Thinking of sending money overseas?

Ria Money Transfer is one of the most popular and widely accessible remittance services in the world — with branches in Singapore, Johor Bahru, and even Little India. But how good are Ria’s exchange rates, fees, and delivery times compared to alternatives like YouTrip?

Here’s your ultimate 2025 guide to Ria Money Transfer, including today’s rates, locations in Singapore, reviews, and how to track your transfer easily.

💜 Stay Up To Date:

– Japan Rail Pass (JR Pass) 2025: Prices, Calculator, Map & Full Guide

– Best Time to Visit New Zealand & Weather by Month (2025-2026 Guide)

– Best Time To Visit Japan: Your Ultimate 2025-2026 Guide

📚 Table of Contents:

- What is Ria Money Transfer?

- Ria Money Transfer Singapore Locations

- Ria Exchange Rates

- Transfer Fees

- How to Send Money with Ria

- How to Receive Money with Ria

- Ria Delivery Times

- How to Track Your Ria Transfer

- Alternative Option: YouTrip

- FAQs

- Verdict

What is Ria Money Transfer?

Image credits: Ria Money Transfer

Ria Money Transfer is a global remittance service that lets users send and receive money internationally via bank transfer, cash pickup, or mobile wallet.

With over 500,000 agent locations worldwide, Ria is one of the biggest names in the remittance scene — trusted for both in-person and online transfers.

You can use Ria through:

- Physical outlets (e.g. Jurong East, Little India, Johor Bahru)

- Ria Money Transfer app (iOS & Android)

- Ria website

📖 Related guides: Find out more about DBS Remit here

Ria Money Transfer Singapore Locations

Looking for a Ria Money Transfer near me? Here are the main outlets in Singapore:

- Ria Money Transfer – Jurong East MRT, #B1-11

- Ria Money Transfer – Little India Arcade

- Ria Money Transfer – Lucky Plaza, Orchard Road

- Ria Money Transfer – City Hall Link, Raffles City

- Ria Money Transfer – Tampines Mall

You can also find Ria Money Transfer in Johor Bahru (JB) near City Square and KSL City Mall — great if you’re crossing the Causeway.

📖 Related guides: Remitly Singapore: Rates, Fees & Money Transfers (2025)

Ria Money Transfer Exchange Rates

Ria’s rates change daily based on the mid-market rate. Here’s an example of the Ria Money Transfer Singapore today rate compared to YouTrip:

| Currency | YouTrip | Ria Money Transfer |

|---|---|---|

| MYR | S$1 = 3.294 MYR | S$1 = 3.290 MYR |

| IDR | S$1 = 11,840 IDR | S$1 = 11,800 IDR |

| INR | S$1 = 63.12 INR | S$1 = 62.81 INR |

| PHP | S$1 = 43.30 PHP | S$1 = 43.30 PHP |

| USD | S$1 = 0.7446 USD | S$1 = 0.7291 USD |

| EUR | S$1 = 0.7077 EUR | S$1 = 0.6944 EUR |

*Rates taken as of 12 Dec 2024

💡 TL;DR: Ria’s rates are decent, but YouTrip typically offers better exchange rates using real-time wholesale rates (the same ones Google and XE display).

📖 Find out how to send money from Singapore to Malaysia here

Ria Money Transfer Fees: How Much Does It Cost to Send Money?

The fees for Ria Money Transfer aren’t one-size-fits-all — they vary depending on several key factors:

1. Transfer Destination

Different countries have different service charges. Sending money to nearby countries like Malaysia or Indonesia generally costs less than sending to Europe or the U.S.

2. Amount You’re Sending

Larger transfers often come with slightly higher flat fees, though Ria’s percentage-based cost tends to decrease with bigger amounts.

3. Payment Method

How you fund your transfer affects your total cost:

- Bank transfers → Usually the cheapest option

- Debit or credit cards → Faster, but more expensive (and may trigger cash advance fees!)

- PayNow → Available after your first in-store transfer in Singapore

🔎 Note: If you’re transferring money from Singapore, your first Ria transfer must be made in-store. After verification, you can use digital payment options like PayNow or online bank transfers via the Ria Money Transfer app.

4. Delivery Method

Your Ria Money Transfer fee also depends on how your recipient receives the funds.

- Bank deposits usually cost less.

- Cash pickups at Ria branches or partner outlets can be slightly pricier due to handling fees.

