Among 1,396 frequent Singapore travellers, 7 in 10 do not understand how they are charged Overseas Transaction Fees and almost half of travellers are at risk of 5%+ extra card fees. Are you one of them?

We all love holidays! Adventures with friends, annual family trips, or even that spontaneous trip we decide to take two days prior.

For the past year, Singaporeans made an average of 3 overseas trips, spending up to S$1,800 per trip. Throughout our travels, many worry about overseas card fees and sometimes we are not even aware of the extra charges.

Travel Money Woes

“For a cashless city like New York, I was making so many transactions a day… I never really thought about the fees that would add up.” – Yang (25)

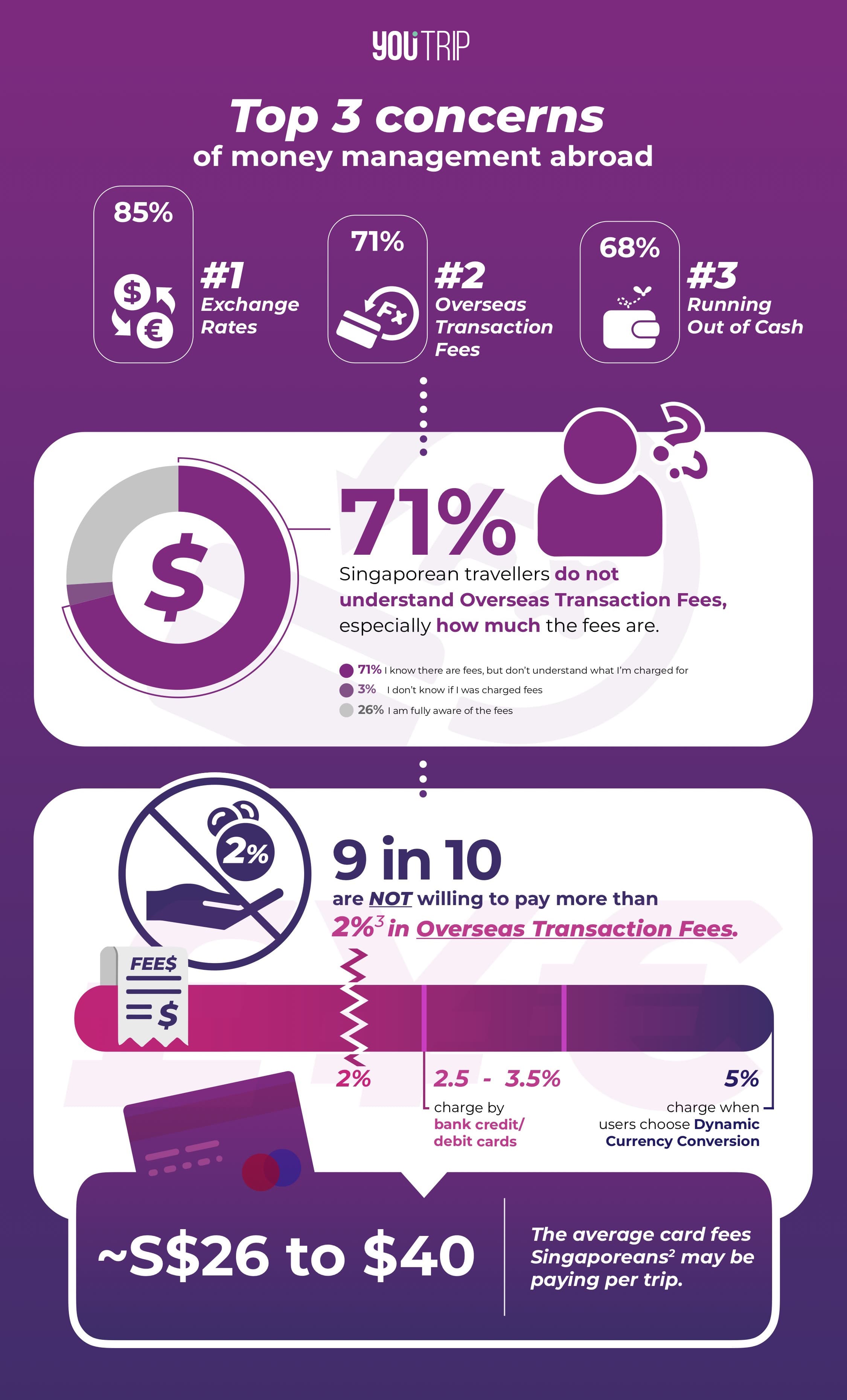

85% of Singaporeans agree that Exchange Rates are their biggest concern, while a good 71% also lament about Overseas Transaction Fees charged by banks for overseas card payment. Despite the large numbers, 7 in 10 Singaporeans do not understand how Overseas Transaction Fees work and how much they are being charged when making card payments abroad.

In addition, 9 in 10 Singaporeans are not willing to pay any more than 2% in Overseas Transaction Fees.

However, the current average fees are between 2.5% to 3.5%, or even over a whopping 5% when the card payment is made via Dynamic Currency Conversion (DCC). DCC occurs when a card user pays for a foreign currency transaction in the card issuer’s home currency (i.e., SGD). This is a service provided by the merchant’s payment solution provider, which comes at a relatively poor exchange rate.

