We’re putting the multi-currency mobile wallets to a travel test! Here’s an overseas payment comparison across transactions and currency exchange rates in Johor Bahru, Malaysia.

Part #1: YouTrip vs Revolut vs TransferWise: Weekend Rates

Part #2: YouTrip vs Revolut vs TransferWise: Weekday Rates

New multi-currency mobile wallets, new choices, and everyone’s asking the same questions: Who’s better? Which is easier to use? And most importantly, who gives the best rates? That’s why we’re putting all the multi-currency mobile wallets (including us) to the realest overseas payment test – an overnight weekend trip to Johor Bahru (JB)!

All multi-currency mobile wallets have different product offerings – remittance, savings, investments, and many others. But for travellers like you (and us), we’ll focus on overseas payment functions and experience.

Among restaurants, snacks, bubble tea, and pharmacy essentials, we’re covering payments with as many types of stores as you would visit on a holiday trip to JB. 😎

YouTrip vs Revolut vs TransferWise at a glance:

In order to avoid the peak hour crowd, we left office early on Friday (don’t tell our boss LOL) and made our way to Woodlands Checkpoint. From Woodlands Checkpoint, it only took 20 minutes for us to cross Malaysian customs.

Before we got into spending money and currency exchange rates in JB, we had to perform top ups into each wallet first.

1. Top Up Process & Fees

| YouTrip | Revolut | TransferWise | |

| Top-up Fees | No | No | 2.65% (debit card) 2.8% (credit card) |

| OTP to Add Card | Yes | Yes | Yes |

| OTP to Top Up | No | No | Yes |

| Minimum Top-up | SGD $20 | SGD $20 | SGD $5 |

The top up process for all multi-currency mobile wallets were fairly easy, but here were some problems we faced:

