Searching for the best multi-currency card in Singapore for 2026?

Whether you’re travelling, shopping online, or sending money overseas, the right multi-currency card can save you serious cash. We’re talking better exchange rates, fewer fees, and way less hassle than the old-school money changer route.

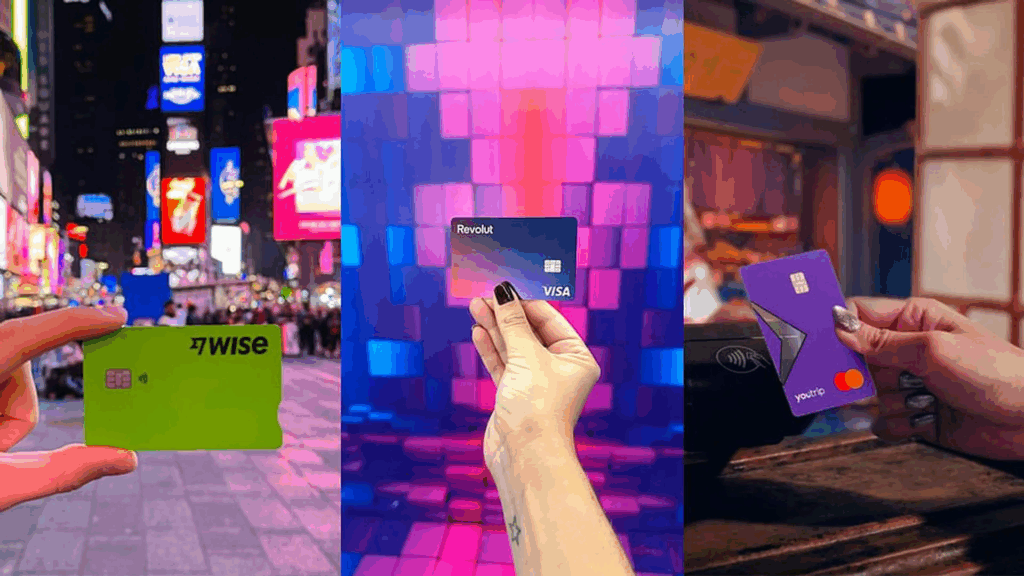

In this guide, we break down the top multi-currency cards — YouTrip, Revolut, Wise, Amaze, and Trust Bank – so you can figure out which one works best for you and your travel and spending style.

It’s time to say goodbye to hidden FX fees and hello to smarter spending overseas!

💜 Stay Up To Date:

– UOB Lady’s Card Guide 2026: Categories, Fees, Miles Earn Rate

– SGD To Yen Guide: Capitalising On The Japanese Yen

– Best SGD to EUR Rate in Singapore (2026 Guide)

⚡️ TL;DR: Best Multi-Currency Cards at a Glance

| Card | Best For | FX Fees | Exchange Rate | Free ATM Withdrawal | Annual Fee | Key Benefit |

|---|---|---|---|---|---|---|

| YouTrip | Overall savings & travel | ✅ Zero | Wholesale (best) | S$400/month | Free | No FX fees + competitive exchange rates |

| Wise | International transfers | ✅ Zero | Mid-market | S$350/month (2 withdrawals) | Free | 40+ currencies supported |

| Revolut | Budgeting & crypto | 0% weekdays, 1% weekends | Interbank | S$350/month (5 withdrawals) | Free – S$219/year | 30 currencies + crypto trading |

| Amaze | Credit card linking | ✅ Zero FX | Competitive | None free (2% fee) | Free | Link 5 cards + InstaPoints |

| Trust Bank | Local savings | ✅ Zero | Real-time (no lock-in) | Unlimited free | Free | 3.5% savings interest |

⚖️ YouTrip offers the best combination of zero fees, wholesale rates, and S$400 free ATM withdrawals monthly.

📚 Table of Contents:

- What’s A Multi-Currency Card?

- What To Look For In A Multi-Currency Card

- Best Multi-Currency Cards In Singapore (2026)

- Real-Life Comparison: Buying a YSL Bag in France

- Sending Money Overseas: How the Cards Compare

- Pros & Cons Overview

- Conclusion: What’s the Best Multi-Currency Card in 2026?

