Travelling soon and wondering whether you should head to a money changer or just rely on a travel card like YouTrip? You’re not alone.

For years, CashChanger.co Singapore has been a go-to tool for checking real-time exchange rates from licensed money changers. It helps you locate the best rate for SGD to MYR, USD, JPY, and more without needing to walk from counter to counter.

But here’s the thing: While CashChanger helps you compare cash rates, YouTrip offers a different approach – a multi-currency wallet and card that often beats money changer rates altogether, and allows you to pay directly in foreign currency with no markup.

💜 Stay Up To Date:

– Indonesia Power Plug & Socket Guide (2025): Types, Voltage, Adapters & Tips

– WeChat Pay For Foreigners In China Guide 2025

– SGD To MYR Rate Today (2025): Best Exchange Rates, Forecast & Where to Change Money

📚 Table of Contents:

- TL;DR

- What is CashChanger.co?

- What is YouTrip?

- Comparing YouTrip Vs CashChanger.co

- Where is the Best Place to Exchange Money in Singapore?

- Convenience: Digital vs Physical

- When’s the Best Time to Exchange Money?

- Verdict

- FAQs

⚡TL;DR: Quick Overview

| Feature | CashChanger.co | YouTrip |

|---|---|---|

| Exchange Rate | Varies by money changer (can be good) | Real-time wholesale exchange rates, typically better overall |

| Fees | None from CashChanger; individual money changers typically charge a markup of 0.3-1.5% | No admin fees, no FX markup |

| Convenience | Requires physical visit to money changer | Fully digital, use via app |

| Real-time rates | Yes, aggregated from many changers | Yes, via SmartExchange™ in app |

| Availability | Limited to Singapore opening hours | 24/7 worldwide usage |

| Best for | Large cash exchanges | Travel spending, everyday use |

- 💵 CashChanger.co is great for comparing Singapore money changers if you still rely on physical currency.

- 💳 But if you’re looking for a faster, more secure, and usually better-value solution, YouTrip is a game-changer for modern travellers.

What is CashChanger.co?

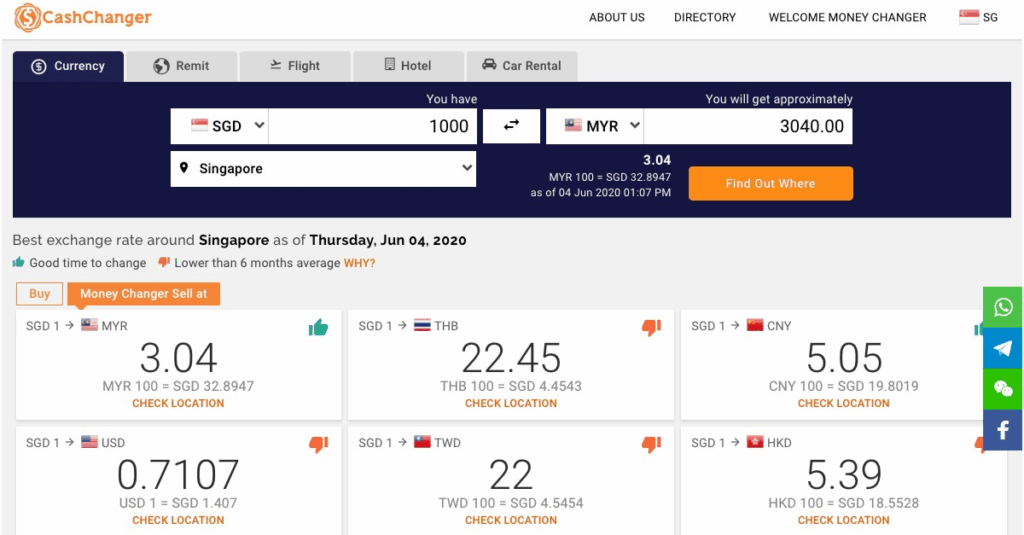

Image Credits: cashchanger.co

CashChanger.co is a rate-comparison site that lists real-time exchange rates from money changers all across Singapore. Instead of hunting down the best rate physically, you can check rates for:

- SGD to MYR

- USD, EUR, THB, JPY and more

- With listings from changers at places like The Arcade, Mustafa Centre, and Lucky Plaza

It’s a great tool if you need to withdraw physical currency before a trip.