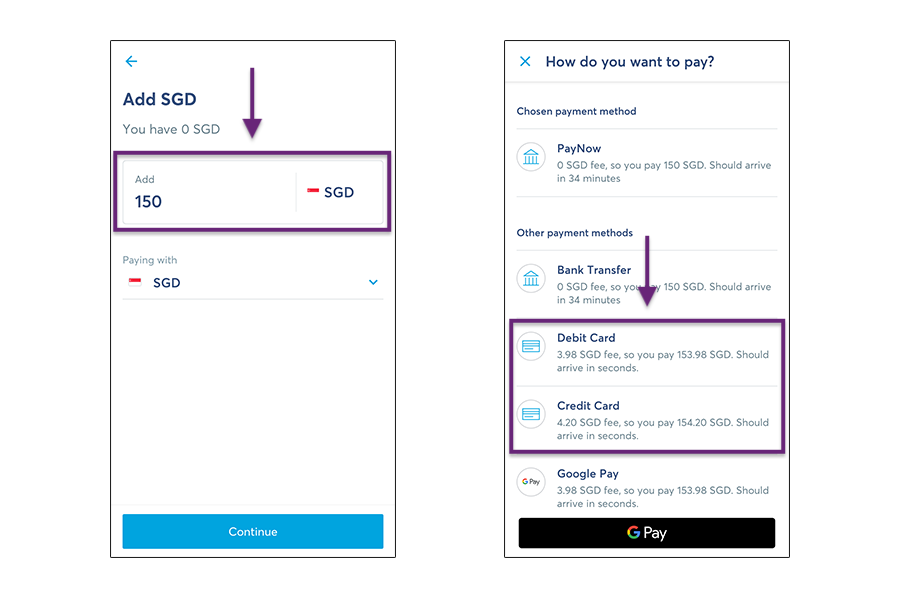

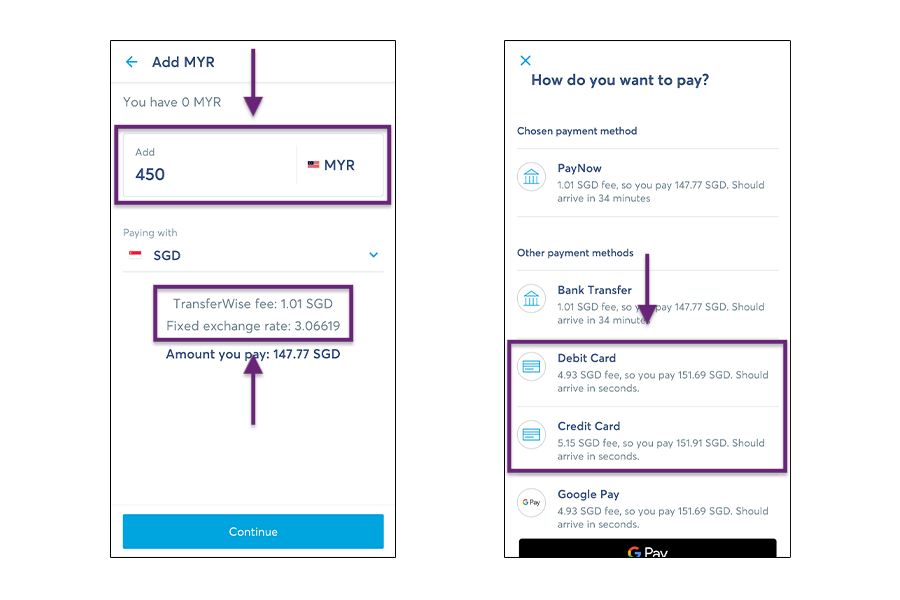

a) Top-up Fees

We realised that there was a 2.65% to 2.8% fees on TransferWise for credit and debit card top-ups. There were other top up methods that didn’t require fees (PayNow, bank transfer), but they were not instant and required about 20 minutes for the money to come in. Hence, for common ground comparison, we topped up all 3 accounts with our credit cards.

b) One-time Password (OTP) to Add Card

All three multi-currency mobile wallets required an OTP to add a credit or debit card to our wallet for the first time. It’s recommended to add it before travelling!

c) One-time Password (OTP) to Top Up

TransferWise required a One-time Password (OTP) sent to our registered mobile number. This means that if you’re planning to buy a prepaid Malaysian SIM card, you’ll not be able to receive the OTP for top up. Fortunately for us, we were using roaming data with our Singapore mobile number and we were able to receive the OTPs.

d) Topping up to various currency wallets

While both YouTrip and Revolut had a straightforward process of topping up in Singapore Dollars (SGD), TransferWise required us to choose a currency wallet. It took us a while to figure out, and we even thought it was a good idea to top up to the Malaysian Ringgit (MYR) wallet, but realised that there’s an upfront currency conversion fee. This means that:

• If you top up to MYR wallet, you pay the currency conversion fee now

• If you top up to SGD wallet, you pay the currency conversion fee as you spend

However, if you’re a heavy user of remittance, this TransferWise feature could be useful for you to use the money that you’ve received from MYR remittance.

2. Currency Exchange Rates

After a good night’s rest on Friday, we began our eating and shopping on Saturday morning at Mid Valley Southkey. We stuck to buying three items with the same price at every store, so that we could compare the currency exchange rates easily.

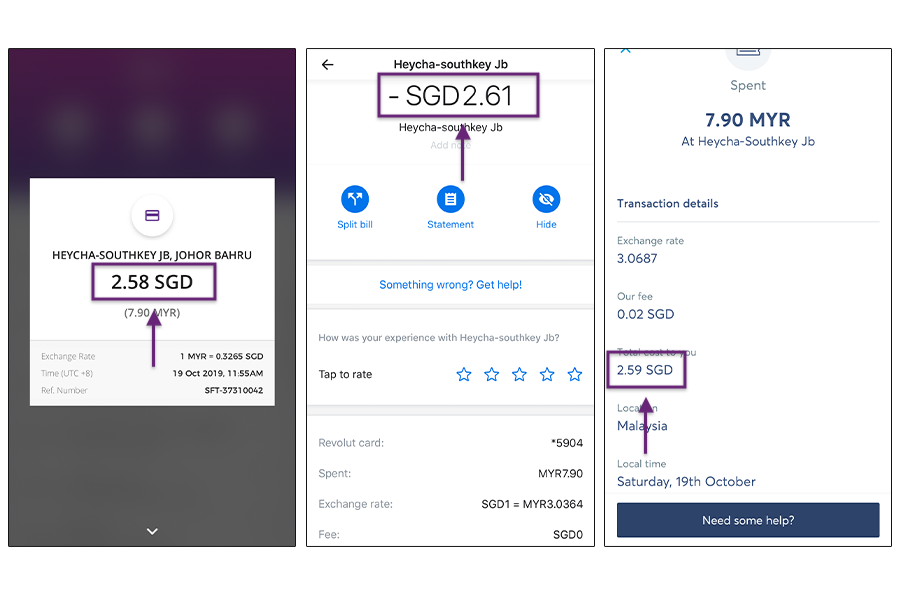

HeyCha

We mistook HeyCha as HEYTEA, but hey the bubble teas were still good though!