- Frequently Asked Questions (FAQ)

What’s A Multi-Currency Card?

Image Credits: Her World Singapore

A multi-currency card is a prepaid travel card or app-linked card that lets you:

- Spend in multiple currencies with low or no FX fees

- Lock in good exchange rates ahead of time

- Withdraw money at overseas ATMs

- Send money internationally

- Avoid carrying large amounts of cash

These cards often support contactless payment, top-ups via PayNow or card, and even include budgeting tools or cashback rewards. But which one’s right for you? Let’s dive in 👇

📖 Related Guide: Best Singapore Credit Card For Overseas Spending

What To Look For In A Multi-Currency Card:

1. Competitive Exchange Rates

If you’re travelling often, small rate differences can add up fast. Look for cards that use wholesale rates – these are close to the rates you see on Google, XE.com, and other financial sites.

Fun fact: These foreign exchange rates are used by banks, large corporations, and public and private institutions for large-volume currencies.

👉 Pro Tip: YouTrip uses wholesale rates with zero markup.

Want to get into the specifics? Check out this Mastercard Calcuator for Wholesale Exchange Rates.

📖 Related Guide: YouTrip Exchange Rates: Everything You Need to Know

2. Transparent Fees

Some cards come with hidden charges that can sneak up on you:

- Annual Fees: Some cards come with an annual fee when you opt for premium plans that give you extra benefits. Consider whether this extra cost is worth it for you.

- Foreign Exchange Mark-ups: Some cards charge a foreign transaction or currency conversion fee of up to 3% when you’re paying in foreign currency.

- Overseas ATM Withdrawal Fees: Most multi-currency cards charge a fee for overseas ATM withdrawals — but some offer free monthly withdrawals. Choose a card that lets you withdraw your money hassle-free.

- Remittance Fees: If you’re sending money to friends/family overseas, it’s worth considering a multi-currency card that doesn’t impose high transfer fees. Some wallets charge a fee of up to 3% when transferring funds to other accounts.

- Top-Up Fees: Top-up fees may reach as high as 2.08% and can vary depending on the top-up method.

Tip: Always check the fee structure before signing up — especially if you’re a frequent spender or plan to send money overseas.

📖 Related Guide: Money Changer Near Me: 14 Best Money Changers In Singapore

3. Wallet & Spending Limits

Some cards cap your top-up or annual usage — which can be frustrating if you’re shopping or travelling big.

- YouTrip, Revolut, and Wise: Up to S$20,000 top-up and S$100,000 annual limit.

- Amaze: Slightly lower at S$15,000 top-up.

📖 Related Guide: Wise Vs Revolut: Which Is Better for Singaporeans?

4. Features, Rewards & Extras

Much like your traditional credit cards (beyond good FX rates), multi-currency cards also offer exclusive rewards and bonuses such as:

- Exclusive cashback & deals (YouTrip, Amaze)

- Travel insurance (YouTrip, Revolut, Trust Bank)

- Loyalty points (Amaze InstaPoints)

- Budgeting tools (Revolut)

- Crypto & savings (Revolut, Trust Bank)

📖 Related Guide: YouTrip vs Wise: Which Multi-Currency Card Is Best for Singaporean Travellers?

Best Multi-Currency Cards In Singapore (2026)

Here’s a detailed comparison between the most popular options when it comes to overseas spending — YouTrip, Revolut, Wise, Amaze, and Trust Bank:

| Feature | YouTrip | Revolut | Wise | Amaze | Trust Bank |

|---|---|---|---|---|---|

| Wallet Currencies Available for Exchange | ✅ 12 | ✅ 30 | ✅ 40 | ✅ 11 | ❌ Unavailable |

| Annual Fees | None | Standard Plan: Free Premium Plan: S$10.99/month or S$109/year Metal Plan: S$21.99/month or S$219/year | None | None | None |

| Transaction Fees | None | Weekdays: No fees apply if you’re within your plan’s fair usage limit Weekends: A 1% fee applies regardless of your plan | Transaction Fee: None Currency Conversion Fee: From 0.26% | FX transactions: No fees Domestic (SGD) Transactions: 1% fee (min. S$0.50) when paired with a linked card | None |