In addition, almost half of us are at risk of being overcharged due to DCC. When asked if a purchase should be paid in SGD or USD while travelling in the United States, 4 in 10 chose SGD – a choice that would come with a hefty price tag.

While this is not indicative of Singaporean’s knowledge on DCC, this highlights the need to implement further education to reduce potential overcharges imposed on Singaporeans abroad.

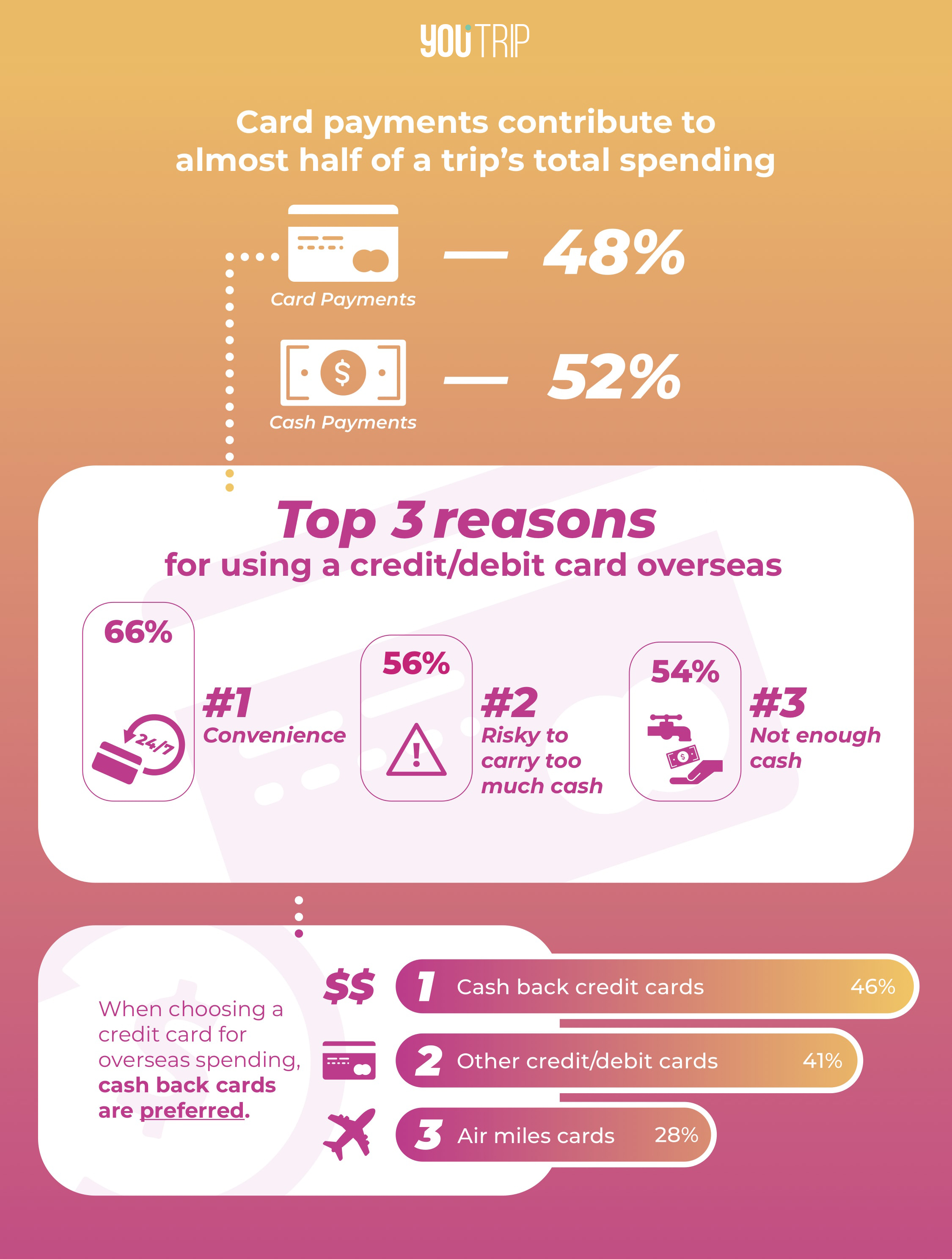

Cards vs Cash

Are you an old-school tourist or a digital traveller? Singaporeans are a good mix of both, with card payments contributing to 48% of a single trip’s total spending. Even though 9 in 10 Singaporeans are not willing to pay more than 2% of card fees, many still turn to card payments nonetheless to avoid the hassle and risks of cash.

“We end up with not enough (cash) or we end up with excess of it. As much as we try to avoid incurring card charges, for convenience we end up using our credit cards for certain purchases overseas.” – Alex (29), Daphne (27)

Read: Fake Foreign Currencies & How to Avoid Them.