| YouTrip | Revolut | TransferWise | |

| Price in MYR | RM 7.90 | RM 7.90 | RM 7.90 |

| Markups | No | + 1% rates | No |

| Fees | No | No | + $0.02 fee (0.78%) |

| Rates | $1 = RM 3.0627 | $1 = RM 3.0364 | $1 = RM 3.0687 |

| Price in SGD | $2.58 | $2.61 | $2.59 |

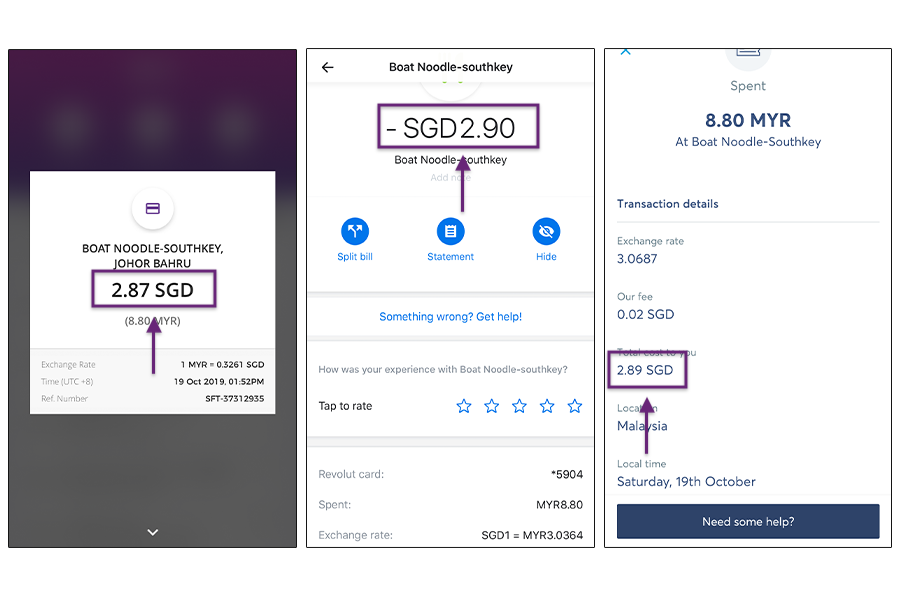

Bangkok Boat Noodles

Thai boat noodles were only SGD $0.70 a bowl, how could we miss it?

| YouTrip | Revolut | TransferWise | |

| Price in MYR | RM 8.80 | RM 8.80 | RM 8.80 |

| Markups | No | + 1% rates | No |

| Fees | No | No | + $0.02 fee (0.67%) |

| Rates | $1 = RM 3.0665 | $1 = RM 3.0364 | $1 = RM 3.0687 |

| Price in SGD | $2.87 | $2.90 | $2.89 |

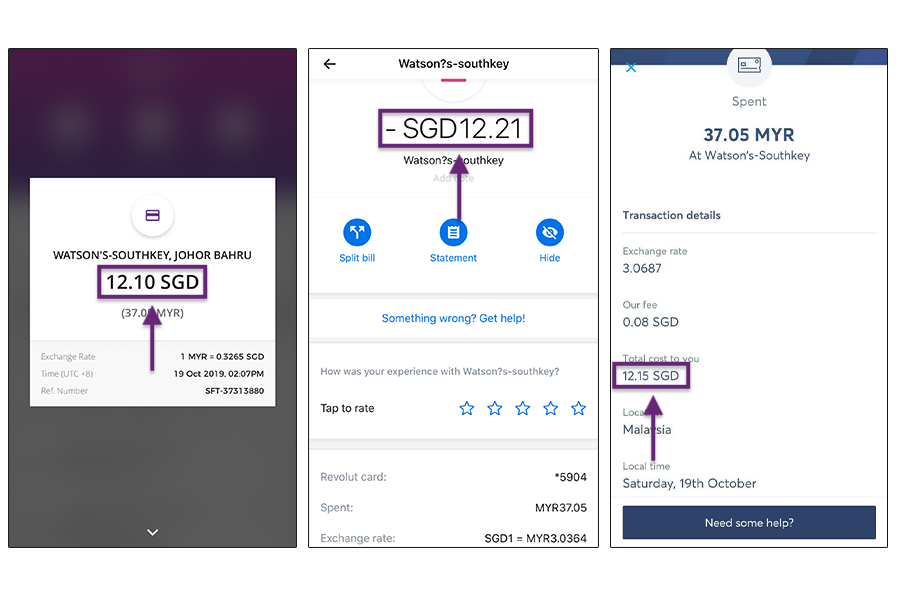

Watsons

“Wait, let me get something from Watsons!” – at least one colleague on every JB trip…