| Exchange Limit & Fair Usage Fee | None | Standard Plan 👉 Exchange limit: S$5,000/month 👉 Fair usage fee: 1% when exceeded. Premium Plan: 👉 Exchange limit: S$15,000 👉 Fair usage fee: 0.5% when exceeded Metal Plan: No exchange limits | None | None | ❌ Unavailable |

| Overseas ATM Withdrawal Fees | S$400 free per month *2% fee applies thereafter | S$350/5 withdrawals free per month *2% fee applies thereafter | Up to S$350/month 2 or less withdrawals: Free 3 or more withdrawals: S$1.50 per withdrawal More than S$350/month 2 or less withdrawals: 1.75% fee 3 or more withdrawals: S$1.50 + 1.75% fee | 2% fee on all amounts withdrawn | None |

| Sending Money Overseas | Variable fee shown in-app | Variable fee shown in-app | Variable fee from 0.26% | Variable fee from 0.4% | ❌ Unavailable |

| Bank Withdrawals | 10 free bank withdrawals/month For more than 10 bank withdrawals: Request for a refund (S$10 processing fee) | 5 free transfers *S$2.99 fee for each transfer thereafter. | Same currency transfers: Often free Different currency transfer: Fee varies based on currency | ❌ Unavailable | No fees |

| Top-up Fees | Mastercard credit & debit card, Visa debit card, PayNow: No fees Linked Bank Account (eGIRO): No fees Visa credit cards: 1.5% service fee | Mastercard debit card: 0.51% Mastercard credit card: 0.62% Visa debit card: 0.30% Visa credit card: 1.97% International cards: 2.08% Commercial cards: 1.12% From bank accounts in Singapore: Free | PayNow: No fees Bank transfer: No fees Debit Card, Apple Pay, Linked bank account (eGIRO): Varies by amount from S$0.20 | PayNow: No fees | PayNow & Bank Transfer: No fees |

| Wallet Limits | Top-up: S$20,000 Annual spending: S$100,000 | Top-up: S$20,000 Annual spending: S$100,000 | Top-up: S$20,000 Annual spending: S$100,000 | Top-up: S$15,000 Annual spending: S$75,000 | N/A |

| Perks | Cashback, Deals with YouTrip Perks | Budgeting, Crypto | – | InstaPoints | Interest Savings |

📖 Related Guide: Revolut vs YouTrip Singapore: Which Multi-Currency Card Saves You More?

Real-Life Comparison: Buying a YSL Bag in France

Image Credits: YSL

👜 The Bag In Question: Le 5 À 7 In Smooth Leather

Let’s start off by looking at one of the most popular YSL handbags — the classic 5 to 7 bag. Currently, this iconic bag is 2,000 EUR (~S$2,999.62) in France — way cheaper compared to Singapore’s price of S$3,390. However, depending on your card’s FX rate and fees, the final cost may vary.

| YouTrip | Revolut | Wise | Amaze | Trust Bank | |

|---|---|---|---|---|---|

| Current Exchange Rates Google’s Rate: 👉 1 SGD = 0.667 EUR | 1 SGD = 0.6668 EUR | 1 SGD = 0.6666 EUR | 1 SGD = 0.6652 EUR | 1 SGD = 0.6666 EUR | 1 SGD = 0.6644 EUR |

| Total Cost Of YSL Le 5 À 7 In Smooth Leather Bag | ~S$2,999.40 👑 | ~S$3,000.30 | ~S$3,006.61 | ~S$3,000.30 | ~S$3,010.23 |

*Rates taken as of 14 Jan 2026

💡 YouTrip gives you the lowest total cost, with no FX fees and real-time wholesale exchange rates.

📖 Related Guide: Check out this comparison article on YouTrip Vs iChange here

Sending Money Overseas: How the Cards Compare

We tested remitting S$1,000 to different countries — factoring in both exchange rates and fees.

