Travelling to Malaysia this long weekend? If so, bookmark this Touch ‘n Go guide! We promise it’ll come in handy.

Whether you’re heading to Johor Bahru for shopping or driving deeper into Malaysia for a road trip, having Touch ‘n Go (TNG) sorted is non-negotiable.

Most Singaporeans already know the Touch ‘n Go card — your essential tap-and-go pass for tolls, parking, and public transport. But that’s just one part of the ecosystem. The real game-changer is the Touch ‘n Go eWallet, which unlocks QR payments, online shopping, bill settlements, and even works at selected merchants in Singapore.

In this guide, we’ll break down what TNG is, how it works, and how Singaporeans can use it to go fully cashless in Malaysia — without fumbling for small notes at toll booths or food stalls.

💜 Stay Up To Date:

– Into The Trippieverse: Meet The Trippies

– YouTrip Turns 7: Celebrate With Us And Trippie!

– International Driving License Singapore 2025: Price, Validity & How to Apply

📚 Table of Contents:

- Introduction: What is TNG in Malaysia?

- Touch ‘n Go Card vs Touch ‘n Go eWallet

- Features and Functions

- eWallet Tiers and Limits

- Convenience Fees

- How to Register and Use TNG in Malaysia (for Singaporeans)

- How to Link Your Touch ‘n Go Card

- Which Travel Card Should I Link?

- How to Top Up

- How to Pay

- FAQs

Introduction: What is TNG in Malaysia?

So, what exactly is TNG in Malaysia?

Touch ‘n Go (TNG) is Malaysia’s leading electronic payment system. It comes in two parts:

- The Touch ‘n Go card – a contactless smart card used for tolls, public transport, and parking.

- The Touch ‘n Go eWallet (TNG eWallet) – a digital wallet app used for QR payments, shopping, bill payments, and more.

Together, they form the backbone of Malaysia’s cashless ecosystem, making payments quick, secure, and seamless.

For Singaporeans heading into Malaysia, the TNG card is essential for driving and commuting, while the TNG eWallet makes shopping, dining, and everyday transactions incredibly convenient.

📚 Related guides: JB Food Guide: 20 Places To Eat In Johor Bahru

Touch ‘n Go Card vs Touch ‘n Go eWallet

↪️ Touch ‘n Go Card

A physical card used for:

- Highway tolls

- MRT, LRT, KTM, and buses

- Parking at malls and buildings

Works by tapping at card readers and must be topped up physically at machines, petrol stations, or convenience stores (yes, even 7-Eleven Malaysia).

↪️ Touch ‘n Go eWallet

A mobile app with much wider functionality:

- QR code payments at 1.2 million merchants

- Online shopping (Lazada, FoodPanda, Taobao, iTunes)

- Utility bill payments

- Peer-to-peer transfers

- Street parking payments via app

Can be linked to your physical card for PayDirect or auto top-ups.

👉 Available for both Malaysians and Singaporeans (via passport verification).

📚 Discover next: Best Breakfast in JB: 22 Top Spots To Visit

Touch ‘n Go eWallet Features and Functions

Image Credits: SoyaCincau

The TNG eWallet is more than just a payment app. Here’s what it can do in 2026:

- Toll payments with RFID & PayDirect.

- QR payments at McDonald’s, Starbucks, Shell, Watsons, TGV Cinemas, and more.

- App & online shopping with Lazada, FoodPanda, Taobao, iTunes, Apple Music, and App Store.

- Street parking extensions via app (supported across KL, PJ, Putrajaya, Seremban & more).

- P2P transfers with other users.

- Prepaid reloads & postpaid bills.

- Taxi fares via #JOMTEKSI.

- Digital donations to NGOs, temples, mosques, and churches.

📚 Here’s a guide to ATM withdrawals with YouTrip in Malaysia

TNG eWallet Tiers and Limits

Feeling limited by your 200 MYR wallet cap? You’re likely on the Lite tier. Here’s a quick comparison of the TNG eWallet tiers:

| Touch ‘n Go eWallet Tiers | Lite | Premium* |

|---|---|---|

| eWallet Size | 200 MYR (~S$60) | 20,000 MYR (~S$6,000) |

| Monthly Transaction Limit (excluding transportation, RFID, and PayDirect) | 2,000 MYR (~S$596) | 120,000 MYR (~S$35,765) |

| Annual Transaction Limit (including transportation, RFID, and PayDirect) | 24,000 MYR (~S$7,153) | 360,000 MYR (~S$109,294) |

| Features | ✅ Make payments ✅ Reload ✅ RFID ✅ Receive money | ✅ Make payments ✅ Reload ✅ RFID ✅ Receive money ✅ Transfer money ✅ Money-back guarantee protection ✅ Earn daily returns via GO+ ✅ Balance Cash Out |

| How To Access Different Tiers | Register in the Touch ‘n Go app | Complete your eWallet Account Verification (eKYC) with passport/IC |

Note: To upgrade to Premium, users will have to successfully verify your account via Account Verification (eKYC).