How to use CashChanger.co in Singapore

Using CashChanger is simple. Just follow these steps:

- Select your currency pair (e.g. SGD to MYR)

- Enter the amount you plan to exchange to estimate how much you’ll get in return

- Tap ‘Find Out Where’ – The site will show a list of money changers and their live exchange rates

- Compare real-time rates by filtering results by Area, Rates, or Near Me

- Get all the details you need – view addresses, contact details, and opening hours

- Head down in person to lock in your chosen rate (some changers allow you to reserve rates online)

👉 Great for those exchanging large sums or who still prefer cash-in-hand.

📚 Discover the Best Multi-Currency Cards In Singapore (2025): A Full Comparison Guide

What is YouTrip?

YouTrip is a multi-currency wallet and Mastercard that lets you:

- Exchange 12 in-app currencies at competitive wholesale exchange rates

- Spend in 150+ countries with zero FX fees and no markups

- Use SmartExchange™ to monitor live FX rates and lock in the best time to convert

- Withdraw up to S$400 per month at overseas ATMs (*A 2% fee is imposed thereafter)

It’s designed for modern travellers, online shoppers, and anyone who prefers digital convenience over physical cash handling.

Using YouTrip Overseas

- Top up your YouTrip wallet in SGD using PayNow, a linked bank account, or a credit/debit card.

- Lock in foreign exchange rates in the app before your trip for 12 popular currencies.

👉 SGD, MYR, JPY, THB, AUD, USD, EUR, HKD, CHF, GBP, SEK, NZD - Use the YouTrip Mastercard overseas for shopping, dining, and transport — it’ll automatically deduct from the right currency wallet or auto-convert SGD at wholesale rates.

- Withdraw cash overseas (free up to S$400/month*).

- Avoid DCC by always choosing to pay in the local currency.

📚 Check out this comparison article on YouTrip Vs iChange here

Comparing YouTrip Vs CashChanger.co

| Currency | YouTrip | Best Rate on CashChanger.co |

|---|---|---|

| MYR | 1 SGD = 3.29 MYR 👑 | 1 SGD = 3.27 MYR |

| JPY | 1 SGD = 114.45 JPY 👑 | 1 SGD = 112 – 114.41 JPY |

| THB | 1 SGD = 25.11 THB 👑 | 1 SGD = 25.10 THB |

| AUD | 1 SGD = 1.195 AUD 👑 | 1 SGD = 1.194 AUD |

| HKD | 1 SGD = 6.117 HKD 👑 | 1 SGD = 6.090 HKD |

| EUR | 1 SGD = 0.6675 EUR 👑 | 1 SGD = 0.6673 EUR |

| USD | 1 SGD = 0.7787 USD 👑 | 1 SGD = 0.7776 USD |

*Rates taken on 7 Aug 2025.

📚 Here’s everything you need to know about YouTrip Exchange Rates

Where is the Best Place to Exchange Money in Singapore?

If you’re after cash, popular physical locations include:

- The Arcade @ Raffles Place

- Mustafa Centre (open 24/7)

- Lucky Plaza, Orchard

You can check all their rates using CashChanger.co Singapore. It’s helpful because it lets you compare multiple licensed money changers at a glance. Some changers offer excellent rates – especially if you’re exchanging large amounts (e.g. S$1,000+).

But YouTrip has a key advantage:

YouTrip uses real-time wholesale FX rates, which are often better than money changer rates – esepcially for common currencies.

And unlike some money changers, YouTrip doesn’t add markups or admin fees.

