Smarter Global Payments with Better FX Rates.

Enjoy 24/7 access to wholesale exchange rates for card payments, currency conversion and remittance. Best rates, every day.

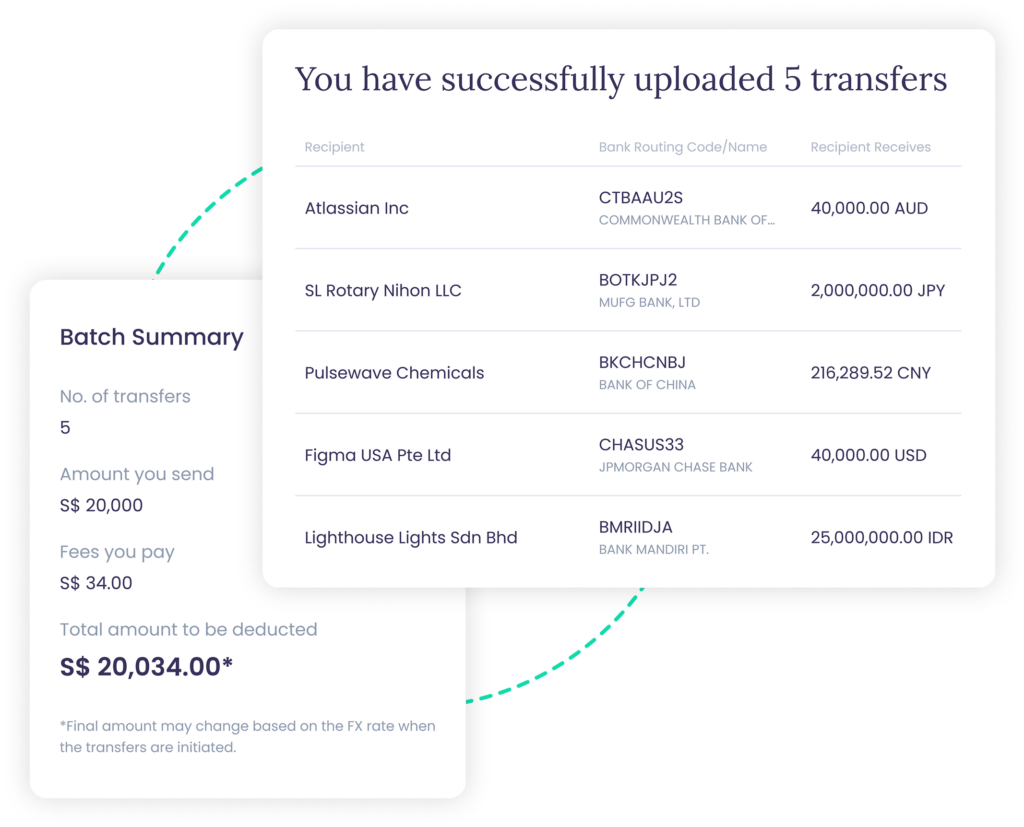

Manage multiple suppliers

with batch transfers

Say goodbye to time-consuming and manual payment processes.

Streamline supplier payments with YouBiz batch transfers and send up to 1,000 payments in one go.

Send money overseas

with the best rates

Send money directly overseas from your YouBiz account at transparent and affordable fees.

Save up to 6x compared to traditional solutions on remittance fees.