📚 Here’s How To Capitalise On The Malaysian Ringgit Right Now

Touch ‘n Go eWallet Convenience Fees

| Fees & Charges | Amount |

|---|---|

| Credit card reloads (Malaysian bank) | 1% convenience fee of the reload amount |

| Credit card reloads (Non-Malaysian bank) | Up to 2.6% of the reload amount |

| Debit card reloads (Malaysian bank) | No fee |

| Debit card reloads (non-Malaysian bank) | Up to 2.6% of the reload amount |

| Reload PIN | 1% of the reload amount or the converted amount from non-transferrable balance |

| Overseas Transactions | 1% overseas transaction conversion fee (included in the daily exchange rate of your travel destination) |

📚 Check out 21 Things To Do In Mount Austin JB | Food & Activities

How to Register and Use TNG in Malaysia (for Singaporeans)

Can Singaporeans use TNG?

Yes! You can register for TNG eWallet in Singapore before even crossing the border.

Steps:

- Download the TNG eWallet app (App Store / Google Play).

- Register with your Singapore mobile number.

- Verify via WhatsApp OTP.

- Complete eKYC with your passport.

Once registered, you can use the app at 1.2M+ Malaysian merchants and even in Singapore at NETS and Alipay+ partners.

📚 For rest & relaxation: Best JB Massage Spots For Your Weekend Getaway (With Prices)

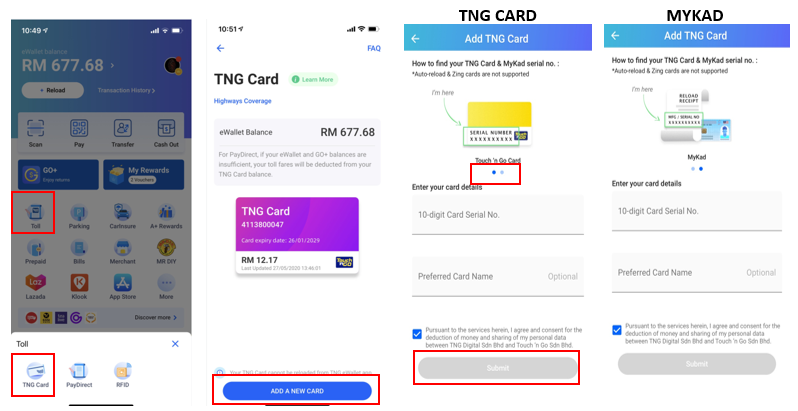

How to Link Your Touch ‘n Go Card to Your TNG eWallet

Image Credits: Touch ‘n Go

Link your Touch ‘n Go card to the eWallet app to top up on the go!

- Download the Touch ‘n Go app on the App Store or Google Play

- Tap on ‘TNG Card’ on the home page > ‘Add card’

- Verify your account

- Enter the 10-digit serial number on your Touch ‘n Go Card > ‘Submit’

- Enter your 6-digit PIN to verify your identity

- Your TNG card has now been added to your eWallet!

📚 For your durian cravings: Durian JB Guide: Best Durian Stalls and Buffets In Johor

Which Travel Card Should I Link to My Touch ‘n Go eWallet?

YouTrip Vs Revolut Vs Wise Vs Trust Bank. Here’s a comparison between the most popular multi-currency wallets in Singapore so you can determine which works best for you when basking in the sun on your next Malaysia getaway!