📚 Find a Money Changer Near Me: 14 Best Money Changers In Singapore (2025)

Convenience: Digital vs Physical

- CashChanger.co requires you to find and visit a physical money changer, which can be a hassle during peak periods or holidays.

- YouTrip lets you top up instantly via PayNow and spend overseas like a local – just tap your card or phone

💡 YouTrip works globally in 150+ countries, while CashChanger is only useful while you’re still in Singapore.

📚 Discover the Best Miles Credit Card in Singapore (2025): The Ultimate Guide

When to Use Which

| Use This If… | Go With… |

|---|---|

| You’re exchanging a large amount of cash (e.g. >$1,000) | CashChanger.co |

| You want to avoid handling cash | YouTrip |

| You value speed and convenience | YouTrip |

| You’re comparing many options for cash manually | CashChanger.co |

| You need cash urgently in person | CashChanger.co |

| You want competitive rates for day-to-day overseas spend | YouTrip |

When’s the Best Time to Exchange Money?

Here’s a common question:

“What is the best day of the week to exchange money?”

Truth is, there’s no fixed ‘best day’ – exchange rates fluctuate based on:

- Global currency markets

- Political and economic news

- Market demand and supply

So the smarter move is to: Activate YouTrip’s ‘Rate Updates’ feature to track your top currencies and get instant alerts when FX rates hit their best in the past week or month.

Verdict: CashChanger.co or YouTrip?

CashChanger.co is a solid tool if you’re looking to exchange large sums and are willing to make the trip.

But for most travellers, YouTrip is simply the more efficient, fee-free and hassle-free option. It gives you:

- Real-time exchange rates (SmartExchange™)

- Zero admin or conversion fees

- Instant top-ups via PayNow

- Worldwide acceptance

So, unless you’re after a stack of foreign cash for a shopping spree, YouTrip is the smarter, more flexible way to get great rates — without ever needing to visit a money changer.

FAQs:

Q: Is CashChanger.co free?

Yes, it’s free to use and accessible from any browser.

Q: Does YouTrip always offer better rates than money changers?

While rates vary, YouTrip often beats physical money changer rates, especially after accounting for markup and fees.

Q: Can I use both CashChanger and YouTrip?

Absolutely. Use CashChanger if you need cash. Use YouTrip for card spending, online purchases, or when travelling overseas.

Q: Can YouTrip withdraw MYR from ATMs in Malaysia?

Yes, YouTrip supports overseas ATM withdrawals—you’ll just need to enable it in the app. However, the ATM operator may charge a small fee.

Q: Is it safe to carry large amounts of foreign cash?

There are always risks. That’s why many travellers are switching to multi-currency cards like YouTrip for added security and ease.

Ready to Try YouTrip?

If you’re searching for the best exchange rate Singapore has to offer, CashChanger.co is a reliable place to start. It lets you compare rates for SGD to MYR, USD, and more — all in one place.

But remember:

📉 Rates at physical money changers may still come with markups or manual fluctuations.

💸 Travel-focused digital options like YouTrip offer competitive rates — without the queues or manual comparison.

👉 Whether you’re team “cash” or team “card,” the best choice is the one that gives you the most value — when you need it most.

Not a YouTrooper yet? Singapore’s go-to multi-currency wallet helps you save with great FX rates and zero fees. Skip the money changer and get a free YouTrip card + S$5 YouTrip credits with code <YTBLOG5>.

Then, head over to our YouTrip Perks page for exclusive offers and promotions — we promise you won’t regret it. Join our Telegram (@YouTripSG) and Community Group (@YouTripSquad) for travel tips, event invites, and more!

Happy travels!

Related Articles:

Best Singapore Credit Card For Overseas Spending (2025)

Japan ATM Withdrawal Guide: Fees, Locations, Exchange Rates 2025

How To Capitalise On The Malaysian Ringgit Right Now

YouTrip Vs Wise Card Comparison Guide In 2024