Ria Money Transfer Rate Comparison (S$1,000 Transfer)

Here’s how Ria’s rates and fees compare against YouTrip, based on a S$1,000 transfer from Singapore to different countries.

| YouTrip | Ria | |

|---|---|---|

| MYR | S$1,000 = 3,289.78 MYR Fees included: S$1.28 | S$1,000 = 3,280.13 MYR Fees included: S$3 |

| IDR | S$1,000 = 11,812,057.60 IDR Fees included: S$2.36 | S$1,000 = 11,752,800 IDR Fees included: S$4 |

| INR | S$1,000 = 62,933.16 INR Fees included: S$2.96 | S$1,000 = 62,621.57 INR Fees included: S$3 |

| PHP | S$1,000 = 43,104.71 PHP Fees included: S$4.51 | S$1,000 = 43,196.08 PHP Fees included: S$2.40 |

| USD | S$1,000 = 741.54 USD Fees included: S$4.10 | S$1,000 = 720.35 USD Fees included: S$12 |

| EUR | SS$1,000 = 705.35 EUR Fess included: S$3.31 | S$1,000 = 689.53 EUR Fees included: S$7 |

*Rates taken as of 12 Dec 2024

📖 Find out how to send money overseas with YouTrip here

How to Send Money via Ria

Here’s how to send money using the Ria Money Transfer app or website:

1️⃣ Create an account and verify your ID.

2️⃣ Tap “Send Money” and choose your recipient’s country.

3️⃣ Enter the amount you wish to send.

4️⃣ Choose your delivery method — bank deposit, cash pickup, or mobile wallet.

5️⃣ Select a payment method and confirm.

6️⃣ Track your transaction in real time.

📖 Here’s everything you need to know about Western Union

How to Receive Money with Ria Money Transfer

Wondering how to receive money from Ria Money Transfer? It’s easy — whether you’re collecting cash in person or getting funds sent straight to your bank. Here’s how it works:

1. Cash Pickup at a Ria Agent Location

Head to your nearest Ria Money Transfer location — for instance, Ria Money Transfer Singapore, Little India, or Johor Bahru — and collect your cash in person.

Just bring along a valid photo ID (like your NRIC or passport) and your money transfer reference number for verification.

💡 Tip: Search “Ria Money Transfer near me” on Google Maps to find your closest branch. Popular options include:

- Ria Money Transfer Little India (Singapore)

- Ria Money Transfer Jurong East (Singapore)

- Ria Money Transfer Johor Bahru (Malaysia)

2. Receive Money via Bank Deposit

Your sender can choose to transfer directly into your bank account — perfect if you prefer not to visit a branch. Funds will appear once the transfer clears, depending on your bank’s processing time.

3. Receive Money via Mobile Wallet

In select countries, Ria also supports transfers to mobile wallets, allowing recipients to access funds instantly from apps like GCash or Paytm.

⏱️ Ria Delivery Times

Delivery times with Ria Money Transfer depend on your payment and delivery method. Here’s what to expect:

| Transfer Method | Estimated Delivery Time | Notes |

|---|---|---|

| Cash Pickup | Within 1 business day | Fastest for urgent transfers |

| Bank Transfer | Up to 4 business days | Cheapest option, but slower |

| Debit/Credit Card | 15 minutes to 3 hours | Quick but may have higher fees |

⚠️ Heads up: Transfers may take longer on weekends, public holidays, or when flagged for security review. Check your email or the Ria Money Transfer tracking tool for real-time updates.

How to Track a Ria Transfer

Use the Ria Money Transfer tracking tool on their website or app. Simply enter your PIN or Order Number to view your transfer status in real time.

📖 Here’s how to send money to Philippines from Singapore

What will I need for a transfer?

