We are in the golden age of cashless payment. Beyond debit and credit card, we are experiencing a new boom with mobile wallets too. With so many options available, here’s what you need to know about each mode of payment and how YouTrip fits on the spectrum.

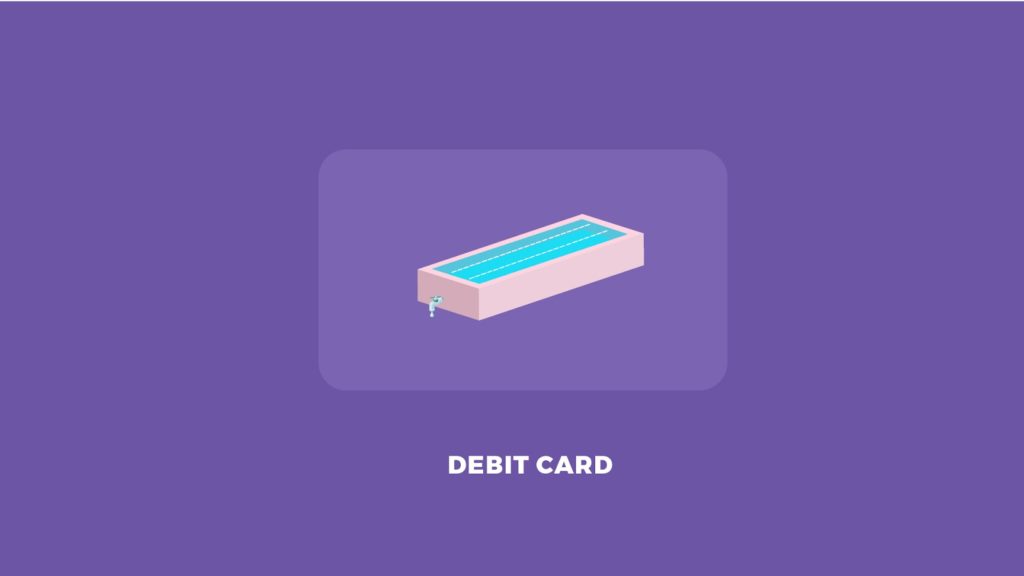

Debit Card

A debit card is basically an extension of your bank account. Imagine a tap attached to your own pool of water. Every time you turn it on, it drains directly from your pool.

For Example:

When you pay for $500 air ticket with a debit card, $500 is deducted from your bank account.

The debit card is probably your first introduction to cashless payment and it’s usually linked to your ATM card as well. It doesn’t come with annual fees but like the credit card, the debit card comes with a range of rewards too from cash-back to discounts. However, credit cards’ reward systems generally have wider applications and could save you more in the long run.

Still, a debit card is a great option for controlling your spending. Since you won’t be able to spend more than what you have, you won’t have to worry about being in debt.

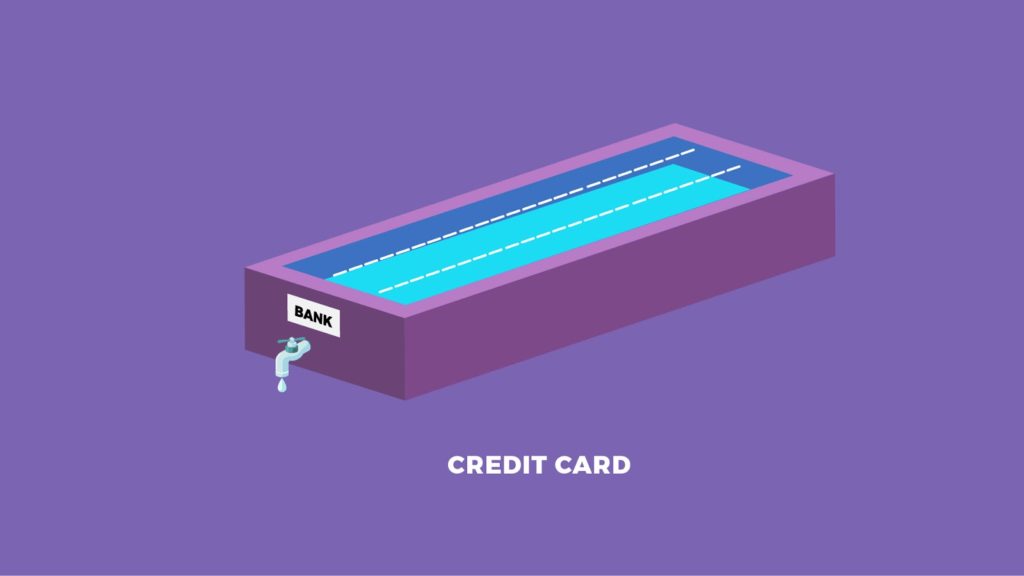

Credit Card

A credit card allows you to loan from a bank and pay with the bank’s money first. Imagine a tap attached to the bank’s pool instead of your own. But at the end of every month, you’ll have to pay back the bank at least a part of the money spent.

For Example:

With a credit card, you can pay for a $500 air ticket when you have only $100 in your bank account. At the end of the month, you can pay either the bank in full or a part of the $500. However, it is best to always pay the full amount to avoid high-interest rates from unpaid balance.

Credit cards generally have a more extensive rewards program that covers a wider range of vendors. Also, with so many credit card options, it’s easy to find one with incentives that fit with your lifestyle and spending habits. However, do note that some credit card comes with an annual fee while others have certain conditions that allow you to waive its annual fee.

If you are financially disciplined and you pay your bills on time, the credit card can help you save more in the long run with a more robust rewards program.

Mobile Wallet

A mobile wallet exists as a mobile app and some notable examples are DBS PayLah! And GrabPay. You’ll have to top-up money in your mobile wallet first (be it through your bank account or credit card) before you can use it. Imagine a water bottle – you can only pour water from it when you first pour water in.

For Example:

To purchase a $500 air ticket, you’ll first have to top up or ensure that your mobile wallet has at least $500. Then, you’ll be able to pay for it using the app.

Mobile wallets, in general, are safer than credit or debit card, in how they exist in your phones instead of a physical card. If you lost your wallet, your cash and cards could be used right away. However, if you lose your phone, people first have to get past your phone’s security (be it your password or fingerprint) and your app’s login, before accessing your mobile wallet.

Similar to the debit card, the mobile wallet, allows you to spend only the amount you have stored in the wallet. But opting for mobile wallet allows you to pay using only your mobile like scanning the QR code at Grab or DBS PayLah! Vendors. Mobile wallets like PayPal also has features like PayPal One Touch allowing you to bypass login pages or the need to input credit card information if you are willing to opt in.

However, the main challenge currently facing the mobile wallet is a limited adoption by merchants. For example, you will not be able to use GrabPay in other countries like USA.

So what is YouTrip really?

A Multi-Currency Mobile Wallet with Linked Mastercard®.

At its core, YouTrip is a mobile wallet (think water bottle). The topping up happens in-app and you can use either a debit or credit card to do it. Adding to the mobile wallet is its multi-currency function, allowing you to pay in over 150 different currencies with no fees and no markups at wholesale exchange rates. So you can avoid paying extra in fees when making purchases overseas.

However, it has a physical component to it as well – the YouTrip Mastercard that’s mailed to you upon registration. The Mastercard is basically an extension of your mobile wallet (like a tap attached to your YouTrip account). Using this Mastercard you’ll be able to pay online or overseas without any of the hidden charges credit cards usually charge. Since MasterCard has already been accepted widely globally, YouTrip can be conveniently used locally, overseas and even online.