*Trust Bank currently does not offer remittance services and will not be included in this comparison table

| | YouTrip | Revolut | Wise Card | Amaze |

|---|---|---|---|---|

| MYR | S$1,000 = 3,300.76 MYR Fee: S$1.28 | S$1,000 = 3,290.45 MYR Fees: S$4 | S$1,000 = 3,280.29 MYR Fee: S$3.95 | S$1,000 = 3,281.10 MYR Fee: S$7.5 |

| IDR | S$1,000 = 11,860,453 IDR Fee: S$2.36 | S$1,000 = 11,849.780 IDR Fee: S$4 | S$1,000 = 11,796,093 IDR Fee: S$5.12 | S$1,000 = 11,832,804 IDR Fee: S$6 |

| INR | S$1,000 = 62,614.11 INR Fee: S$2.96 | S$1,000 = 62,444.80 INR Fee: S$4 | S$1,000 = 62,260.84 INR Fee: S$5.10 | S$1,000 = 62,455.24 INR Fee: S$5.80 |

| PHP | S$1,000 = 43,044.98 PHP Fees: S$4.51 | S$1,000 = 43,056.16 PHP Fee: S$4 | S$1,000 = 42,847.06 PHP Fee: S$6.56 | S$1,000 = 43,026.24 PHP Fee: S$6.60 |

| USD | S$1,000 = 737.16 USD Fee: S$4.10 | S$1,000 = 735.88 USD Fee: S$4 | S$1,000 = 733.30 USD Fee: S$4.34 | S$1,000 = 731.53 USD Fee: S$3.90 |

| EUR | S$1,000 = 702.10 EUR Fee: S$3.31 | S$1,000 = 701.18 EUR Fee: S$4 | S$1,000 = 699.46 EUR Fee: S$3.18 | S$1,000 = 699.06 Fee: S$8 |

*Rates taken as of 18 Dec 2024 at the time of writing

💡 YouTrip wins in most cases — offering strong rates with low fees.

📖 Related Guide: Find out how to send money overseas with YouTrip here

Pros & Cons Overview:

YouTrip

Best for: Saving – No FX fees, solid exchange rates, and generous free ATM withdrawals.

What is YouTrip?

YouTrip is a multi-currency wallet and travel card that gives you access to favourable exchange rates for 150+ countries worldwide with zero fees, and lock in 12 popular in-app currencies.

Pros:

- Competitive real-time wholesale exchange rates

- Free S$400 ATM withdrawal/month – highest on the list

- Cashback + perks via YouTrip Perks

- In-app travel insurance via HLAS

- Great for shopping, travel, and remittances

Cons:

- Limited to 12 in-app currencies

- No budgeting tools

📖 Related Guide: Find out more about YouTrip’s enhanced wallet limits here

Revolut

Best for: Budgeting & Crypto

What is Revolut?

Image Credits: Capture the Atlas

Launched in 2015, Revolut is a digital banking app with a multi-currency card that offers interbank exchange rates. Revolut enables you to lock in 30+ currencies and spend in 130+ countries. Revolut accounts range from a free Standard plan to a paid Metal plan with more perks.

Pros:

- 30 wallet currencies

- Free and premium plans available

- Useful budgeting and analytics tools

- Access to crypto trading

Cons:

- Monthly fees up to S$21.99 for premium tiers

- Charges weekend FX fees (1%), P2P transfer fees, and usage-based fees

- Higher top-up fees for both Mastercard and Visa (credit/debit)

📖 Related Guide: Revolut Singapore: The Ultimate Guide To The Revolut Card, Account & Fees

Wise

Best for: Transfers

What is Wise?

Image Credits: Wise

Previously known as TransferWise, Wise is a global money transfer and multi-currency account provider. It lets you hold 40+ currencies and make low-cost transfers to over 160 countries at mid-market exchange rates.

Pros:

- Mid-market exchange rates and transparent fees

- Supports a wider range of currencies than most competitors (40+ currencies)

- Lower ATM withdrawal fee (1.75%)

- Reliable global transfers

Cons:

- Currency conversion fees start from 0.26% onwards

- 2% fee for e-wallets and external account funding (fee varies by currency)

- Exchange rates might not be the most competitive

📖 Related Guide: Wise Card Singapore Guide: Fees, Limits, Exchange Rates

Amaze

Best for: Linking Mastercard credit/debit and InstaPoints

What is Amaze?

