Considering sending money overseas with SingX? Find out more about SingX’s popular international money transfer service 👇🏻

Founded in 2014 by a team of former bankers, SingX is a Singapore-based fintech platform that offers fast and secure cross-border remittance across Asia, Australia, the US, Europe, and beyond.

In this guide, we’ll walk you through everything you need to know about sending money overseas with SingX – from its fees to exchange rates and other remittance features. ✨

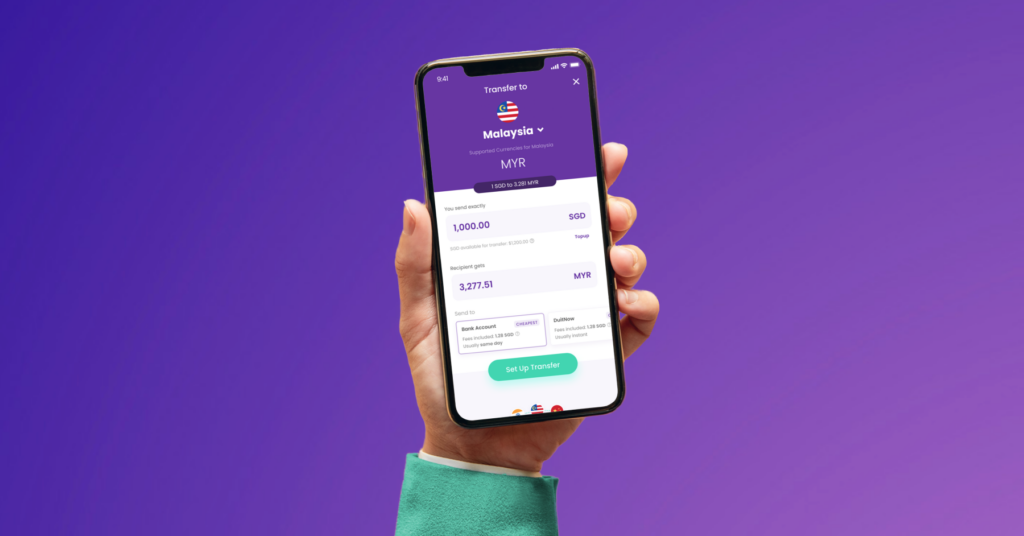

🧐 Exploring your options? YouTrip’s international money transfer offers some of the best exchange rates with no hidden fees and low transfer costs. Find out how to send money overseas with YouTrip here!

All you need to know about sending money overseas with SingX

What is SingX?

SingX is a Payment Services company founded in 2014 and headquartered in Singapore. Licensed and regulated by the Monetary Authority of Singapore (MAS), SingX helps users make bank-to-bank international transfers in a transparent, cost-effective way. Currently, you can send money from Singapore to over 180 countries with SingX.

Key Features of SingX

SingX prides themselves on making overseas money transfers simple, stress-free, and affordable. Having been around for over a decade, it has earned a strong reputation as a reliable and trusted option for international money transfers.

Here are some key features of SingX’s money transfer service:

- Wide country coverage: SingX offers global reach with its remittance service, enabling transfers to over 180 countries in 35+ currencies. Some popular transfer destinations include Malaysia, India, the Philippines, Australia, Indonesia, and the United States.

- Mid-market exchange rates & transparent fees: SingX provides users with competitive exchange rates and charges a transparent fee of 0.25% – 1%, depending on your transfer destination. Their fees are notably lower, especially if you compare with banks and traditional remittance services. You can expect to pay between S$3 – S$10 for a S$1,000 transfer from Singapore.

- Fast Processing: Most of SingX’s transfers are usually completed within the same day, though there’s a cut-off time (usually 5PM). Otherwise, funds typically arrive the next business day.

- Digital-first Experience: SingX’s international transfer service is available online via their website or app, allowing users to complete transfers without having to visit a physical money transfer service branch. If you require assistance, they have an office at Cecil Street available for consultation on an appointment-only basis.

📚 SingX Overseas Transfer: read our guide on sending money with YouTrip vs Bank Transfers

Comparing Fees and Exchange Rates (YouTrip vs SingX) ⚖️

How much local currency your recipient receives depends on the money transfer platform’s foreign exchange rate 💹 and transfer fees 💸. We’ve put together a quick comparison of how much your recipient will receive when you send S$1,000 to different destinations via YouTrip vs. SingX:

| Transfer destination | YouTrip | SingX |

| Malaysia (MYR) 🇲🇾 | Rate: 1 SGD = 3.309 MYR Fees: S$3.28 Recipient gets: 3,306 MYR 👑 | Rate: 1 SGD = 3.3065 MYR Fees: S$6.50 Recipient gets: 3,283 MYR |

