Smarter travel starts with YouTrip.

Travelling abroad shouldn’t come with hidden fees, confusing exchange rates, or surprise charges. Enter YouTrip — Singapore’s top multi-currency wallet for travellers who want to spend smarter, not harder.

With 0% FX fees, real-time competitive exchange rates, and support for 12 currencies, YouTrip puts you in full control of your money wherever you go.

Whether you’re shopping online, withdrawing cash overseas, or sending money to friends, YouTrip’s prepaid Mastercard makes it simple, fast, and secure. It’s more than a card — it’s your one-stop travel companion, helping you get the most value out of every dollar while keeping your finances stress-free.

⚡️TL;DR

| Feature | Details |

|---|---|

| What is YouTrip? | A multi-currency wallet and prepaid Mastercard for travel |

| Bank Backing | Operated under You Technologies Pte. Ltd, Singapore |

| Card Type | Prepaid debit card |

| Currencies Available | Exchange 12 popular currencies; pay in 150+ countries |

| Annual Fees | None |

| FX Fees | 0% on all overseas spending |

| Top-Up Options | PayNow, Linked Bank Account, Debit/Credit Card, Apple Pay |

| Overseas ATM Withdrawals | Free up to S$400/month; 2% fee thereafter |

| Overseas Transfers | Same-day or instant transfers to 40+ countries via DuitNow, GCash & UPI |

| Bank Withdrawals | 10 free per month |

| Card Application | Sign up via the app; physical card delivered in 5–7 days |

| Wallet Limits | Wallet: S$20,000; Annual Spend: S$100,000 |

| Security | Lock/unlock in-app, 3DS verification, instant transaction alerts |

📚 Table of Contents:

- What is YouTrip?

- Key Features

- One App, One Card; Multiple Currencies

- No More Overseas Bank Fees

- Top-Up Methods

- How to Exchange Currencies

- Virtual Cards

- ATM Withdrawals

- Send Money Overseas With YouTrip

- YouTrip Send

- Stay In Control Of Your Expenses

- Transaction Search Made Simple

- Card Security Right At Your Fingertips

- 3DS Authorisation For Payments

What is YouTrip?

Launched in 2018, YouTrip is a multi-currency wallet designed for Singaporean travellers who want to maximise the value of every dollar spent overseas. The app helps users:

- Avoid hidden FX fees

- Access real-time mid-market exchange rates

- Manage finances from a single platform

Key Features:

- Lock in 12 wallet currencies: SGD, USD, EUR, GBP, JPY, HKD, AUD, NZD, MYR, THB, CHF, SEK

- 0% FX fees and competitive rates in 150+ countries

- Apple Pay & Google Pay integration

- Overseas ATM withdrawals and bank transfers

- Instant transaction notifications and advanced security

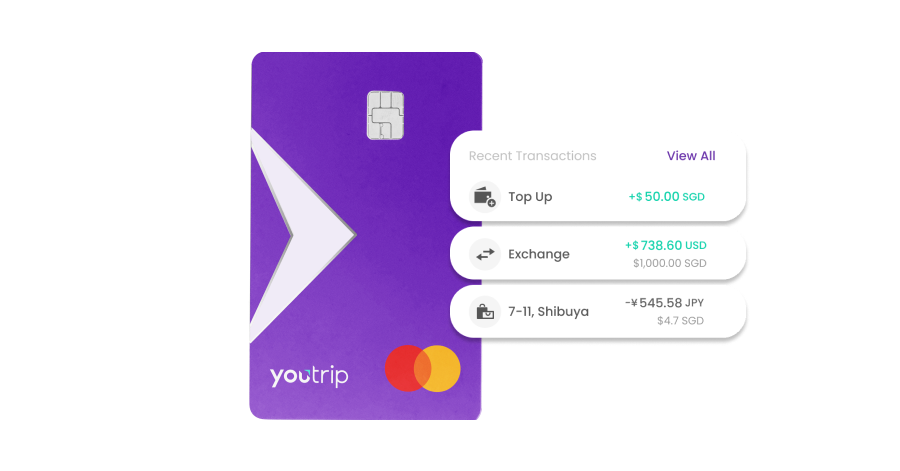

One App, One Card; Multiple Currencies

Each YouTrip account is linked to a contactless Mastercard®, free upon sign-up with no registration or annual fees. Use it to pay in-store or online at 30 million merchants worldwide — all with zero hidden FX fees and competitive exchange rates.

No More Overseas Bank Fees

Traditional bank-issued credit cards often charge 2.8%–3.5% FX fees, plus additional markups via Dynamic Currency Conversion (DCC). This can add 3–5% in hidden fees when paying abroad.