#GenYOLO and Gen X-ers

Singaporeans are willing to save around a quarter of our annual savings to travel, no wonder we made an average of 3 trips last year!

| Top Countries | By Popularity |

| Malaysia | 15% |

| Thailand | 13% |

| Japan | 12% |

| Indonesia | 7% |

| Australia | 7% |

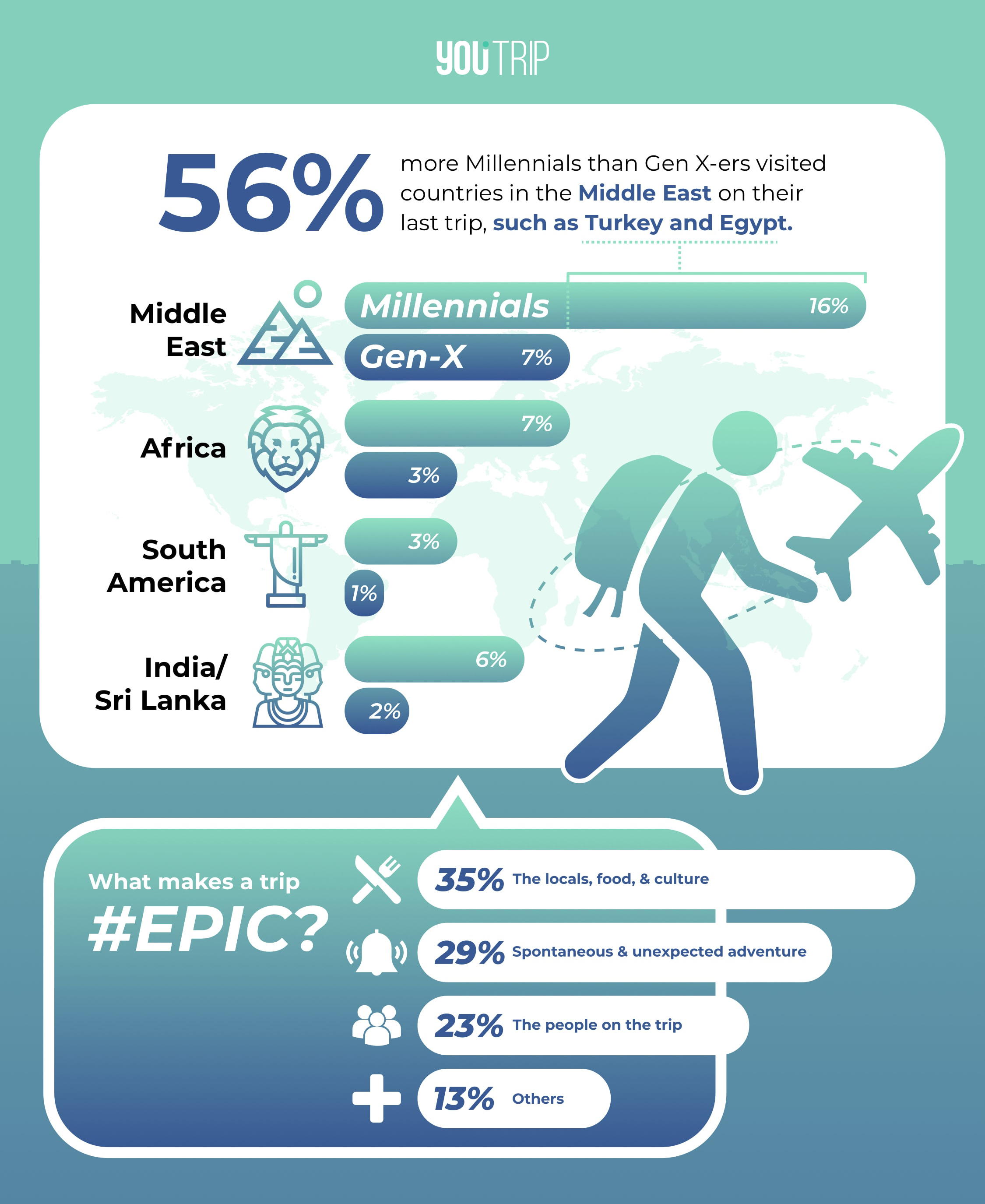

Collectively, Singaporean travellers are proven creatures of habit and prefer destinations closer to home, such as Malaysia and Thailand. Millennials, however, are seeking off-the-beaten-track destinations, such as the Middle East (Turkey, Egypt), Africa (Kenya), South America (Peru), and South Asia (India, Sri Lanka).

Other Interesting Findings

- Singaporeans proactively seek to secure preferred rates and 1 in 3 will exchange money to secure them.

- Singaporeans prefer to visit online rate-monitoring sites, as a convenient alternative to money changers.

As 2019 beckons new adventures abroad, focus on your travel plans and leave your currency worries to us. With YouTrip, you can pay in over 150 currencies worldwide with no fees and enjoy Wholesale Exchange Rates. Here’s to all the memorable trips ahead!

–

The Singapore Overseas Spending Survey 2018 analyses travel and overseas spending behaviour among Singaporean travellers. The survey was conducted by YouTrip through an online questionnaire over 31 days, with survey responses collected through 1,396 respondents, aged 18 to 65. Click here for the full report.

Ready to explore the world? A seamless, fee-less travel experience awaits you in 2019!