When you spend overseas with a Singapore bank-issued debit card, you’re subjected to foreign transaction fees which you may not know about.

Banks have started hopping onto the “no foreign transaction fees” bandwagon recently – about time, we say! 😎

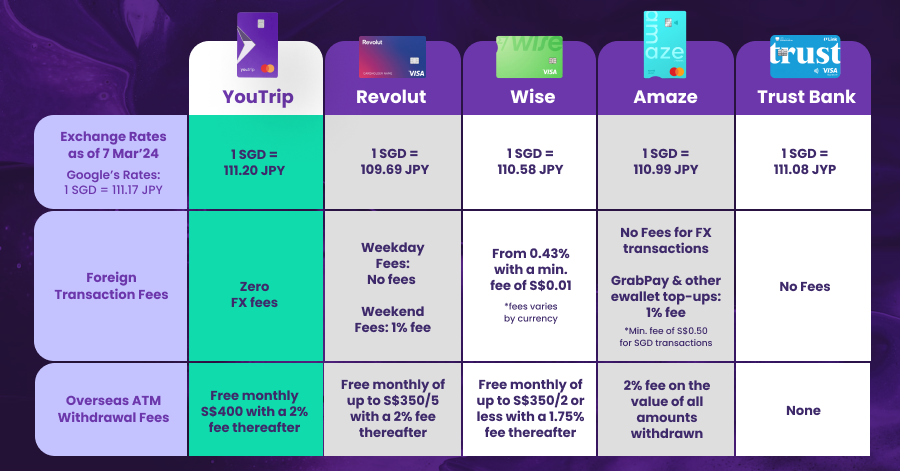

But hey, if you haven’t checked out the terms and conditions, we’ve done the hard work for you. Here’s a comparison of debit card overseas fees, including “hidden” fees and charges.

Guides to Cost Savings For Foreign Currency Payments:

#1: How to Avoid DCC: SGD vs Local Currency

#2: Debit Card Overseas Transaction Fees: Comparison Guide

#3: Credit Card Overseas Transaction Fees: Comparison Guide

What Types of Overseas Transaction Fees are there for Debit Cards?

Foreign Currency Transaction Fee: You make an overseas purchase and charge it to your Singapore bank card in foreign currency. Usually a ~3.25% fee is charged to process the transaction, inclusive of administrative fees.

Currency Conversion Fee: You make an overseas purchase and charge it to your Singapore bank card in Singapore Dollars. Usually a ~2.8% fee is charged to process the conversion. In addition, Dynamic Currency Conversion (DCC) will kick in and you’ll be subjected to poor currency exchange rates. In total, you could pay as much as 7% to 15% extra.

How much Overseas Transaction Fees do banks charge for Debit Cards?

| Bank | Foreign Currency Transaction Fee | Currency Conversion Fee |

| DBS | 3.25% | 2.8% |

| POSB | 3.25% | 2.8% |

| UOB | 3.25% | 2.8% |

| OCBC | 3.25% | 2.8% |

| Maybank | 2.75% | 2.75% |

| Citibank | 2.5% | 2.5% |

| Standard Chartered | 3.5% | 1% |

In addition to the different fees, foreign exchange rates also vary between banks and card associations (Visa, Mastercard, etc.). For the sake of simplicity, let’s assume the same exchange rates across all, as we compare the different overseas fees.

How much more do I pay in Foreign Currency?

When you make a USD $733 (~ SGD $1,000) purchase in the United States and choose to pay in USD on the spot:

| Item Price | Billed Price | Extra Paid |

| USD $733 (~ SGD $1,000) | SGD $1,032.50 | + SGD $32.50 |

How much more do I pay in Singapore Dollars?

When you make a USD $733 (~ SGD $1,000) purchase in the United States and choose to pay in SGD on the spot:

| Item Price | Billed Price | Extra Paid |

| USD $733 (~ SGD $1,000) | SGD $1,070 | + SGD $70 |

Wait, why 7% more? Shouldn’t it be only ~2.8% extra? Well, that’s exactly the bill shock you might get when you realise the extra charges on your card statement. Don’t forget that when you choose to pay in SGD while overseas, you’re allowing the merchant to activate DCC, which is notorious for its poor exchange rates. You could be paying up to 15% more!

Pro tip: Never pay in SGD while overseas. You can learn how to avoid DCC easily and guard yourself against clever merchants.

But some banks promise $0 Overseas Transaction Fees!

Sure, but the promise isn’t without its terms and conditions:

1. Limited currencies: Most of the time the $0 overseas transaction fees only apply to a limited preset of currencies, so you’ll still be subjected to extra fees when you pay in other 100+ foreign currencies.

2. “Cash back” promotion: Sometimes the $0 overseas transaction fees feature is actually a “cash back” promotion where you’ll have to pay the extra fees first. When the promotion ends, you’ll receive the extra paid fees as “cash back”.

Ok, is there a better way to avoid Overseas Transaction Fees altogether?

Here’s three scenarios for you to consider:

Scenario A: Using “No FX Fee” Debit Card

Tom signs up for a “no FX fee” promotion debit card. The promotion requires him to pay the 3.25% overseas transaction fee first when spending overseas. After the “no FX fee” promotion ends in October, he’ll then receive back all the 3.25% he’s paid – as cash back in November.

During this period, Tom has to keep track of all his overseas expenses so that he can calculate the total he should receive in November. Tracking the 3.25% of his overseas expenses for a few months shouldn’t be too hard, right? Hopefully!

Scenario B: Using Multi-Currency Account-Linked Debit Card

Tom signs up for a bank’s multi-currency account that comes with a debit card. The debit card only allows him to pay without fees for the preset 11 currencies. When he spends outside of the supported currencies, he has to pay an extra 3.25% for every transaction.

And if he forgets to maintain a minimum balance in his multi-currency account, he’ll be penalised with a fall-below fee.

Scenario C: Using YouTrip Card

Tom signs up for a YouTrip card. There’s no promotion fine print, because no fees means no fees 😎 (there’s no minimum balance to maintain either). Whenever he spends overseas, Tom also receives a real-time notification on his YouTrip app. While Tom is enjoying a carefree holiday (without having to track extra fees), he’s also bagging significant savings with YouTrip’s Wholesale Exchange Rates.

Holidays should be fun and travels should be worry-free. See, there’s no need to track any 3.25% because you don’t even have to spend the extra fees in the first place (when you use the right card, of course). It’s not rocket science!

Read: How to Avoid DCC: SGD vs Local Currency

Read: 7 Best Holiday Booking Hacks to Score Best Deals

Read: How I Booked a Ghost Flight to China

Read: Best Travel Insurance Singapore Comparison Guide

Read: Multi-Currency Accounts vs Wallets vs Cards: FX Fees Comparison

Enjoy a worldwide fees-less travel experience!