃣ Online + In-Person: Start your payment online and pay in a Western Union agent location

Western Union Guide: All You Need To Know About Sending Money Overseas — Find out more about DBS Remit here

Western Union key features

- Covers 200+ countries and territories

- Multiple transfer options

- Fast transfers depending on the destination and method of transfer

- 24/7 availability

Western Union Guide: All You Need To Know About Sending Money Overseas — What is remittance? Here’s a guide to understanding the meaning of remittance

Western Union: Exchange Rates

Western Union’s exchange rate includes a markup on the mid-market rate, a.k.a the rate you’d typically find on Google or other financial platforms. This means an additional percentage fee is added to the rate you’d receive.

Here’s a look at Western Union’s exchange rates for popular currencies. We’ll be adding YouTrip to the mix as a comparison:

| YouTrip | Western Union | |

|---|---|---|

| MYR | S$1 = 3.297 MYR | S$1 = 3.283 MYR |

| IDR | S$1 = 11,890 IDR | S$1 = 11,890 IDR |

| INR | S$1 = 62.53 INR | S$1 = 62.36 INR |

| PHP | S$1 = 42.96 PHP | S$1 = 42.76 PHP |

| USD | S$1 = 0.7358 USD | S$1 = 0.7345 USD |

| EUR | S$1 = 0.7082 EUR | S$1 = 0.7062 EUR |

*Rates taken as of 24 Dec 2024

Western Union Guide: All You Need To Know About Sending Money Overseas — Find out how to send money from Singapore to Malaysia here

Western Union Transfer Fees

Western Union’s fees depend on several factors such as the transfer amount, payment method, and transfer destination.

Using the exchange rates above and factoring in the fees, here’s how much your recipient would receive if you transferred S$1,000 to their bank account for the following currencies:`

| YouTrip | Western Union | |

|---|---|---|

| MYR | S$1,000 = 3,292.77 MYR Fees included: S$1.28 | S$1,000 = 3,273.15 MYR Fees included: S$3 |

| IDR | S$1,000 = 11,863,196 IDR Fees included: S$2.36 | S$1,000 = 11,854,330 IDR Fees included: S$3 |

| INR | S$1,000 = 62,344.91 INR Fees included: S$2.96 | S$1,000 = 62,172.92 INR Fees included: S$3 |

| PHP | S$1,000 = 42,766.25 PHP Fees included: S$4.51 | S$1,000 = 42,631.72 PHP Fees included: S$3 |

| USD | S$1,000 = 732.78 USD Fees included: S$4.10 | S$1,000 = 730.82 USD Fees included: S$5 |

| EUR | SS$1,000 = 705.85 EUR Fess included: S$3.31 | S$1,000 = 702.66 EUR Fees included: S$5 |

*Rates taken as of 24 Dec 2024

Tip: Pay with PayNow or Bank Transfer for lower fees. You may get hit with higher fees when using a debit or credit card as your method of payment.

*Note that only your first online transfer is fee-free when you pay with PayNow or Bank Transfer. Fees, exchange rates, and taxes are subject to change.

Western Union Guide: All You Need To Know About Sending Money Overseas — Find out how to send money overseas with YouTrip here

Western Union Transfers Limits

Western Union users can transfer up to S$20,000 per transfer when using PayNow to send money directly to a receiver’s bank account. For other payment methods, the maximum limit per transaction is S$5,000.

If you need to transfer a larger amount, you’ll have to visit a Western Union agent location in Singapore. Note that each agent sets its own transfer limit, so you’ll need to call ahead and confirm the details. However, arranging your transfer in person may incur a slightly higher fee compared to arranging your transfer online.

Western Union Guide: All You Need To Know About Sending Money Overseas — Find out how to send money overseas with YouTrip here

How to send money with Western Union on the app

1️⃣ Download the Western Union app > Log in or register with your email address

2️⃣ Enter your recipient’s details, the destination country & the amount you’d like to send

3️⃣ Choose your preferred payout method

- Cash, direct to bank, or mobile wallet (if applicable)

- If you’re sending directly to a bank account, enter your recipient’s bank name, code & account number

4️⃣ Verify your profile with your ID details > upload a picture of yourself to complete the verification process

5️⃣ Complete your transfer payment > track your transfer with a confirmation email