With YouTrip:

- 0% admin/processing fees on foreign currency transactions.

- 0% markups on wholesale exchange rates for 150+ currencies.

Example: On a 500 Euro purchase, YouTrip charges only the mid-market rate in SGD, saving you significantly compared to most credit cards.

Top-Up Methods

| Top-Up Method | Fee |

|---|---|

| PayNow | Free |

| Linked Bank Account (eGIRO) | Free |

| Mastercard Debit/Credit Card | Free |

| Visa Debit Card | Free |

| Visa Credit Card | 1.5% service fee |

| Apple Pay | Free |

📖 Find out more here

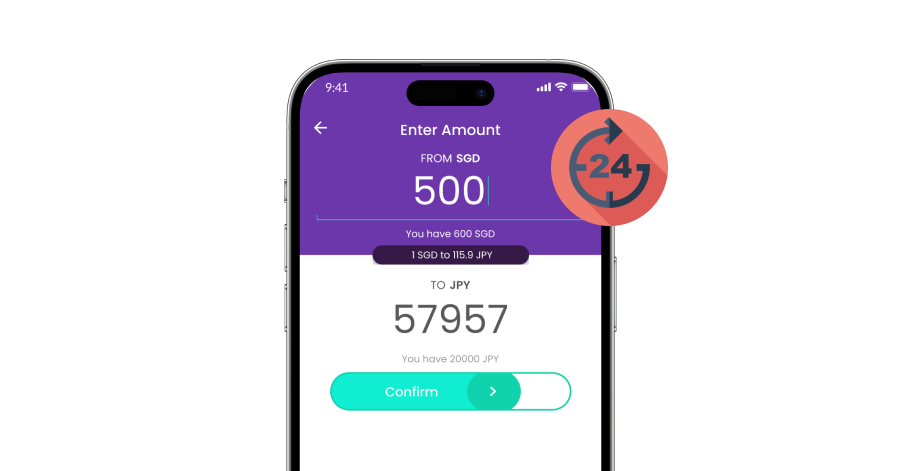

How to Exchange Currencies on YouTrip

YouTrip makes exchanging and storing multiple currencies fast, easy, and transparent. You can hold up to 12 currencies and lock in competitive rates instantly.

Step-by-Step Guide:

- Open the YouTrip app > Tap ‘Exchange’

- Select the currency to exchange

- Check the live exchange rate (updates every second to reflect the true mid-market rate).

- Enter the amount you want to exchange > Swipe

- That’s it! You’ve locked in the best rates all day 🎉

Tips:

- Track your top currencies with the app’s Rate Updates feature and get real-time alerts when exchange rates hit their best in the past week or month.

- Unsure of the mid-market rate? A quick Google search can help you compare interbank rates before making the swap.

- Once exchanged, your funds are ready to use globally in 150+ countries and 30 million merchants, both online and offline, without hidden FX fees.

Virtual Cards

No need to wait for your physical card — add a virtual card to Apple Pay or Google Pay and start spending immediately online or in-store with the best rates!

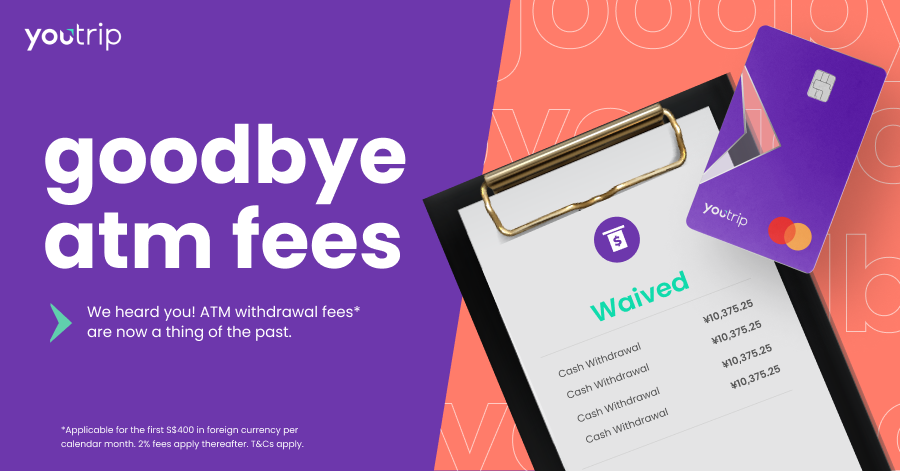

ATM Withdrawals

Enjoy FREE withdrawals of up to S$400 in foreign currency per calendar month. A 2% fee will be imposed thereafter on the amount withdrawn once you surpass the S$400 threshold.