- Your recipient’s name, address, and contact information

- Bank account information (IBAN or SWIFT code) if you’re sending to a bank

- Your ID for verification when setting up your account

📖 Here’s how to send money to India from Singapore

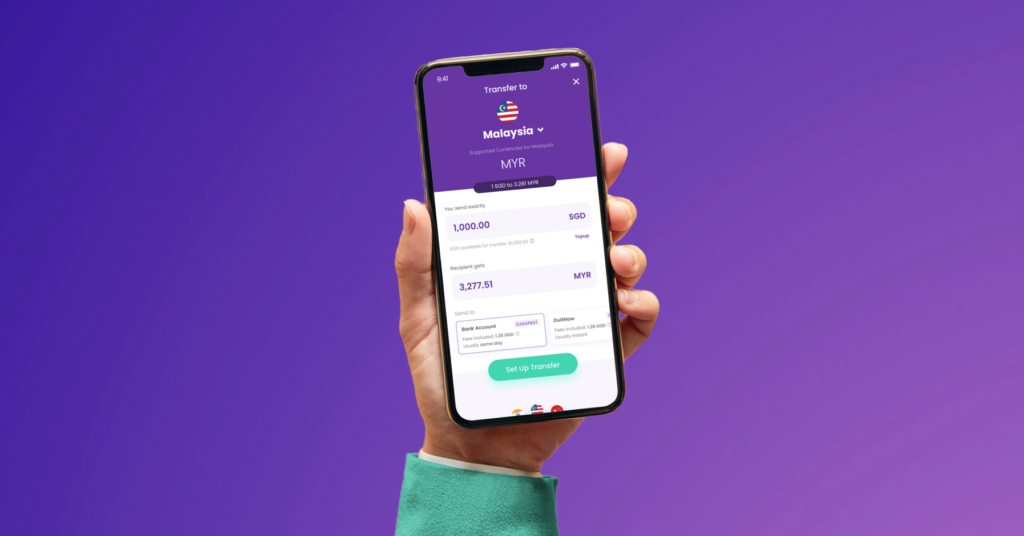

Alternative options: YouTrip

Looking for a faster and cheaper alternative to Ria?

With YouTrip, you can send money to 40+ countries at real-time wholesale rates and zero hidden fees. Enjoy same-day or instant transfers via DuitNow, GCash, or UPI — anytime, any day.

How to Send Money Overseas with YouTrip:

1️⃣ Sign up for YouTrip

Don’t have an account yet? Download the app and use promo code <YTBLOG5> to get S$5 free!

2️⃣ Top up your YouTrip wallet

Add funds via Linked Bank Account (eGIRO) or PayNow to ensure your SGD wallet has enough balance.

3️⃣ Tap ‘Transfer’ → ‘Transfer Overseas’

Select the currency you want to send.

4️⃣ Enter your transfer amount

Choose your preferred method based on your recipient’s country:

- 🏦 Bank Account

- 💬 DuitNow

- 💸 GCash

- ⚡ UPI

5️⃣ Add your recipient

Tap ‘Set Up Transfer’ → ‘+ Add Recipient’ and key in their details.

6️⃣ Slide to send

Confirm the details and slide to transfer — your recipient will get the money instantly or within the same day, in their local currency. Easy.

✨ Pro tip: Compare transfer speeds and rates — YouTrip often beats traditional money transfer services like Ria for both speed and value.

📚 Read next: Check out our guide to the best multi-currency cards for the biggest savings here

FAQs:

Q: How long does Ria Money Transfer take?

- Bank transfers: 2–4 business days

- Cash pickups: Within 1 day

- Debit/Credit card: 15 mins–3 hrs

Q: Can I cancel a Ria transfer?

Yes — if it hasn’t been processed yet. Contact Ria customer support.

Q: Does Ria have an app?

Yes, available on iOS and Android.

Q: Can I send money to Bangladesh from Singapore via Ria?

Yes — just check the Ria Money Transfer Singapore today rate (Bangladesh) before confirming.

Q: Is Ria the same as Western Union?

No — Ria is owned by Euronet Worldwide (which also owns XE), and tends to be slightly cheaper than Western Union.

Q: Does 7-Eleven Singapore support Ria Money Transfer?

Not currently. Visit physical Ria outlets like Jurong East or Little India.

💡 Verdict: Is Ria Worth It?

✅ Pros:

- Widely available in Singapore and Malaysia

- Multiple delivery options (cash, bank, mobile)

- Trusted global brand

❌ Cons:

- Exchange rate markup

- Longer delivery times

- Must verify in-store before using PayNow

If you’re after better rates, instant transfers, and no hidden fees, YouTrip is the smarter choice for overseas transfers from Singapore.

Send Money with YouTrip Today!

Ria’s fees are competitive, but they include a small markup on the exchange rate compared to services like YouTrip, which uses real-time wholesale rates.

If you’re transferring from Singapore and want to maximise how much your recipient receives, it’s worth comparing Ria Money Transfer Singapore today rate against YouTrip’s rate before sending.

Not on YouTrip yet? Sign up today with <YTBLOG5> to get FREE S$5 in your account and experience a smarter way to transfer money internationally!

For more great tips and articles like this, join our Telegram (@YouTripSG) and subscribe to our free weekly newsletter here or down below. And while you’re at it, why not join the conversation with thousands of #YouTroopers in our very own Community Telegram Group @YouTripSquad?

Get tips and tricks to everything YouTrip including exclusive invites to exciting events and experiences, & be part of the #YouTripSquad! 💜

Bon voyage!

Related Articles

Overseas Transfers: Send Money Overseas With The Best Rates

How To Send Money From Singapore To Malaysia

How To Send Money To Indonesia From Singapore