Alternative options: Send money overseas with the best rates via YouTrip

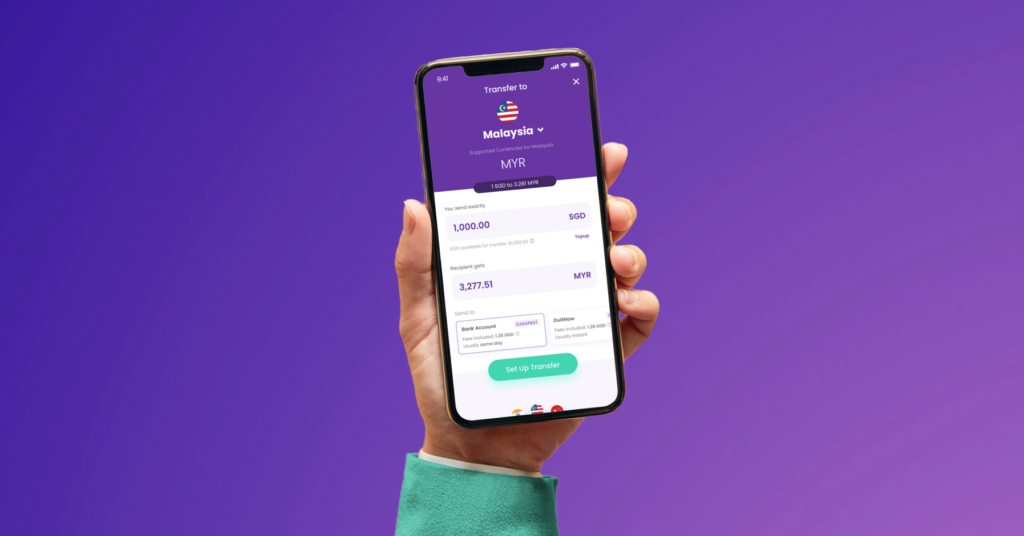

Send money overseas to 40+ countries with the best rates all day and no hidden fees with YouTrip. Experience same-day or even instant transfers for popular currencies with Duitnow, Gcash and UPI — with no cut-off timings anytime, any day.

Here’s a six-step guide on how to send money overseas with YouTrip:

1️⃣ Sign up for YouTrip

Don’t have an account yet? Sign up now and use the promo code <YTBLOG5> for free S$5!

2️⃣ Top up your YouTrip wallet with a Linked Bank Account (eGIRO) or PayNow to ensure your SGD wallet has sufficient funds

3️⃣ Click ‘Transfer’ > ‘Transfer Overseas’ > Select the desired currency you wish to transfer

4️⃣ Enter the amount you want to transfer in SGD > Choose your preferred transfer method based on the destination you’re transferring to:

- Bank Account

- DuitNow

- Gcash

- UPI

5️⃣ Tap ‘Set Up Transfer’ > ‘+ Add Recipient’ and enter the required details

6️⃣ Slide to transfer and voilà! Your recipient will receive the money in their local currency, hassle-free!

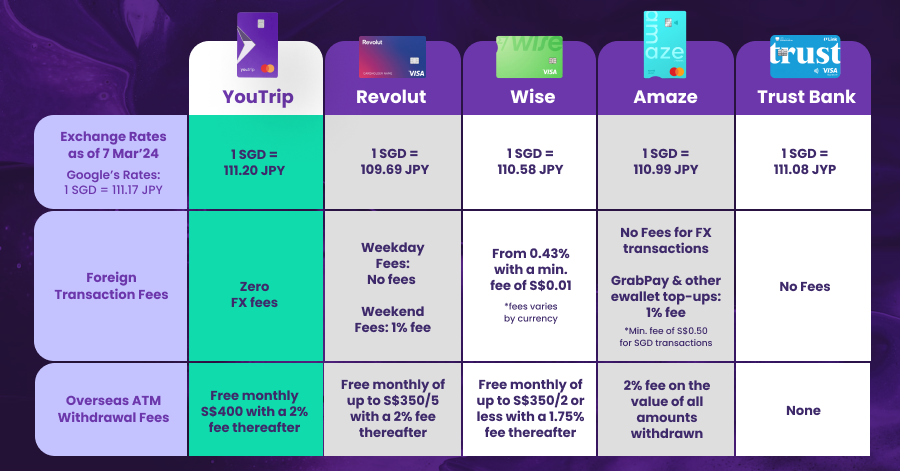

Western Union Guide: All You Need To Know About Sending Money Overseas — Check out our guide to the best multi-currency cards for the biggest savings here

Save more on your overseas transfers with YouTrip

Sending money overseas has never been easier, faster, or more affordable. With YouTrip, you’re in control of every aspect of your transfer — from getting the best exchange rates to low transfer fees.

Ready to get started? Sign up today with <YTBLOG5> to get FREE S$5 in your account and experience a smarter way to transfer money internationally!

For more great tips and articles like this, join our Telegram (@YouTripSG) and subscribe to our free weekly newsletter here or down below. And while you’re at it, why not join the conversation with thousands of #YouTroopers in our very own Community Telegram Group @YouTripSquad? Get tips and tricks to everything YouTrip including exclusive invites to exciting events and experiences, & be part of the #YouTripSquad! 💜

Bon voyage!

Related Articles

Overseas Transfers: Send Money Overseas With The Best Rates

How To Send Money From Singapore To Malaysia

How To Send Money To Indonesia From Singapore