Image Credits: Instarem

Powered by Instarem, the Amaze card is a multi-currency debit card that links up to 5 Mastercard credit/debit cards. It offers competitive FX rates, rewards on spend, and 0% foreign transaction fees.

Pros:

- Link up to 5 Mastercard debit/credit cards

- No foreign exchange fees

- Earn InstaPoints for redeemable cashback/miles/rewards

Cons:

- 1% fee for SGD payments to GrabPay, prepaid cards, and other e-wallets

- No free ATM withdrawals

- Might not have the most competitive exchange rates in the market when it comes to overseas spending

📖 Related Guide: Instarem Amaze Card Singapore Guide: Fees, Rewards & Is It Worth It?

Trust Bank

Best for: Local savings & credit rewards

What is Trust Bank?

Image Credits: Trust Bank

Backed by Standard Chartered and FairPrice Group, Trust Bank is a full digital bank offering two card options –The Trust Link Card and the NTUC Link Card (exclusively for NTUC Union members). Unlike typical multi-currency cards, Trust is structured more like a savings account.

Pros:

- High savings interest (up to 3.5% p.a.)

- No FX or ATM fees

- NTUC reward ecosystem

Cons:

- Can’t lock in FX rates – not ideal when rates drop

- Not suited for frequent overseas spending

- No remittance or international transfer features

- Late payment fees: S$100 + accrued interest if overdue

📖 Related Guide: Trust Bank Singapore Guide: Credit Card & Cashback Card Review

Conclusion: What’s the Best Multi-Currency Card in 2026?

If you want a no-fuss, cost-saving travel card, YouTrip checks all the boxes:

✅ No FX fees

✅ Real-time wholesale rates

✅ Travel insurance

✅ Cashback perks

✅ Strong remittance rates with transparent fees

It’s the best multi-currency card for most Singaporeans — whether you’re backpacking, shopping in Europe, or just skipping the money changer queue.

But hey, every card has its strengths:

- Wise: Best for frequent international transfers and holding 40+ currencies

- Revolut: Ideal if you love financial tools and crypto

- Amaze: Great for linking your credit cards and earning InstaPoints

- Trust Bank: Better for local savings with limited overseas features

FAQs:

Q: What is the best multi-currency card in Singapore?

The best multi-currency card depends on how you use it. YouTrip is best for overseas spending, Wise for transfers, Revolut for budgeting tools, and Amaze for credit card rewards stacking.

Q: Is YouTrip or Wise better?

YouTrip is better for travel spending, while Wise is better for international transfers and holding many currencies. For most Singaporean travellers, YouTrip’s zero FX fees and higher free ATM limit make it the better choice.

Q: Are multi-currency cards worth it?

Yes, multi-currency cards are worth it if you travel or shop online in foreign currencies. They eliminate 2.5–3.5% bank FX fees, offer better exchange rates, and are more convenient than cash.

Q: What are the benefits of a multi-currency card?

Key benefits include zero or low FX fees, wholesale exchange rates, and the ability to hold multiple currencies in one card. They’re safer than cash, widely accepted overseas, and easy to manage via mobile apps.

Ready to Try YouTrip?

Find a card that suits your needs best — whether you’re looking for the best rates in town or one with zero fees.

Not a YouTrooper yet? Singapore’s go-to multi-currency wallet helps you save with great FX rates and zero fees. Skip the money changer and get a free YouTrip card + S$5 YouTrip credits with code <YTBLOG5>.

Then, head over to our YouTrip Perks page for exclusive offers and promotions — we promise you won’t regret it. Join our Telegram (@YouTripSG) and Community Group (@YouTripSquad) for travel tips, event invites, and more!

Happy travels!

Related Articles:

Trust Card Vs YouTrip: Which Is The Better Card For Overseas Spending?

Best Miles Credit Card in Singapore For Overseas Spending

Best DBS Miles Credit Cards In Singapore

Best Citi Miles Credit Cards in Singapore: PremierMiles, Prestige, Rewards