| US Dollars (USD) 🇺🇸 | Rate: 1 SGD = 0.778 USD Fees: S$4.10 Recipient gets: 775.20 USD 👑 | Rate: 1 SGD = 0.777 USD Fees: S$7.00 Recipient gets: 772.01 USD |

| Indian Rupees (INR) 🇮🇳 | Rate: 1 SGD = 67.41 INR Fees: $2.96 Recipient gets: 67,210 INR 👑 | Rate: 1 SGD = 67.36 INR Fees: S$5.00 Recipient gets: 67,022 INR |

| Great British Pounds (GBP) 🇬🇧 | Rate: 1 SGD = 0.5768 GBP Fees: $3.56 Recipient gets: 574.74 GBP 👑 | Rate: 1 SGD = 0.5763 GBP Fees: S$7.00 Recipient gets: 572.37 GBP |

*Rates taken as of 20 June 2025

💡 Based on this comparison, your recipient will receive more local currency when you send money with YouTrip vs. SingX due to YouTrip’s competitive exchange rates and lower transfer fees. ✨

📚 SingX Overseas Transfer: find out how to send money from Singapore to Malaysia!

How to use SingX to send money overseas?

Sending money with SingX is pretty easy! Here’s a step-by-step guide:

- Sign up: Create an account on the SingX website or app.

- Verify your identity: Complete identity verification either via SingPass or by uploading documents manually.

- Add a recipient: Enter your recipient’s bank details. SingX supports a wide list of local and international banks.

- Check rates & fees: Choose your recipient’s country and you’ll see the exchange rate and exact transfer fee.

- Make payment: Select fund source (bank transfer or PayNow) to complete transfer.

📚 SingX Overseas Transfer: read our guide on how to send money to the Philippines from Singapore 🇵🇭

Alternatives to SingX in Singapore

While SingX is a good new option for international transfers, there are many other remittance options in Singapore such as DBS Remit, Wise, Ria Money Transfer, Western Union, Remitly, and YouTrip! 👀 Consider picking a money transfer service that best suits your needs.

You can now send money to 40+ countries with the best rates and no hidden fees with YouTrip! Enjoy fast, secure, and hassle-free overseas transfers in six simple steps 🌍💵

1️⃣ Sign up for YouTrip

Don’t have an account yet? Sign up now and use the promo code <YTBLOG5> for free S$5!

2️⃣ Top up your YouTrip wallet with a Linked Bank Account (eGIRO) or PayNow to ensure your SGD wallet has sufficient funds