| YouTrip | Revolut | TransferWise | |

| Price in MYR | RM 37.05 | RM 37.05 | RM 37.05 |

| Markups | No | + 1% rates | No |

| Fees | No | No | + $0.08 fee (0.66%) |

| Rates | $1 = RM 3.0627 | $1 = RM 3.0364 | $1 = RM 3.0687 |

| Price in SGD | $12.10 | $12.21 | $12.15 |

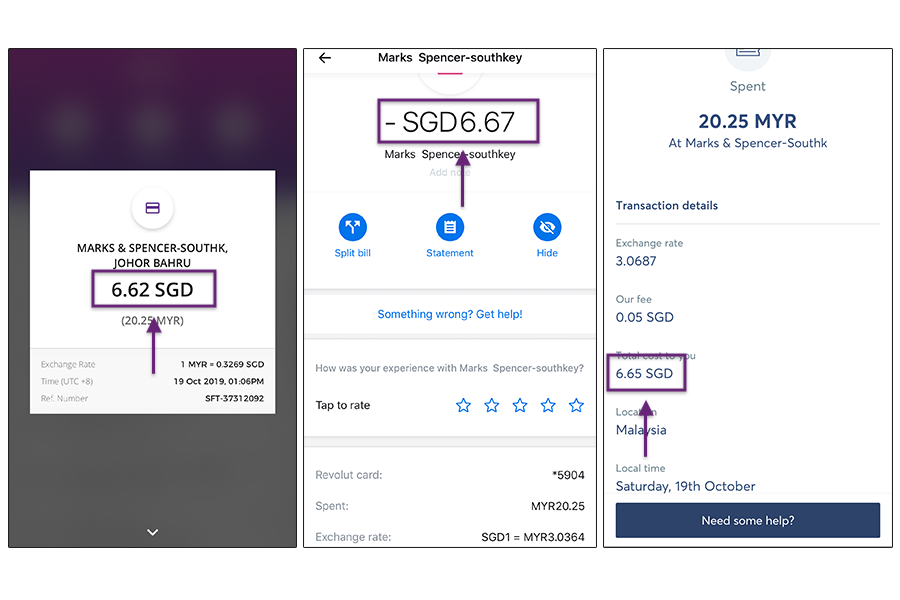

Marks & Spencer

We heard that Marks & Spencer was also cheaper in JB, so we got some snacks for our colleagues who couldn’t join us on this trip (ok at this point you could tell we were trying to finish the budget our boss gave us).

| YouTrip | Revolut | TransferWise | |

| Price in MYR | RM 20.25 | RM 20.25 | RM 20.25 |

| Markups | No | + 1% rates | No |

| Fees | No | No | + $0.05 fee (0.76%) |

| Rates | $1 = RM 3.0590 | $1 = RM 3.0364 | $1 = RM 3.0687 |

| Price in SGD | $6.62 | $6.67 | $6.65 |

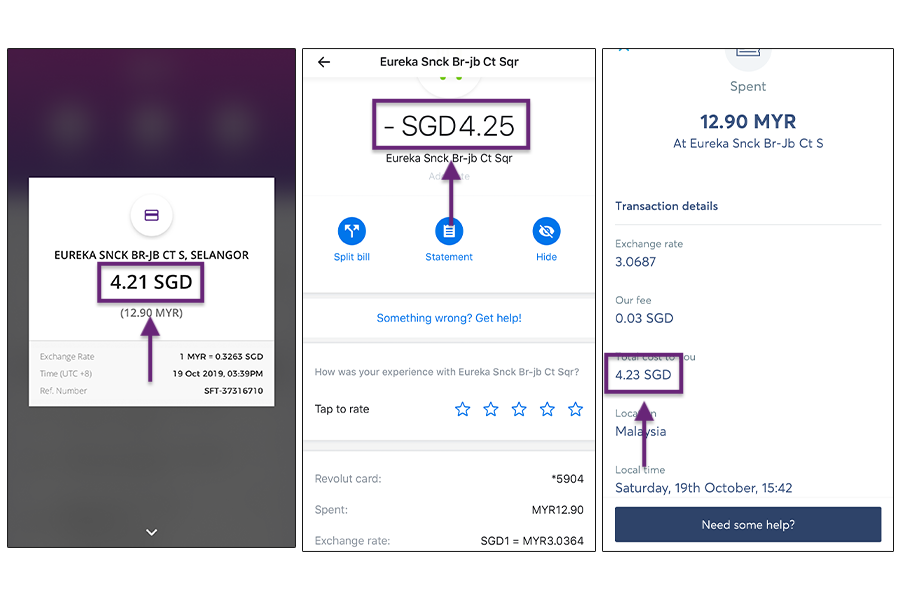

Eureka Popcorn

We also braved the queue to get our hands on some of the most addictive popcorns, hopefully they don’t run out within a day back in office…