Here’s a breakdown of some of the key features and benefits available:

| YouTrip | Revolut | Wise | Trust Bank | |

|---|---|---|---|---|

| Able to lock in currencies? | ✅ | ✅ | ✅ | ❌ |

| Exchange rates *Rates taken as of 2 Feb 2026 | 1 SGD = 3.104 MYR | 1 SGD = 3.079 MYR | 1 SGD = 3.091 MYR | 1 SGD = 3.019 MYR |

| Transaction Fees | No fees | ✅ During weekdays: No fee for all currencies ✅ During weekends: 1% fee for all currencies | ✅ From 0.43% with a min. fee of S$0.01 (fee varies by currency) | No fees |

| Fees Incurred When Topping Up Your TNG eWallet | Up to 2.6% convenience fee | Up to 2.6% convenience fee | Up to 2.6% convenience fee | Up to 2.6% convenience fee |

📚 Read more here: Best Multi-Currency Cards In Singapore: A Full Comparison Guide

How to Top Up Your Touch ‘n Go eWallet

Link your YouTrip card to your TNG eWallet for easy top-ups. Here’s how:

- Sign up for YouTrip

👉 Don’t have an account yet? Sign up now and use the promo code <YTBLOG5> for free S$5! - Top up your YouTrip wallet with PayNow or a Linked Bank Account (eGIRO) > Tap ‘Exchange’ to lock in the best MYR rates!

- On the home page of your Touch ‘n Go app, tap ‘+ Add money’ > ‘Debit Card’

- Enter the amount you’d like to reload (minimum 20 MYR) > ‘Continue’

- Enter your YouTrip card details > ‘Reload Now’

You’re all set to top up your Touch ‘n Go eWallet with the best MYR rates!

📚 YouTrip Vs Amaze in Malaysia — which suits your travel needs best?

How to Pay?

Using the TNG card and eWallet for payments in Malaysia is not only simple but also convenient. With over 360,000 participating merchants in Malaysia, it’s accepted just about everywhere.

✅ In-store

Simply open up the Touch ‘n Go app and scan the merchant’s QR code — or let them scan yours. Look for the TNG logo at checkout.

✅ Online:

Select ‘Touch ‘n Go’ as your payment method on sites like Lazada.

Pro Tip: Make sure your TNG Wallet is topped up. For overseas merchants, check for currency conversion fees (unless linked with YouTrip or another multi-currency card).

📚 Here’s how you can send money from Singapore to Malaysia with YouTrip

✈️ Paying with the Touch ‘n Go eWallet Overseas

If you’re shopping overseas, the TNG eWallet works with partners in over 40 countries. You can use it internationally at:

- Singapore: NETS terminals

- Thailand: PromptPay

- EU, UK, US, China: Alipay+ supported outlets

🚌 Using the Touch ‘n Go eWallet for Transport

- Train Tickets: Buy online using TNG Wallet

- Tolls: Link your RFID tag for cashless toll payments

- Buses: Some still require the physical TNG card

🅿️ Using the Touch ‘n Go eWallet for Parking

Using PayDirect, link your TNG card to the eWallet for auto deductions during parking. No more topping up manually!

📚 Check out: Train to JB Guide: How To Travel From Singapore To JB In 5 Minutes

FAQs:

Q: How does Touch ‘n Go work?

- The card uses contactless RFID for tolls, parking, and transport.

- The eWallet works via QR scanning or linking with your card.

Q: Can 7-Eleven top up a Touch ‘n Go card?

Yes, all 7-Eleven stores in Malaysia support TNG card reloads. You can also buy Reload PINs for the eWallet.

Q: How to buy a Touch ‘n Go card in Singapore?

You cannot buy a TNG card in Singapore. They are only available in Malaysia (petrol stations, 7-Eleven, toll plazas). However, you can still register for the eWallet app in Singapore.

Q: What is the difference between the TNG Card and the TNG eWallet?

- Card = physical, for tolls/transport/parking.

- eWallet = digital, for QR payments, shopping, bills, transfers, and linked card functions.

Q: Can Singaporeans use TNG?

Yes! Both the TNG card (for tolls/commute) and the TNG eWallet (for payments in Malaysia + select Singapore outlets) are usable.

New to YouTrip?

Now you’re all set to travel the causeway hassle-free! Link your YouTrip card with your Touch ‘n Go eWallet for the best MYR rates with zero FX fees and no hidden charges.

Skip the money changer and get a free YouTrip card + S$5 YouTrip credits with code <YTBLOG5>.

Then, head over to our YouTrip Perks page for exclusive offers and promotions — we promise you won’t regret it. Join our Telegram (@YouTripSG) and Community Group (@YouTripSquad) for travel tips, event invites, and more!

Happy travels!

Related Articles:

25 Trendy JB Cafes To Visit Right Now

11 Best Dim Sum JB Spots To Try

15 Things To Do In The Mall, Mid Valley Southkey JB