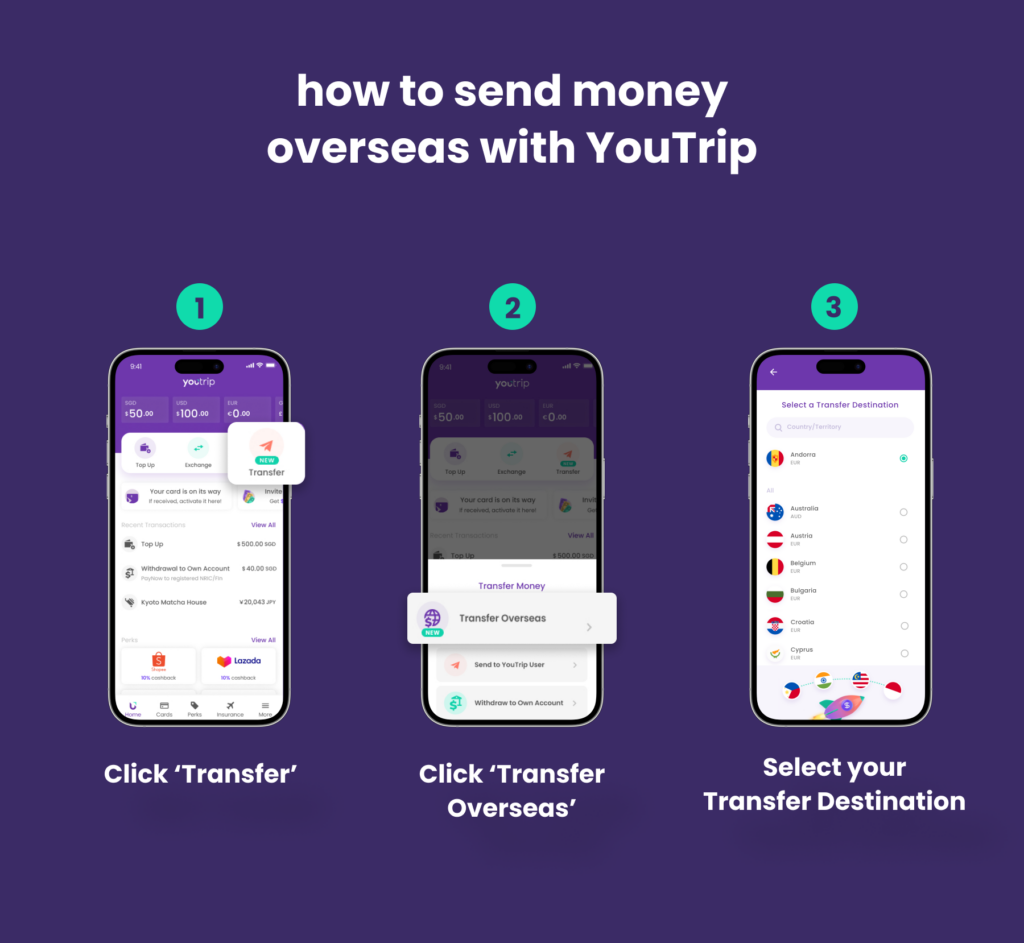

3️⃣ Click ‘Transfer’ > ‘Transfer Overseas’ > Select the desired currency you wish to transfer

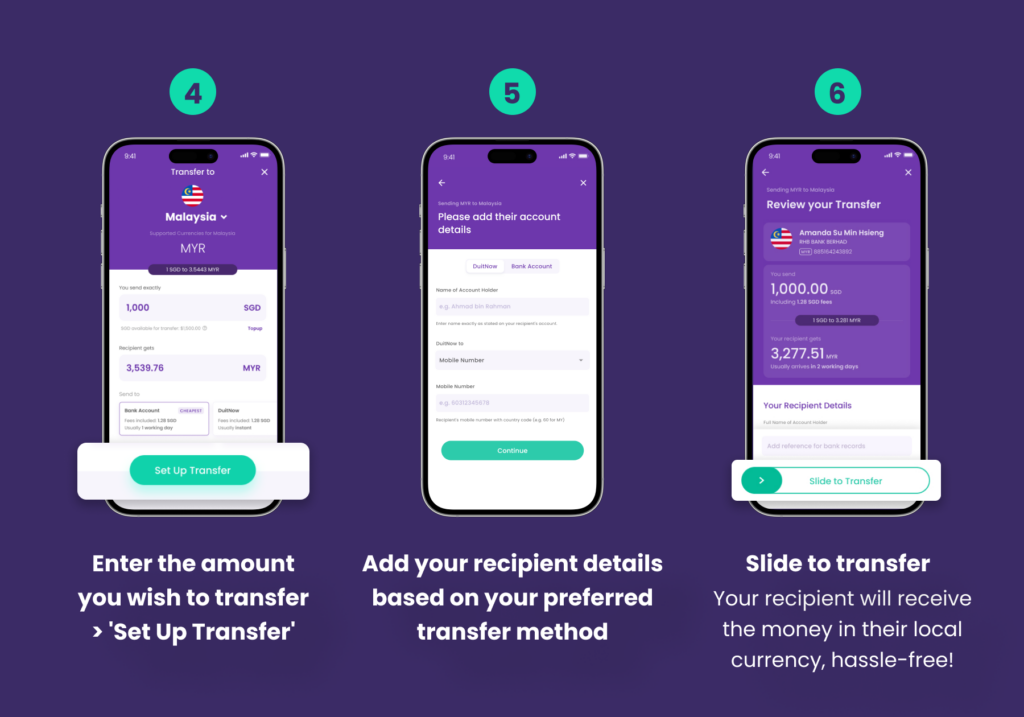

4️⃣ Enter the amount you want to transfer > ‘Set Up Transfer’

5️⃣ Choose your preferred transfer method based on the destination you’re transferring to > ‘+ Add Recipient’ and enter the required details

- Bank Account

- DuitNow

- Gcash

- UPI

6️⃣ Slide to transfer and voilà! Your recipient will receive the money in their local currency, hassle-free!

Ready to start sending money overseas?

Whether you’re sending money to family back home, paying for overseas tuition, or managing cross-border business expenses, SingX offers a reliable and transparent platform for international transfers. With competitive rates and relatively low fees, it’s a great alternative to traditional banks and legacy remittance providers.

Or even better, consider YouTrip!

Much like SingX, YouTrip is committed to offering Singaporeans a safe, secure, and affordable way to send money overseas. With even lower fees and better exchange rates, you can now send money to Malaysia, Indonesia, the Philippines, Europe, and more in a few easy taps 💜 We’re here to solve your international transfer headaches!

Ready to get started? Sign up for a YouTrip account in minutes – use code <YTBLOG5> to get FREE S$5!

Guides on money transfer services in Singapore:

- DBS Remit Money Transfer Guide

- Ria Money Transfer Guide

- Western Union Money Transfer Guide

- Remitly International Money Transfer Guide

- Maribank Overseas Transfer Guide

- Easy and Cheap Overseas Transfers from Singapore (2025 Guide)