Navigate the diverse landscape of international transfer services! We’ll break down everything you need to know about making easy and cheap overseas transfers from Singapore 🌍

Whether you’re looking to send money overseas to family or handle cross-border business payments, international transfers from Singapore can be a headache if it’s new to you.

However, the options of platforms for cheap overseas transfers are plentiful, ranging from traditional banks to modern apps and physical money transfer stores. In this guide, we’ll break down all you need to know about finding the easiest and cheapest money transfer service in Singapore. Keep reading for a guide on different international transfer options that will help you make an informed decision!

What to look for in a money transfer service?

- Exchange rates: Exchange rates may seem trivial, but they impact the final amount your recipient gets. Different money transfer services use different exchange rates – look for services that offer mid-market or near-market rates.

- Transfer fees: Most money transfer services charge a fee on your transfer – this includes service charges, markup fees, or processing fees. Opt for a transfer service that offers low and transparent fees. 💸

- Transfer speed: Need your transfer to be done instantly? Pick your money transfer service wisely! Some services can send your money in minutes or even seconds, some may take up to a few days. 🚀

- Ease of use: You don’t want to go through stress trying to handle your international transfers. Opt for a service that’s simple, fuss-free, and easy to use.

💡 Looking for a money transfer service that offers the best exchange rates and low, transparent fees? Check out YouTrip! 💜

3 main options for cheap and easy overseas transfers

Option 1: Traditional Banks

Most major banks in Singapore (DBS, UOB, OCBC) offer international transfer services. However, overseas transfers with banks typically come with a few downsides:

- Less Favourable Exchange Rates: Banks often provide exchange rates that are not as competitive and include mark-ups.

- High Transfer Fees: Fees can reach up to S$30 per transaction, depending on the bank, amount, and destination.

- Processing Time: Transfers can take 1 – 3 working days to process.

🔍 Verdict: Reliable but costly. Traditional bank transfers are a solid choice for large, formal transfers where speed and cost are not major concerns.

Option 2: Digital Wallets & Remittance Apps

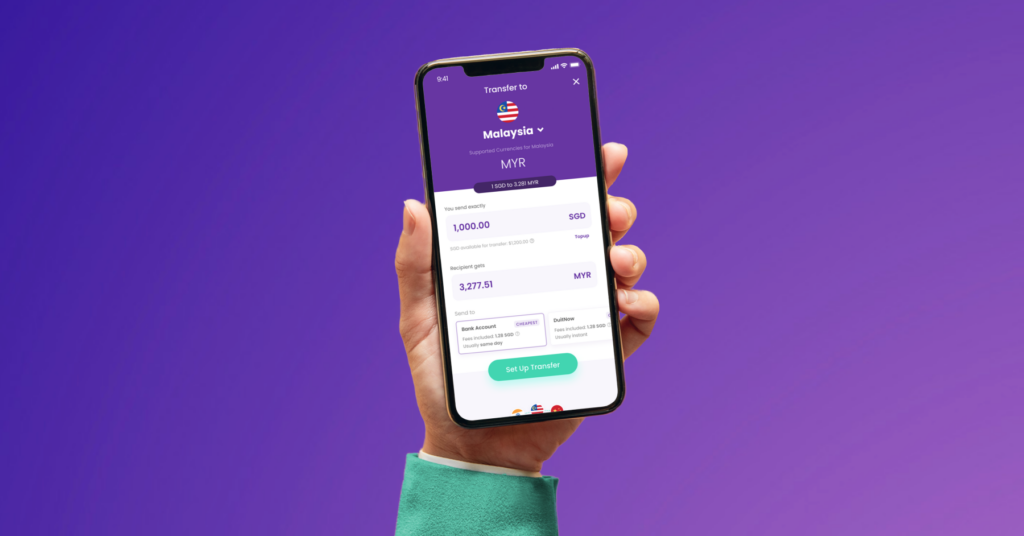

For quick and cheap overseas transfers, digital payment apps like YouTrip, Wise, PayPal, Revolut, and Remitly are excellent alternatives. These platforms are designed for user convenience and cost-effectiveness:

- Low Costs: Minimal and transparent fees compared to traditional banks.

- Better Exchange Rates: Enjoy more competitive exchange rates, translating to more money in your recipient’s hands!

- Convenience: Easy sign-ups and hassle-free transactions in a few taps on your phone

- Security: These apps employ robust security features to safeguard your transactions.

🔍 Verdict: Ideal choice for everyday transactions and quick, stress-free remittances.

Option 3: Traditional Remittance Services

If you’re not that confident with digital money transfer platforms, traditional remittance services like Ria Money Transfer and Western Union are good options for you. Here’s why:

- Convenience of Physical Branches: Services like Ria Money Transfer and Western Union have physical locations across Singapore where you can send money (cash deposits) in person, providing assurance and direct assistance if needed.

- Wide Accessibility: These traditional remittance services have extensive networks and are great for sending money to areas with limited banking infrastructure.

🔍 Verdict: Useful for individuals who are less tech-savvy and prefer physical interaction when sending money overseas.

So, what’s the cheapest and easiest way to send money overseas?

Ultimately, the best method for sending money overseas hinges on your personal preferences and comfort level with different services! For those who prioritise cost and convenience, digital wallets like YouTrip stand out as the cheapest and easiest international transfer options, allowing for hassle-free transactions with competitive rates.

🛎️ Try sending money overseas with YouTrip!

Send money overseas to 40+ countries with the best rates all day and no hidden fees with YouTrip. Experience same-day or even instant transfers for popular currencies with Duitnow, Gcash and UPI — with no cut-off timings, anytime, any day. Get started 👇🏻

More guides you may find useful:

- How to Send Money Overseas with YouTrip

- What is Remittance?

- How to Send Money to Malaysia from Singapore

- How to Send Money to Philippines from Singapore

- How to Send Money to the USA from Singapore

- How to Send Money to Europe from Singapore

- How to Send Money to India from Singapore

- How to Send Money to Indonesia from Singapore

Stay up to date:

- 14 Best Money Changers in Singapore

- Best Massage Spots in JB (2025)

- Top 15 Capsule Hotels in Tokyo Under S$100/Night

- Best Singapore Credit Card for Overseas Spending