But fret not, this S$400 calendar limit will reset on the 1st of each month.

Do note:

- Some overseas banks that operate the ATM may charge a fee

- ATM withdrawals will not be available in Singapore

Send Money Overseas

Guess what? Besides hassle-free travel spending with YouTrip, you can now enjoy fast, secure, and affordable overseas transfers with our Overseas Transfer feature!

Enjoy same-day or even instant international transfers to 40+ countries worldwide, including Malaysia, Indonesia, the Philippines, Europe, and more.

YouTrip Send

TL;DR: Instantly send money in 12 wallet currencies to other YouTrip users with no fees, using real-time wholesale exchange rates — no delays, no hidden charges.

YouTrip Send is perfect for:

- Reimbursing friends after group purchases, including overseas online orders.

- Sending money to family or loved ones abroad quickly and securely.

How to Use YouTrip Send:

- Update your YouTrip app to the latest version.

- Tap the “Send” button at the top of your home screen.

- Grant YouTrip access to your contacts.

- Select a recipient (they must be a YouTrip user) and the amount.

- Confirm the transfer — funds arrive instantly.

It’s that simple. With YouTrip Send, splitting bills or sending money internationally has never been easier.

Stay In Control Of Your Expenses

With the YouTrip app, every transaction — no matter how small — is recorded instantly. You’ll receive real-time notifications on your mobile device for every purchase, so you never miss an expense.

The app also alerts you immediately if there’s a suspicious or potentially fraudulent transaction, keeping your funds secure.

Managing your daily budget has never been easier. Log in to the app at any time to view your full transaction history at a glance — no more waiting for statements or sifting through clunky PDFs.

Transaction Search Made Simple

Finding a specific transaction is effortless. Tap the magnifying glass icon at the top-right corner of the app and search by:

- Merchant name

- Location

- Currency code

- Amount

- Date

This feature makes tracking your spending and reviewing past transactions fast, convenient, and stress-free.

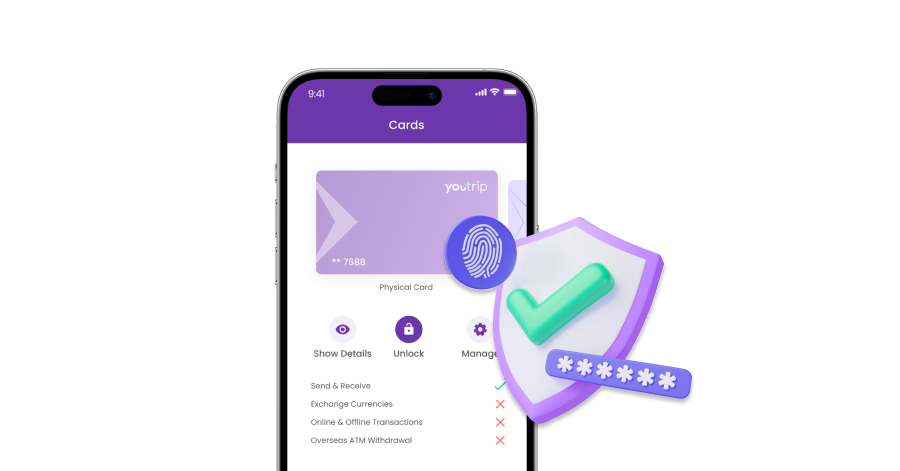

Lost your card before and had to call the bank to block it? With YouTrip, there’s no need for that hassle. You can lock and unlock your card instantly right from the app, giving you complete control over your funds at all times.

Find out how else we’ve enhanced our security measures to keep your money safe wherever you travel.

3DS Authorisation For Payments

All YouTrip cards come with 3D Secure (3DS) verification to confirm that it’s really you making the purchase. Here’s how it works:

- Enter your YouTrip card details and confirm the purchase.

- Receive a push notification on your phone.

- Open the notification, review the details, and approve or reject the transaction.

With this extra layer of protection, your online payments are secure, fast, and fraud-proof — giving you peace of mind every time you spend.

Sign Up In 3 Minutes

In case you didn’t know, YouTrip is completely free! There are no minimum income requirements, account fall-below fees, or annual card membership fees. All you’ll need to do is download YouTrip to register, wait to get verified, and you’ll receive your spanking new YouTrip card in the mail within 5-7 days!

Related Articles:

- YouTrip vs Credit Cards: Which One’s Better For Travelling?

- Can YouTrip Be Used In China?

- Malaysia ATM Withdrawal Guide: Fees, Locations, Rates