| YouTrip | Revolut | TransferWise | |

| Price in MYR | RM 12.90 | RM 12.90 | RM 12.90 |

| Markups | No | + 1% rates | No |

| Fees | No | No | + $0.03 fee (0.71%) |

| Rates | $1 = RM 3.0646 | $1 = RM 3.0364 | $1 = RM 3.0687 |

| Price in SGD | $4.21 | $4.25 | $4.23 |

Throughout our transactions, YouTrip remained consistent with no fees. In contrast, Revolut had a standard 1% markup for MYR currency exchange rates on weekends (there’s no markup on weekdays though), while TransferWise had a fee that hovers around 0.69% for every MYR transaction.

3. Payment Experience

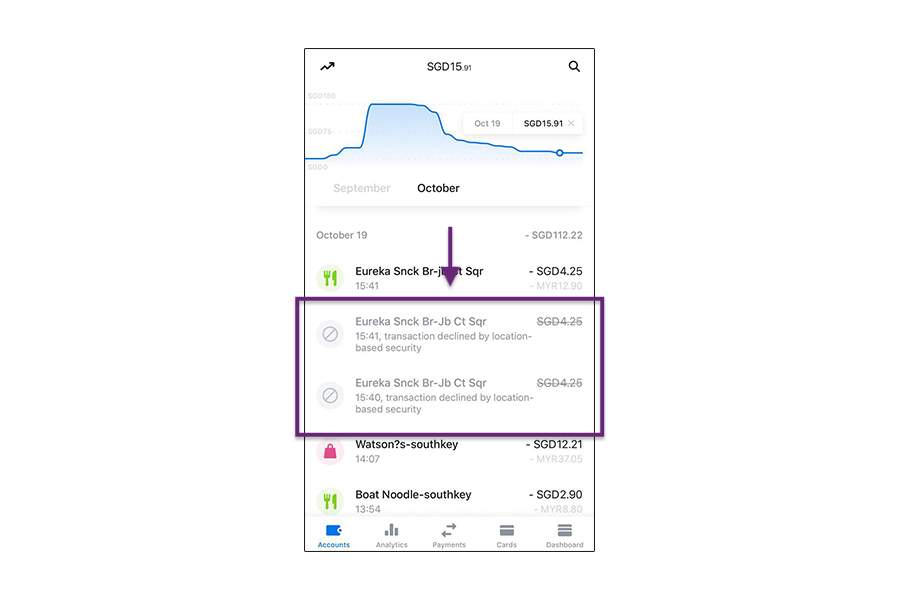

The transactions we’ve made were clearly displayed in all three apps, and we particularly enjoyed the vibrant colours on the Revolut app. However, we did have a hiccup at Eureka Popcorn, where our Revolut card was denied twice due to “location-based security”. This means that our location was recorded (wrongly) to be outside of JB, Malaysia, so the app blocked our transaction.

After we figured out to turn off the location-based security function in the app, our transaction finally went through. Though we held up the queue for a while, we thought that this was still a good security concept for users – if executed well. Perhaps you’ll see this in upcoming versions of YouTrip too!

Conclusion

YouTrip vs Revolut vs TransferWise

If your focus is to pay with the best exchange rates, then stick to YouTrip to help you save the most money! There are no currency conversion fees or extra markups, including the weekend, so you can spend anywhere with a peace of mind.

However, with that being said, there were also many app functions we enjoyed from our fellow multi-currency mobile wallet peers – TransferWise’s comprehensive remittance function, as well as Revolut’s analytics and various security features. You should choose the travel wallet that best meets your needs!

Cheaper, smarter, better

After all, YouTrip started off a year ago with one ambition: Travellers like you deserve a cheaper, smarter, and better way to pay overseas. Now, this ambition has become a reality, and we’re thrilled to see many users and brands join us in this movement.

We hope that our JB trip provided a good overseas payment insight for you, and if you enjoyed it, let us know where you want us to go next! Also, if you were wondering, nope we didn’t manage to finish the budget – 20 hours weren’t enough…

Read: How to Avoid DCC: SGD vs Local Currency

Read: How to Avoid Credit Card Scams and Frauds Overseas

Read: 7 Best Holiday Booking Hacks to Score Best Deals

Read: 12 Travel Hacks To Become a Smarter and Better Traveller

Read: Multi-Currency Accounts vs Wallets vs Cards: FX Fees Comparison

Enjoy a worldwide fees-less travel experience!