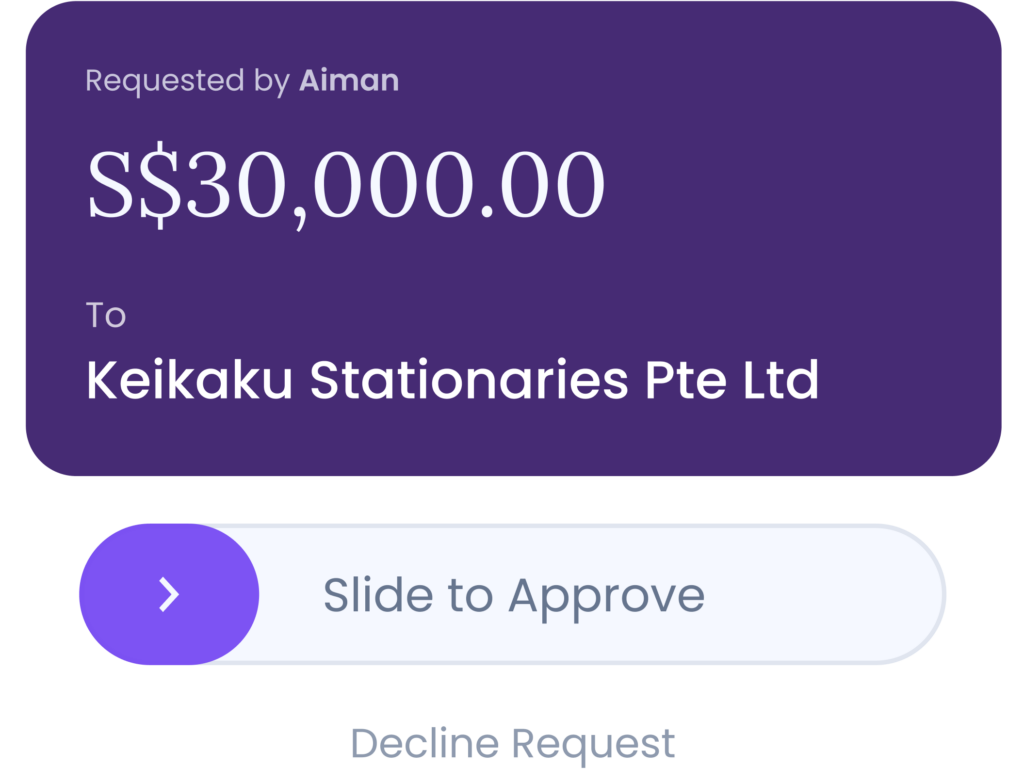

Secure every transfer

with custom approvals

Gain greater control and visibility by implementing customised approval workflows with two approval steps.

Approve transfers easily on the web dashboard or in the YouBiz app — whatever’s more convenient for you.

“With YouBiz, we no longer have to worry about unfavourable conversion rates or administrative costs that impact our decision to take on international clients.”

Founder, KOVA Collective

FAQ About

FX and Transfers

For remittance or overseas transfers, you can send money to an overseas bank account by first adding the recipient’s account;

- Select the ‘Send Money’ option on the Dashboard

- Choose ‘Overseas Transfer’

- Select an existing recipient or add a new recipient

- Input the amount and currency

- Verify the accuracy of all details before sending

YouBiz supports overseas transfers in 20 currencies, with no foreign transaction (FX) fees;

- Singapore Dollar (SGD)

- Australian Dollar (AUD)

- Brazilian Real (BRL)

- British Pound (GBP)

- Canadian Dollar (CAD)

- Chinese Yuan Renminbi (CNY) *English/PinYin character only*

- Euro (EUR)

- Hong Kong Dollar (HKD)

- Indian Rupee (INR)

- Indonesian Rupiah (IDR)

- Japanese Yen (JPY)

- Malaysian Ringgit (MYR)

- Philippine Peso (PHP)

- Sri Lankan Rupees (LKR)

- South Korean Won (KRW)

- Swiss Francs (CHF)

- Thai Baht (THB)

- Turkish Lira (TRY)

- US Dollar (USD)

- Vietnamese Dong (VND) *Individual account only*

Transfers made through YouBiz are typically completed immediately, with both the sender and receiver notified upon completion. However, there are a few reasons why a transfer may not be successful;

Receiving funds

- Incorrect account details (particularly the beneficiary name or account number)

Sending funds

- Insufficient funds

- Incorrect account details

- Approval policy may be in place

When this happens, you may reach out to your Admin or Finance member to find out more.

The sending limit to a local recipient is a maximum of SGD $200,000 for a single transfer. If you need to send more than the sending limit, you may attempt a second transfer afterwards.

The transfer or sending limit to an overseas recipient would vary for different currencies. This amount would be reflected accordingly before you proceed to make the remittance. For reference, below are the respective amounts:

| Currency | Minimum Overseas Transfer Limit | Maximum Overseas Transfer Limit |

| AUD | 1 | 500,000 |

| BRL | 10 | 300,000 |

| CAD | 1 | 100,000 |

| CHF | 1 | 340,000 |

| CNY | 200 | 6,343,650 |

| EUR | 1 | 300,000 |

| GBP | 1 | 250,000 |

| HKD | 1 | 2,500,000 |

| IDR | 1000 | 2,500,000,000 |

| INR | 1 | 1,500,000 |

JPY | 100 | 45,000,000 |

| KRW | 1 | 500,000,000 |

| LKR | 1 | 20,000,000 |

| MYR | 1 | 1,000,000 |

| PHP | 1 | 500,000 |

| THB | 1 | 10,000,000 |

| TRY | 1 | 1,000,000 |

USD | 1 | 500,000 |

| VND | 1 | 490,000,000 |